Imagine sitting on the beach somewhere being totally blissful with a fresh ocean breeze across your face and the feeling of sand between your toes. It’s been a while since I’ve been to the beach, but last time I visited, I didn’t want to leave.

Maybe you’re sitting in one of those stretched out chairs with a huge umbrella over you, while you scroll through the cyberpunk NFTs you bought a few days ago—you know, those pixelated JPGs of humans with very slight cosmetic alterations—checking to see the passive income they’re earning, in fact maybe they’re the reason you’re at the beach in the first place.

Passive income NFTs are a type of non-fungible token designed to generate ongoing earnings for their holders, typically through mechanisms like revenue sharing, royalties, or staking rewards.

Unlike traditional NFTs, which are valued mainly for their uniqueness and collectibility, passive income NFTs offer the added benefit of a continuous income stream, creating a blend of digital asset ownership and investment.

Sound like something you desire? Let’s dig in.

What is an NFT?

First, let’s understand what an NFT is.

We actually have an entire NFT page that breaks down what they are and how they will eventually replace car titles and house deeds on the blockchain one day, but we’ll give you a quick summary.

NFT stands for Non-Fungible Token, which is a fancy way of saying it’s a unique token that can’t be duplicated and is special in some way.

Most NFTs you probably know about are simply digital art NFTs, where you think that the token is a piece of art. It’s not—at least, not always. Most often, the Token ID is paired with an image URL on a third-party website like OpenSea where they say that a token represents that image, although there’s truly no image data on the blockchain.

The Token ID is simply a pointer saying “I represent that image over there” and the image is uploaded to a server that could easily change the image if it wanted to.

NFTs can be so much more than art though. For example, I said they could be house deeds or car titles, and even domain names like WhiteboardCrypto.eth is an NFT—it’s a token that I hold that is unique, there’s no other token out there like it.

Content Creation

Now that we have brushed you up on what NFTs are, let’s explain how they can be used to earn passive income.

If you’re new to WhiteboardCrypto, we absolutely love using examples and in this example we will use our channel.

For starters, you should know that each video on our channel is monetized and that means that Youtube ads play before each video. When they do, the advertisers pay Google, which takes a cut and gives us the rest.

What if I made an NFT of each video on this channel? I could sell them individually and then I could promise whoever owned them would get 20% of the revenue from that video’s ad income during the past month.

For example, if the video got around 20,000 views, and earned $100, then whoever held the NFT would be given $20 worth of USDC coin for that month.

This would continue forever, so if the video made $5000 in the course of a few years, 20% would be paid to the holder. The 20% is arbitrary, we could make it 100% or 2%, but the idea is the same.

This allows our audience to invest in our project and also be able to earn a reward if our videos do well, basically allowing you to have skin in the game for our success as well.

Not only that, but these NFTs quickly could become somewhat of a gamble, where some users could pay more and more for each NFT because they expect a certain video to pop off one day due to the algorithm.

I’m sorry to say, but we won’t be doing that any time soon, there are many problems, which we will talk about later in this article. Nevertheless, this is the core idea of a passive income NFT.

A passive income NFT is a digital representation of a physical asset that truly adds value.

I remember Youtube creators like Graham Stephan, Alex Hormozi, Andrew Kirby, and Practical Psychology were once in their growing stages and thinking “man, if they were a stock, I’d invest in them. They just need a little support and I know they’ll big one day.”

Needless to say, they got big anyways, but NFTs like this would allow them to benefit in the short term, and investors like me to benefit in the long term.

That’s exactly what music artists will soon be using them for!

Music

The next example of passive income NFTs will be music artists.

I recently heard of this artist 3LAU who set up an NFT drop of 333 total tokens. All of these tokens combined represents 50% ownership in the streaming royalty rights of a song called “Worst Case.”

What this means for you is that 50% of all the money he earns from Spotify playing that song, he’s giving to those NFT holders. Each token also had unique artwork tied to it, so they were all different.

To put into perspective how much this artist made, there are current 257 items on OpenSea, which is an NFT marketplace, and the floor price is 2 ether. 257 items * 2 ether * $4000 average eth price = $2,056,000 for half of his streaming royalties.

This doesn’t mean he earned all of that though, he only got the proceeds from initially selling them.

One trick that these artists can implement is to add a transaction fee to each NFT that gets rerouted back to the artist’s wallet. For example, 3LAU could add a 5% trading fee so that if $100,000 of his NFTs get traded this month, $5000 would be deposited straight into his wallet, simply for his NFTs being traded.

So NFT holders will earn passive income, but the artists will also earn passive income for their works, along with the other 50% of royalties.

I personally think this technology will revolutionize the way artists are created and promoted, however I would love to know your thoughts.

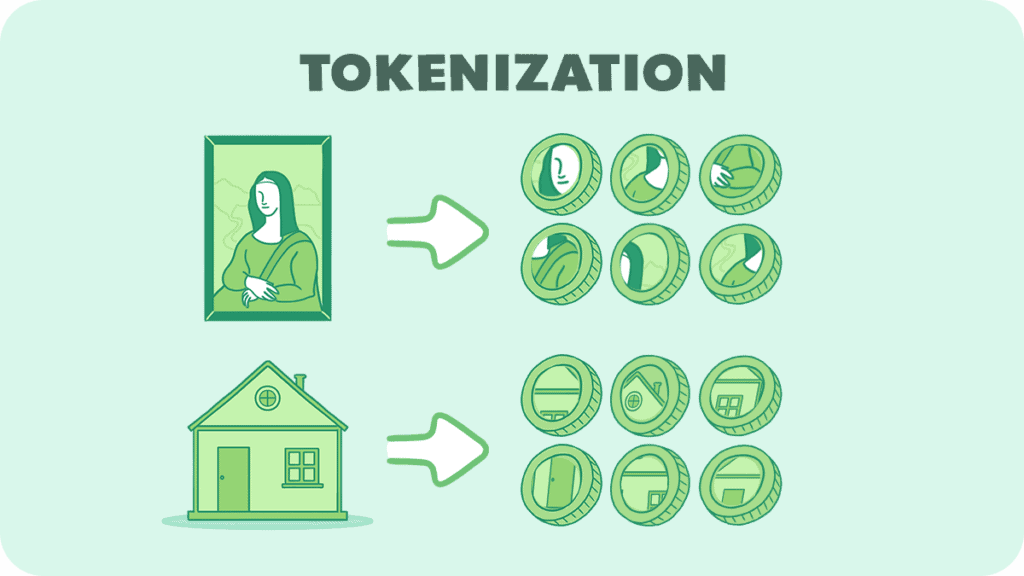

Real Estate

Real Estate is another great example. What if an entire apartment complex was turned into 100,000 NFTs, where each NFT holder got a percentage of the complex’s profits?

This way you wouldn’t need to have one hundred million dollars to invest in these high-return buildings, but could join for fractions of that. I don’t know if this will ever happen, but it is fun to think about the endless possibilities of NFT technology.

Even more so, what if the apartment complex started it’s own DAO, where NFT holders could vote on changes like whether to allow smoking, or who to accept to rent to, or even which janitor to hire? Stuff like this is actually already being done, but that’s more about how DAOs work than passive income NFTs.

Potential Problems

1) Distribution

One of the main problems of this idea is “who is going to make the payment” because it certainly won’t be the blockchain. Someone has to take that earned money, deposit it onto the blockchain and then send it to a bunch of different addresses, which could quickly eat up fees if you’re not careful.

This seems to be the biggest problem stopping passive income NFTs from becoming the next big financial opportunity, and I don’t see why companies in the future, or even DAOs, wouldn’t sell shares of their company as an NFT one day.

In fact, this would solve a big problem around the Gamestop naked short selling issues. If the NFTs were on the blockchain, we could see who owns every single share issued, where they were, how often they are moving, and who really does have diamond hands.

2) Regulatory Uncertainty

The legal status of passive income NFTs can be murky, as regulatory frameworks for digital assets are still evolving. Regulators are having a hard time keeping up with the quick growth of the industry.

This uncertainty can pose risks related to compliance with financial regulations, potentially affecting the legality and viability of these NFTs.

For instance, imagine you’ve invested in an NFT that shares profits from a digital art gallery, but suddenly, new regulations deem this as a form of unregistered security. Overnight, your investment could be in murky legal waters.

3) Market Volatility

The value of NFTs, like other cryptocurrency assets, is highly volatile. This can significantly affect the passive income generated, leading to unpredictable and fluctuating returns that may not align with initial expectations.

Picture this: you buy an NFT linked to a popular online game, expecting steady income from its growing user base. But, if the game loses its charm and players move on, the value of your NFT could plummet, taking your expected earnings with it.

4) Liquidity Issues

Unlike more established assets like gold, NFTs can face liquidity challenges, meaning it might be difficult to quickly buy or sell them without impacting their price. This can be a problem if you need to convert your NFTs into cash rapidly.

You might find the perfect buyer for your music royalty-sharing NFT, but if they’re not ready to purchase exactly when you need to sell, you could be left in a bind.

5) Smart Contract Risks

Passive income NFTs rely on smart contracts, which are automated, self-executing contracts with the terms directly written into code. These can have vulnerabilities or bugs, potentially leading to the loss of assets or income.

Imagine a bug in the contract of your NFT that miscalculates your earnings. Rectifying such glitches can be a complex and uncertain process, and often it’s not clear who—if anyone—can fix it.

6) Overestimation of Returns

There’s often a misconception that passive income NFTs will yield high returns consistently.

We often hear success stories, like someone earning thousands from a single NFT, but these are exceptions. The reality can be much less lucrative, and it’s essential to set realistic expectations.

7) Dependency on Project Success

The income from these NFTs often depends on the success and longevity of the underlying project or platform. If the project fails or loses popularity, the value and income potential of the NFTs can plummet.

8) Scams and Frauds

Scams and frauds are, unfortunately, part of the landscape. There have been cases where investors bought into ‘exclusive’ NFTs promising high returns, only to find out the project was a well-orchestrated sham.

One common type of scam in the NFT world is the “rug pull.” In a rug pull, developers create a seemingly legitimate NFT project, often with high-quality artwork and promising marketing materials.

They may even engage with the community actively, building trust and excitement. Investors buy into the project, often at increasing prices due to the hype.

However, once a significant amount of money is invested, the developers suddenly withdraw all the funds from the project’s wallet, effectively stealing the investors’ money. The developers then disappear, leaving investors with worthless NFTs and no way to recover their funds.

This kind of scam preys on the hype and FOMO (Fear Of Missing Out) that can surround new NFT launches.

9) Environmental Concerns

The environmental impact of NFTs, especially those on energy-intensive blockchains like Bitcoin, can be significant. This raises ethical considerations and potential backlash from environmentally-conscious investors and consumers.

Conclusion

You can tell there are a lot of options for passive income NFTs, but there are also a number of risks to be aware of before you dive into a project.

As always, remember to do lots of research into the projects to see who is running them, what other projects they have been a part of, and if any audits have been done (amongst other DYOR—do your own research—stuff). Also be sure to only connect to new projects or dApps with wallets you don’t use for anything else, and only put in what you can afford to lose.

Thanks for reading! We hope you enjoyed it and we hope you learned something.