Think back to the last major purchase you made—maybe it was a car or a house. Possibly, you took out a loan for it. However, even if you paid cash, the odds are you didn’t walk into the dealership or the real estate office with a bag full of $100 bills.

More likely than not, you wrote a check or used a debit card. In fact, my guess is that you do this for most purchases over a couple hundred dollars. Many people use cards for virtually all purchases, even those as minor as a pack of gum.

This is called commercial money. It consists largely of checks and electronic payments such as debit cards that transfer previously deposited money from the purchaser to the seller.

This allows the economy to function more smoothly by letting depositors put their money in a bank and use it for payments without having to either physically withdraw it or carry large amounts around with them.

Instead, they just tell the bank, either through a check order or debit card, that they want the money transferred to a third party.

In this article, we will explore how commercial money works, how it came about, why banks provide this service, and how, by providing this service, banks actually increase the amount of money in circulation.

How Commercial Money Works

Pretend you get a $1000 bonus from work. Putting aside for a moment that the bonus itself is probably paid with commercial money such as a check or direct deposit, what do you do with that money?

Probably the first thing you do is put it in your bank account. So, you take this $1000 and put it in your bank account. Then what? Well, eventually you’re going to want to spend it. Say you’re at the store and see some fancy little trinket you want to buy. It costs $35 but your money is at the bank. What do you do?

You could get in your car, drive to the bank, take the money out, and return to the store to purchase the trinket. If you want to avoid this hassle, you can also write a check or swipe the debit card your bank gave you when you opened the account.

This allows you to access the money you’ve deposited without physically entering the bank by letting the bank know you intend to transfer the money for the purchase to the store. The bank will then carry out that transfer, the store gets its money, and you get your trinket—all with the swipe of a card or the writing of a check.

Other forms of commercial money include money orders and traveler’s checks. The commercial money itself is not legal tender; rather, it is a promise by a financial institution to pay out legal tender on demand.

However, because the promise comes from a respectable and highly regulated institution, they are widely accepted as money.

History of Commercial Money

Since banks are critical in the functioning of commercial money, understanding how commercial money came about involves knowing the history of banking.

Banking can be traced back to ancient Mesopotamia around 2000 BCE where temples would often be used as a storehouse for valuable items and grain. In addition to keeping records of these deposits, the priests of the temple would lend out these resources to farmers and merchants.

With the ancient Greeks, we see the establishment of moneylenders and private depositories. Banks in the Roman Empire established a precursor to commercial money, using bills of exchange to transfer funds from one location to another.

Given the huge size of the Roman Empire, this allowed individuals to access their wealth throughout the empire without having to physically carry it with them.

Though these services declined following the fall of the Roman Empire, the Knights Templar revived them during the Middle Ages to assist pilgrims in their voyage to and from the Holy Land.

A pilgrim could deposit their money at a Temple Church in London, where he would be issued a letter of credit, which he could then exchange at the Temple Church in Jerusalem. This allowed them to access their wealth without having to carry large sums with them, which could make them a target for robbers.

Over time, these letters of credit or bills of exchange would become deposit transfers conducted via written instructions, which led directly to modern checks.

The earliest modern banks came about in Italy during the medieval and early Renaissance periods. In particular, the Italian city-states of Florence, Venice, and Genoa became major banking centers in the 14th and 15th centuries CE.

Notably, the famed Medici family of Florence made their fortune in banking and used it to establish their political dynasty. The 17th and 18th centuries saw banking continue to grow in Europe, and it first came to the Americas with the establishment of the Bank of New York in 1784.

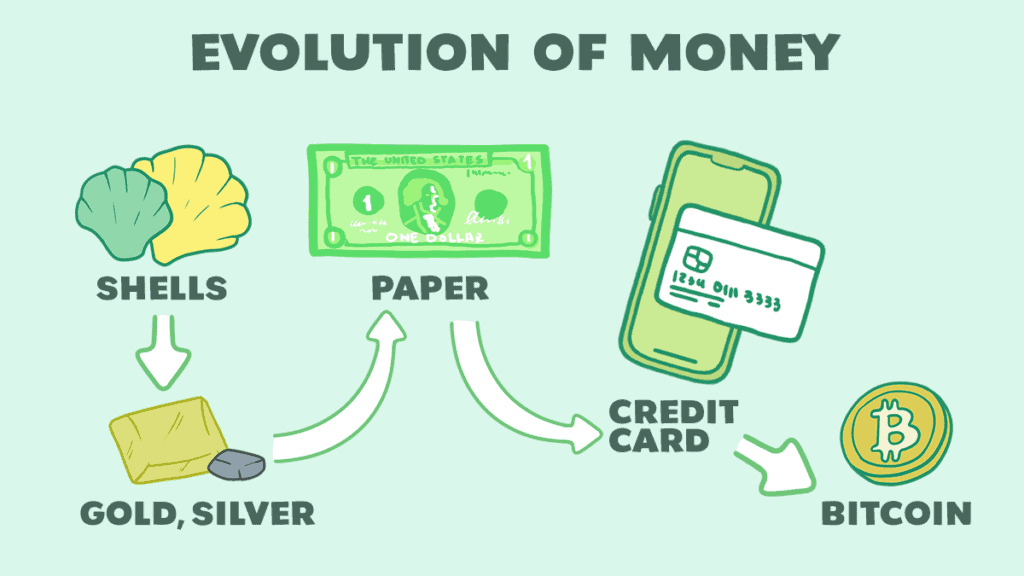

The advent of new technology revolutionized commercial money. First, the invention of the telegraph in the 1840s and the telephone in the 1870s allowed for faster communication between banks. This paved the way for money to be transferred over longer distances, with the first wire transfers occurring in the 1870s. The technology of the latter half of the twentieth century brought about even greater innovations, including:

- ATMs

- electronic payments

- online banking

- international payments

- currency exchanges

- digital currencies

Why do Banks Provide these Services?

We’ve already looked at some of the services banks provide, both in terms of convenience through the use of commercial money and allowing people to access their wealth without having to carry it with them. Why do banks provide such valuable services? Is it out of the goodness of their heart?

Of course not (with the exception being the Knights Templar, who had a religious motivation). It’s because they profit from it.

Early banks charged a fee for their services. This still occurs for some services provided by banks today. However, today most of their profit comes from interest charged on loans.

They are willing to accept your money and provide the convenience of various forms of commercial money such as checks and electronic payments because they aren’t keeping all of it. Instead, they are lending most of it out to other people or businesses, charging interest, and keeping the interest as profit.

Say you deposit $1000 in a bank account. The bank must keep a minimum required portion on hand—this is known as the reserve requirement. However, the rest they will lend out.

So, say the reserve requirement is 10% of the deposit. The banks must put $100 aside, but the remaining $900 can be loaned out at a profit. If the bank can charge a 10% interest rate, then they will make a $90 profit on the loan. The bank has taken the $1000 you deposited and turned it into a $90 profit for themselves.

How Banks Create Money

By doing this, banks actually increase the supply of money in the economy. How can this be? Generally, a key feature of monetary policy is that the central bank can control the money supply. How do private institutions then increase the money supply? They do it through the money multiplier—here’s how it works.

Remember that $1000 you deposited in a bank, $900 of which was loaned out? Well, presumably the borrower didn’t borrow that money to sit in a room and stare at it. They have plans for that money, so they go out and spend it.

Say they buy a car or a house (at $900, a really cheap one, but hey—to each their own). The seller now has $900 and you have $1000, totaling $1900 in an economy that started out with only $1000. If the seller deposits their $900 in the same bank, the bank could loan out $810, repeating the process and further amplifying the amount of money in the economy.

This may seem risky. What if you want your money and the bank doesn’t have it? If the seller deposits the money, all would be well—the bank would have the $100 of it kept in reserve plus the $900 the seller deposited and could provide your $1000 on demand.

What if both you and the seller attempt to withdraw it at the same time? Then the bank would be insolvent.

This is where that reserve requirement comes into play. Remember, with actual banks, we are talking about hundreds of loans with thousands of deposits. Because money is fungible, the bank can use the deposit (or part of the deposit) from one client to satisfy another.

Unless everyone tries to withdraw their money at one time (known as a bank run), all will be well. The reserve requirement is meant to ensure that the bank will always have enough on hand to meet the demands of those wishing to access their money.

Conclusion

We hope you enjoyed this article and that it gave you a clearer understanding of what commercial money is and how it functions with the banking system. We hope you’ll join us again next time.