Boys, it almost happened. I almost lost it all to a crypto scam. I’ve mentioned this briefly in the video we posted “What is a Rug Pull?” but I wanted to dive a little deeper into it.

Before we start this story I want you to know we don’t participate in many scams, this was for educational purposes only to understand how degen yield farms really work.

The day was March 3rd, and I had just tossed out a few hundred dollars into a degen yield farm to see if it was going to pump and dump. This project looked promising—it had all the characteristics I was looking for:

- locked liquidity

- the social media page was blowing up

- the whitepaper said the problems it was solving

But sure enough it was another dredged rug pull. I was lucky enough to get my funds out. I realized as soon as it launched that you couldn’t harvest anything. In fact, the code made it so when you tried to harvest your interest, the harvested tokens were sent to the dev’s wallet address.

People who waited an extra 5 minutes after launch weren’t so lucky.

Let’s dig right in and skip a bunch of formalities.

1) Same Layout

This might not be a definitive sign but it’s a good start. Have you noticed that all new yield farms have pretty much the same layout? This is because they are easily re-using the original code from the GooseSwap degen yield farm to host their new site.

This is important because you can tell if something is a scam by the amount of time they took to develop it. For example, did they spend 10 minutes outsourcing some new images or did they spend a couple weeks coming up with a brand new design to host their new company that will help further crypto?

Some platforms take months to build before they launch, while degen yield farms can be set up in minutes.

2) Liquidity

Checking liquidity is actually only something you can do if you’re investing in a specific token, not an actual project like AAVE or Curve or Dfyn. However, checking the amount of liquidity is a very powerful indicator of how likely a token is to be a scam.

For example, any token with $10,000 in liquidity can easily be manipulated to double or triple the price. But also it means the developer doesn’t have much money to invest in the token.

On the other hand, a token like Uniswap actually has around $34,000,000 in liquidity. If you’re new around here, liquidity refers to the amount of value in tokens that can actually be traded.

Check out our videos on how a liquidity pool works and what an automated market maker is if you want to be a liquidity expert by only watching two videos.

3) Weird Social Authority

Remember your favorite influencer telling you that “honeybee” or “cummies” was the next big project and that if you bought some that they would match it? Well, if you notice large influencers promoting projects that they have no part in, this is another big sign that a rug pull is evident.

Especially generic A-list celebrities promoting a coin, or especially a token, that isn’t Bitcoin or Ethereum. Most A-list celebrities aren’t going to look into the code of how that coin works, let alone even visit the website and read the whitepaper or roadmap of the project.

You don’t let them pick your job, your future stocks, or your romantic partner—so don’t let them pick your coins or tokens either.

4) Whitepaper

Do you know how when you go to buy a course or product that everything on the sales page has been psychologically vetted to make sure it’s the best to get an emotional buying response out of you?

I know this for a fact because personally I run another Youtube channel that sells courses, and these pages can take months to perfect, but when they do, even I get giddy reading through them.

Well this is the same as a whitepaper. Good projects have solid whitepapers where they’ll give you stats, diagrams, and the problems they are solving. If the whitepaper is less than 20 pages, it’s not a whitepaper, it’s a sales page designed to get you to invest your money. Maybe that’s what you’re into.

5) Looking Deeper into Code

Moving on, one of the best ways to avoid a rug pull is simply to look at the code of the smart contract or token code.

There are many ways to do this, but the best is to go to your favorite blockchain explorer and use the contract inspecting tool to… what the heck am I saying… this is supposed to be a SIMPLE explanation of how to spot a smart contract. You guys arent going to do all of that. Lucky for you, I’ve got the hookup.

First, you want to check out the project on Rug Doctor. They have a website dedicated to actually reviewing the smart contract code and identifying common rug pull techniques. They then use their website rugdoc.io to inform the visitors of these scams.

Secondly, you’ll want to bookmark TokenSniffer.com. Token sniffer is an amazing website that basically compares a ton of tokens and how similar they are. If a token is 80%+ similar to another token… it’s not unique and that’s a huge red flag for rug pulls. Why create a unique token when you can just copy/paste some code and scam some degens?

6) Check Wallets for Whales

Here’s some advice where you might actually use a blockchain explorer. Most explorers for the Ethereum, Polygon, and Binance Smart Chains will let you look at all the tokens out there.

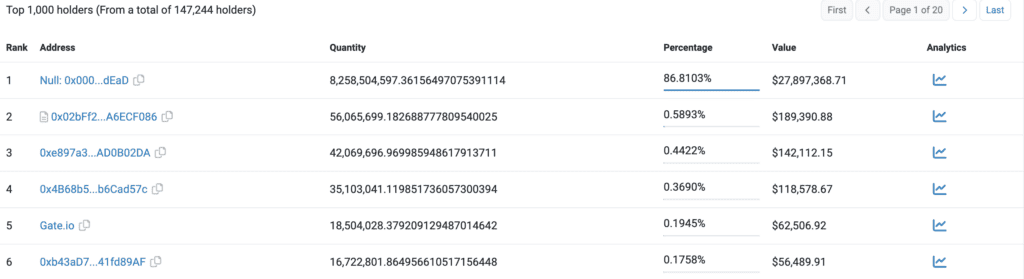

Pop in the token address to the search bar and you can actually see a list of the top token holders who hold that token. If more than 20% of a token is held by 1 wallet, or even if the top 10 wallets hold more than 20% combined, you could be getting rugged.

The idea here is that one person could sell all their tokens, which is a large majority of all the tokens, and crash the price. This is actually probably the easiest way to spot a rug pull.

7) Total Value Locked

In terms of investing in a project and not a specific coin, you can actually check out a metric that is called “TVL” or “total value locked”. TVL is the total dollar amount of coins and tokens invested into the project.

For example, AAVE, which is a well-known bluechip borrowing and lending platform, has over $20 billion invested in it. A degen yield farm I saw on the subreddit r/CryptoMoonShots that recently launched was around $100,000. $100,000 is still a ton of money, but nothing compares to $20 billion or the $10 billion that Curve Finance has.

What to do if you’re in a Rug Pull?

The first thing you should do is remove your investment if you notice that it is going to be rug pulled. This can be tricky because some of the rug pull smart contracts locks your assets so you can’t withdraw within 48 hours of their initial opening.

Secondly, you should probably tell everyone else about the rug pull. Maybe you can share via the Discord or Telegram.

Thirdly, you should reach out to the Rug Doctor and maybe they can add the token to their list.

Conclusion

So to summarize in an out-of-order fashion:

- Invest in projects that already have a bunch of money in them

- Do your due diligence by checking popular rug pull lists and checking wallets

- Join a project’s community and ask specific questions about their whitepaper

- Reach out to us and we would love to check out a project for free, you can join our Discord for free with this link.

Thanks for reading, we hope you enjoyed it, and we really hope you learned something.