If you’ve ever watched any cryptocurrency video you’ll notice the creators say, “This is not financial advice, always do your own research,” like some magical spell that protects them from getting sued, but technically offers you no credible information. What does doing your own research really mean, what does it actually look like? Is it difficult? I’ll answer all these in this article.

Before we get too much into the important stuff, I want to introduce to you an analogy that will help you understand the types of research people do. You know how if you want to lose weight, there are a lot of factors that play into your success, right? Some people say you simply just need to get more exercise. Others say it’s the type of exercise you do, weightlifting vs cardio. Others say the only thing that truly matters is your diet. In reality, it’s probably a collection of the amount of exercise you get, the type of exercise you get, your diet, your sleep cycle, your emotional life, which affects your hormones, and even your motivation for trying to lose weight, which will keep you going on days you don’t feel like continuing. My point is that when it comes to losing weight, a lot of factors are important and responsible for your results. The same is true in making a profitable investment. In basic research, there are three types of analysis we can do, and many people claim that only one matters, but I have a feeling you’ll agree with me they all matter some.

Technical Analysis

Technical Analysis is the study of the past price of an asset. We’ll get a little into this at the end of the article, but it’s mostly looking at charts and making educated guesses based on how other people will make their educated guesses, which produce certain patterns. Again, you can’t really make a good decision by only looking at charts, but they can definitely be helpful.

Sentimental analysis

Sentimental analysis sounds complicated but it’s the study of what everyone is feeling about a stock. We can’t really measure what people are feeling directly, but we can look at the words they use on the web. You can sum this up by asking, “What is the market saying?” or even, “what are crypto influencers saying?” about the project. There are tools out there that look at conversations and news articles on the web, compile them all together, and come up with a sentiment score that tells you if people are saying good things and bad things about the project, but it can easily be manipulated, usually isn’t long-term in nature, and difficult to analyze.

Fundamental analysis

Fundamental analysis is the study of the actual ideas, team, and progress of a specific project. It is what we will focus on in this video, since many people think technical analysis is bogus, most people don’t have the knowledge to perform sentiment analysis, and anyone can do fundamental analysis fairly easily.

Hopefully, if you get this one thing out of this video, you realize the world isn’t black or white, it’s not exercise or diets, and it’s not technical analysis or fundamental analysis, but instead the world is a multivariable environment where patterns may emerge among all these areas that you can find and take advantage of.

Oh, also, none of the stuff in this article is investment advice, but more of me describing what I do to perform research and things that you may not have thought of to look into.

Next, I want to share with you the goal of research.

Goal: Try to make this investment look bad.

You might think this is counterintuitive, but humans are very biased. Anyone can make an investment look good. It takes more effort to make an investment look bad, and that’s exactly what we want to do. The goal of making an investment should be to make the project look bad. Like I said, any project can look good, especially if it contains a new idea, that’s what marketing is, but if you try really hard to convince yourself that it’s a bad project… and you’re still convinced, then you may be making a profitable decision.

After you establish this simple goal of trying to convince yourself NOT to invest, the next thing to focus on, in terms of making a profitable investment is to ask yourself this question.

Question: How many other people are going to buy this coin?

Coins and Tokens are essentially securities. Most don’t have profit-generating mechanisms, meaning that most will only be profitable if you buy before other people buy. Ask yourself, “Can I see 1,000,000 other people finding out about this coin and buying it too?” If the answer is yes, you are staring at a very profitable project.

Now, we can get into specific actions that fall under the research category. Just like to get those six-pack abs, you need to eat well and put in hours at the gym… if you want to consistently make good investment decisions, you will need to put in work and time doing research.

Tokenomics

‘Tokenonics’ is a fancy word for saying the ‘economics of an asset.’ For early coins, there isn’t much long-term data, so the initial tokenomics is a great source of information. Many times you can view tokenomics on the project’s website or whitepaper.

Inflationary or Deflationary

The first thing to find out about a coin is if it is inflationary or deflationary.

Inflationary means the coin will continue to be created. Inflationary assets usually decrease in price as time goes on if nobody buys more, so unless there is a reason to keep buying, the price will go down. For example, the US dollar is inflationary, they keep printing more, and every year it’s worth less, meaning it takes more and more dollars to buy the same thing.

Deflationary means that the coin will actually start to be destroyed. Deflationary assets usually increase in price assuming no other changes in the market, because as time moves on, there are less tokens to buy, so if the demand stays the same, the price will increase.

Some tokens are a mix of these. For example, Bitcoin is inflationary right now because miners will keep minting more coins. One day though, there won’t be any more coins to mint, and when that happens it’ll stop being inflationary. We can assume that since some people will lose their keys, forget their keys, or send to an address that nobody can access… that Bitcoin will eventually become deflationary.

‘Farm Tokens’ are special tokens that are given to investors of a yield farm. To incentivize users to invest their tokens, a developer will create a new token, give it some value, and then create even more, making these highly inflationary tokens to early investors. Watch our video on Degen Yield Farms to spot these highly-speculative, almost scam opportunities.

Premine

Another important thing to find out is the presale data. Some tokens are sold to private investors, others are given out to their early users, and some are mined by a closed-group set of miners. Basically, find out how the token initially gets out to the public. Was it sold at a price? Did early miners mine the token? Did the developers give them away to testers of their platforms? Each of these affect the overall tokenomics.

Airdrop

Airdrops are interesting, because depending on the project and the long-term vision, they could be good or bad. For example, Uniswap was an airdrop. People who received the airdrop that held now have around $10,000 worth of UNI tokens.

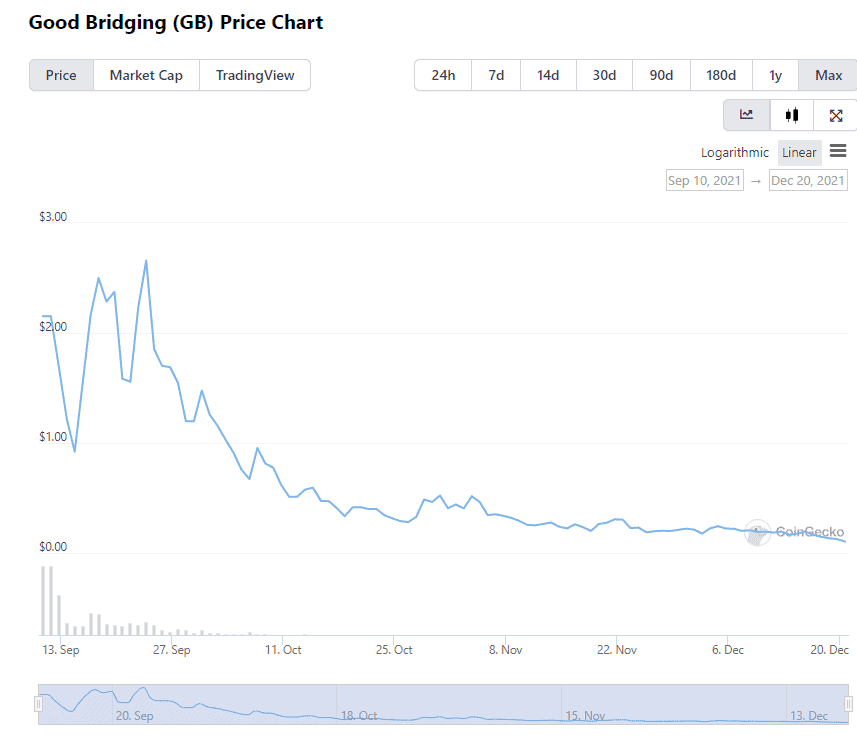

Another airdrop was the GB token airdrop for people who used the Ethereum-to-Avalanche blockchain bridge. The token doesn’t really have a utility, and a lot of people who got it weren’t even sure what it was. I personally received it and sold it for $1500.

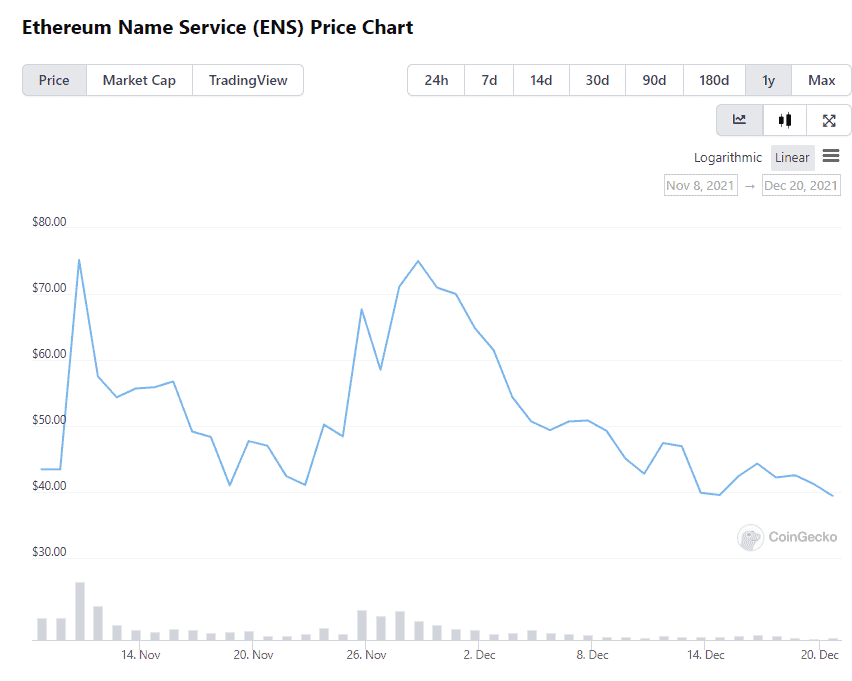

Finally, another airdrop was ENS. This aidrop was worth from $2000-$20000 depending on your interaction with the platform. After 2 days, the price went from $25 to $80, and then fell to around $60 for a while.

There are many other ways to release a coin, including an ICO, Premine, Presale, and even more algorithmic ways to offer coins to the public, but it’s time for us to move on.

Team

The team behind a project is very important. Let me give you a humble brag to explain. About 5 years ago, I started a channel called PracticalPsychology. It now has over 2,000,000 subscribers, and is in most senses “successful.” In fact, in the past year, I have hardly created anything on the channel and it has earned me about as much as an average college graduate.

In the past 10 months, I’ve been creating this second channel called WhiteboardCrypto, and have got it to around half a million subscribers much quicker, and it should also be said it is about 10 times more profitable because I have experience monetizing a Youtube channel. I know what will take the least amount of work that will lead to the most amount of revenue.

In the future, do you think my next channel will be successful? Do you think I’ll take all the things I’ve learned from these two channels and carry them with me? What about the people I’ve met creating this channel? Heck, in the last month, I’ve had around 10 phone calls with multi-millionaires, talked to multiple people who have connections with billionaires, and even developers who have created apps used by millions of people. I didn’t have any of those resources this time last year, and these people were people who wanted to talk to me, which is honestly mind blowing to me.

I say all this, to share one point with you. The people behind a project are very important. Do your research on them, and make sure you trust them with your money. I know how to write engaging, genuine, educational scripts. Our animator is world-class in making these videos fun to watch. The artist I found for thumbnails and other images is also very talented. Again, the team is very important.

Social Media (content creators)

One good signal of a coin increasing in price are the content creators on the internet mentioning it. A golden goose I’ve recently found is if the content creator specializes in only one project.

For example, I’ve talked to Austin from FTM Alerts and he has a Youtube channel and Twitter account specifically for the FTM blockchain. Although he’s not directly sponsored by the chain, he does hold a decent amount and continues to create content to bring on new users.

Another example is Taiki Maeda, who has a considerable amount of Twitter and Youtube followers. When he makes a recommendation, he knows some followers out there will go all in due to his past great calls. This means his reputation is on the line, so he’s not going to promote a pump-and-dump, even if he claims it’s not ‘financial advice.’

Seeing niche content creators is a very good sign, especially if they are creating lots of content. The Shiba Inu Token is another example with an unofficial Youtube account that posts videos almost daily.

If someone spends their time and energy to bring new people onto a coin by creating content, it doesn’t mean the coin is a good project fundamentally, but it does mean a community might form or that a they might lead new investors to the project, which may or may not be good, but definitely is an important piece of information to know as an investor.

What problem are they solving?

One thing to think about for every project is, “what problem are they solving?” Even better, “how are they going to use YOUR money to help solve that problem?”

In the case of Bitcoin, it solves inflation. People often ask me, “why Bitcoin and not some other ERC-20 token or a fork of bitcoin?” Well, Bitcoin was the first. When I talk about cryptocurrencies to anyone, 90% of them have heard of Bitcoin and that is why it may be the best solution for inflation (even when others can solve it)—it’s just well known.

Ethereum solves the problem of expensive and slow banks. Ethereum actually solves many problems, but the existence of banks seems to be the main one. You can’t be ‘overleveraged’ with Ethereum. You can’t be ‘in the hole,’ or have a negative account balance. You can send money very quickly. And it may not be cheap right now, but if you’re moving anything over 7 figures… it’s considerably cheaper than a bank. Also, nobody asks questions on your moves, you can do it anonymously and privately. Ethereum solves a lot of problems, and it’s similar to Bitcoin in the fact that it’s the first of it’s kind of a well known project.

Chainlink gives blockchains off-chain information. With the growing space of blockchain technology, developers are struggling really hard with getting real-world data onto the blockchain in a reliable and trustless manner. Chainlink seems to offer a solution.

In the grand scheme of things, take a step back and ask yourself “What problem is this project solving?” Even OHM, which is something I personally think is quite overvalued, solves a specific problem of a digital reserve currency and protocol owned liquidity. Some problems you may not be aware of, others you may not understand. I will never invest in a coin or token until I understand the problem it is solving, if any.

Read the Whitepaper

Again, one of the best sources of fundamental analysis is to read the project’s whitepaper. A whitepaper is an official paper where they describe the problem they want to solve, how they want to solve it, and why they are going to do so. Whitepapers are usually quite complicated, but I honestly believe anyone can read Bitcoin’s.

Deserving Factor

Think about it like this: “where does this coin deserve to be on the list?”

So does Polkadot deserve to be the #1 coin? Does Bitcoin deserve to be #92? By thinking about this in generalities we can more accurately make a prediction of where a coin might be by our previous knowledge of it. Avalanche may not deserve to be #1, but I don’t think it should be #1000 either, so maybe #20-#30 is a fair guess. Using these guesses, we can then divide the market cap by total distribution of coins to get an idea of a fair price.

This is just a mental model I use to help with my investment decisions.

More Technical Things

I actually have created a full PDF filled with more technical things I do to perform research on a coin or token. Things like checking whale wallets, which is an obvious thing to check, but devs have found a way to get around it so lazy researchers don’t see what they did. There’s an advanced way of how to check the blockchain for dev wallets, but it’s technical and takes time.

Other things include checking liquidity, including a special kind called locked liquidity which is way more important than market cap for cryptocurrencies, and even hidden signals that I’ve found to be super helpful like how I mentioned specific content creators of a project.

I may have teased you little at this point, the Research PDF is actually a bonus to anyone who enrolls in WhiteboardCrypto Club, the most affordable DeFi membership ever. Also in the club, you get instant access to a community, so if for some reason you don’t want to do research, you can politely ask, I’d love to do some preliminary research on a project for you, if anything it improves my research skill.

Also all new members are sent $20 of ethereum, and the main meat and potatoes of the membership are tons of DeFi tutorials on how to use certain protocols, but I’ve already shared too much. If you want to learn more, you’ll have to check out the official WhiteboardCrypto Club enrolment page before the end of the month.

Thanks for reading, I hope you enjoyed this information, I really hope you learned something, and most of all, I hope to see you in our next article!