ZBG is a Hong Kong-based cryptocurrency exchange that launched in 2018 that serves primarily the Asian and European crypto markets.

The exchange requires KYC (Know Your Customer) identity verification protocols to be completed for use of the exchange. US users can use the exchange for access to all products.

History of ZBG

Upon launch in 2018, ZBG soon momentarily landed in the global crypto exchange’s top 10 list by volume during the bear market, thanks to its unique operational features at the time.

Today, ZBG serves clients all over the world and is available in 7 languages including Japanese, Vietnamese, Korean, English, Chinese, Turkish, and Russian. As such, it tends to serve clients from Asia, the Middle East, and Europe, with over 3M users worldwide. The exchange is especially welcomed in emerging markets and was recognized by Russian media in 2019.

ZBG Exchange is a wholly-owned subsidiary of ZB Group. In March 2020, ZBG launched the perpetual contract trading function to move towards cryptocurrency derivatives markets. ZBG is the first exchange under the ZB Group to support perpetual contracts, and ZBG also adopted the fairest index prices, which are anchored to 80 exchanges around the world.

Besides supporting advanced trading features including leverage, ZBG continues to expand its global market and provide stable and safe blockchain project listing, diversified crypto assets and blockchain derivatives investment services to users in emerging markets and around the world.

As of Feb. 2022, ZBG appears to handle about $400M 24H volume across the exchange daily.

ZBG is best for:

-

All types of cryptocurrency investors and spot/margin traders in emerging markets (Asia and Europe specifically, but ZBG may be used almost in any other country) who desire access to a large amount of crypto offerings and products, plus 100x leverage

-

Traders and investors who desire a flat, relatively low 0.025-0.075% maker-taker fee schedule, alongside the full suite of ZBG offerings such as ZBG Launchpad, Rocket, Savings, and more

PROS

- Large range of product offerings

- Geographically diverse

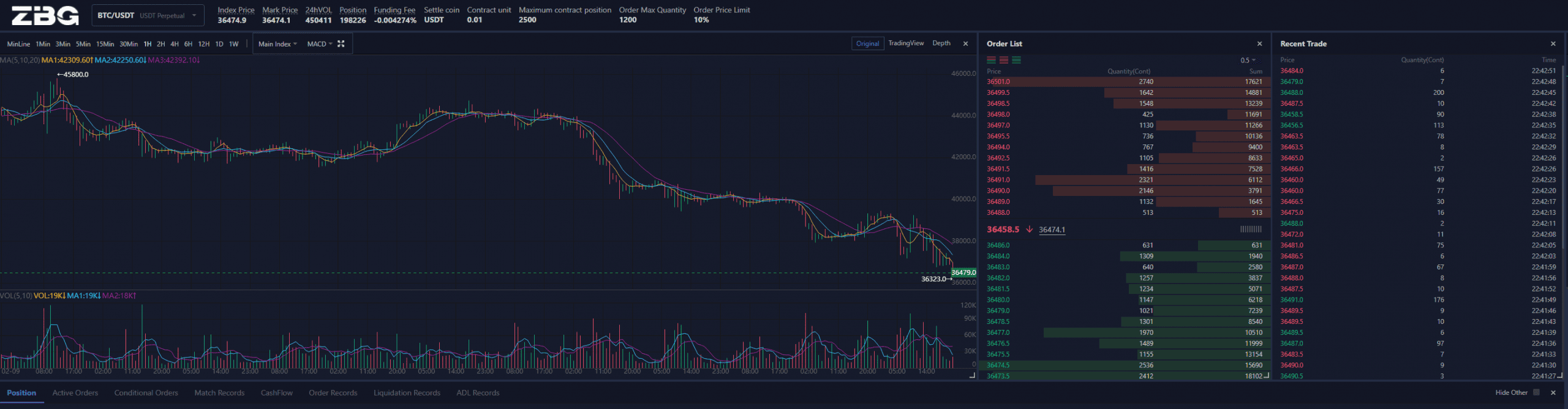

- Advanced charting and trading features

- Spot trading, perpetual futures contracts, and margin access

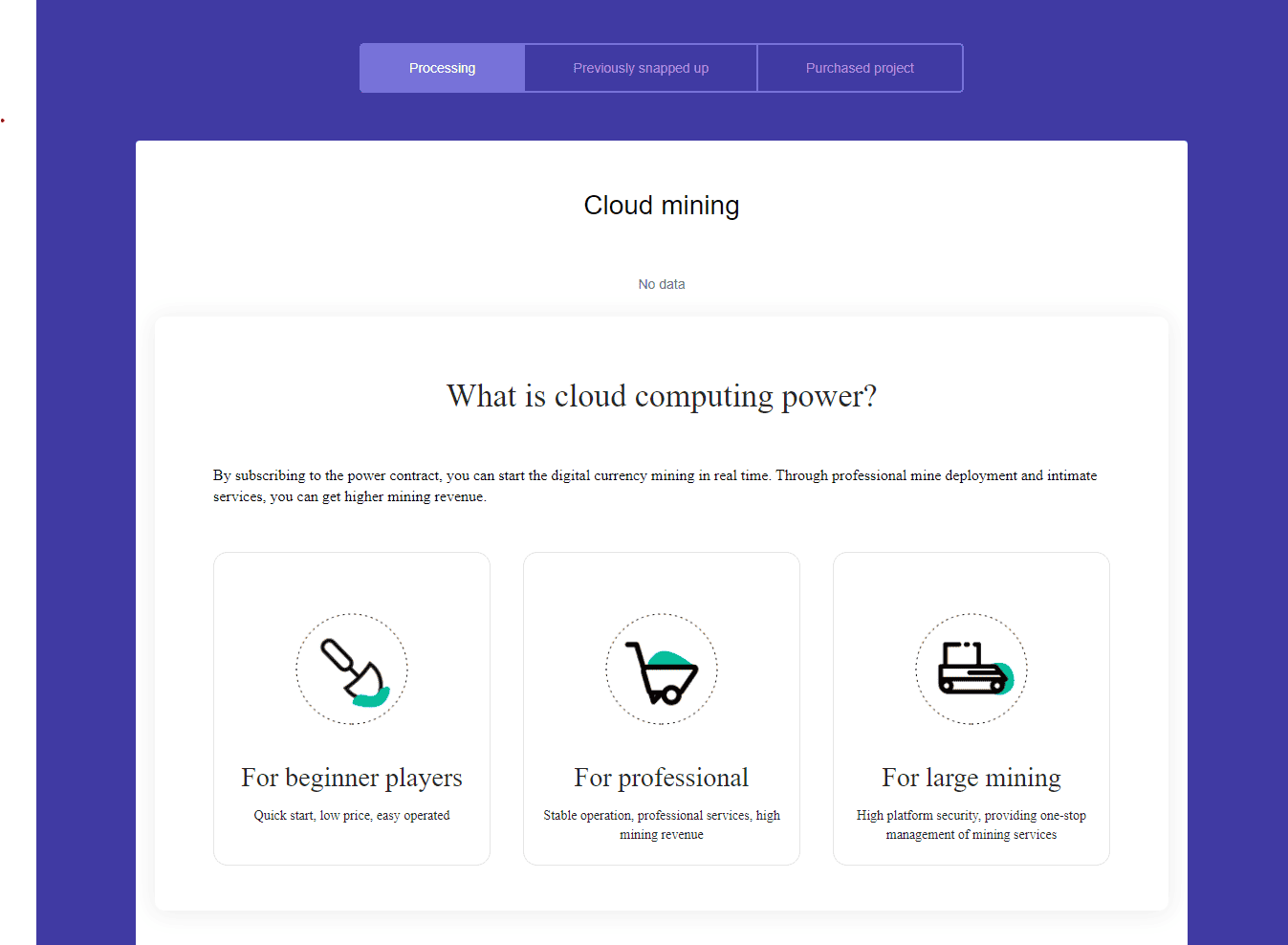

- Cloud mining

- ZBG Launchpad shows new and quality projects

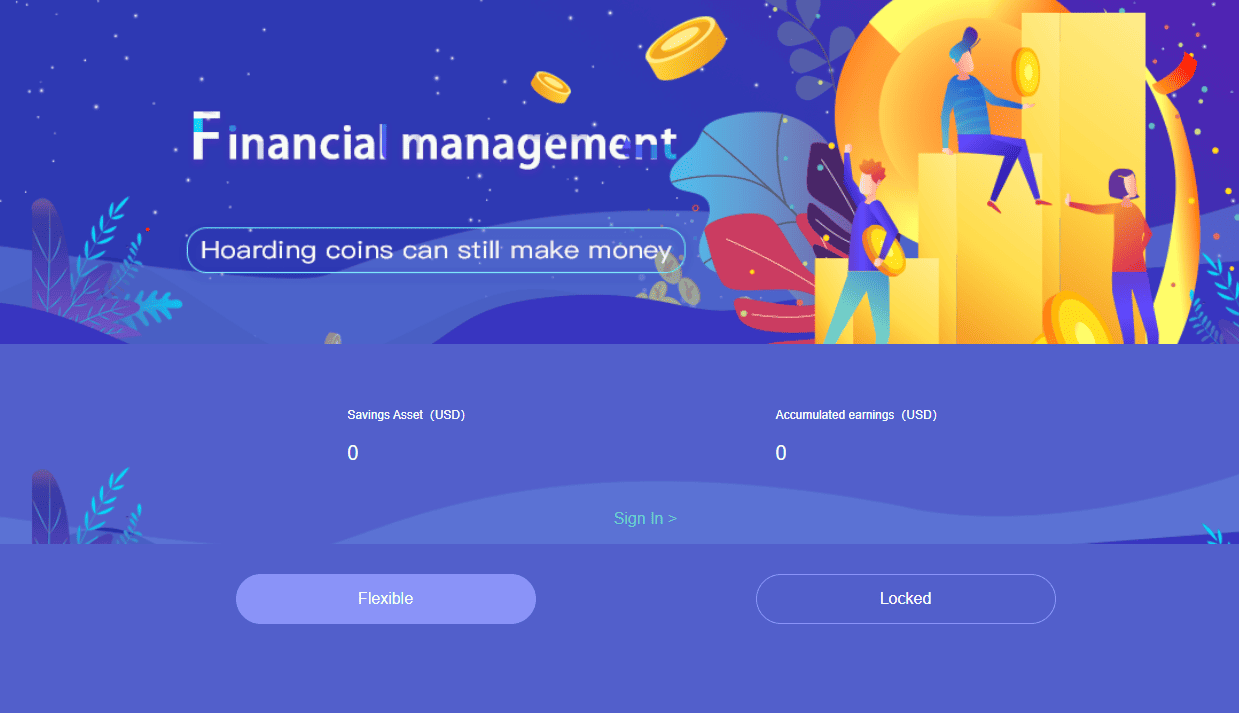

- Savings product

- Native token with fee discounts

- Mobile and desktop apps

CONS

- User interface still underdeveloped

- Limited market offerings

- Flat maker-taker fee model

- KYC required

Pros & Unique Features

The best features of ZBG Exchange are its large range of high quality product offerings for traditionally underserved crypto markets geographically, such as Turkey, Russia, and the rest of Asia. However, it should be noted that ZBG does not restrict many countries from using its exchange, and even US users are able to use all products.

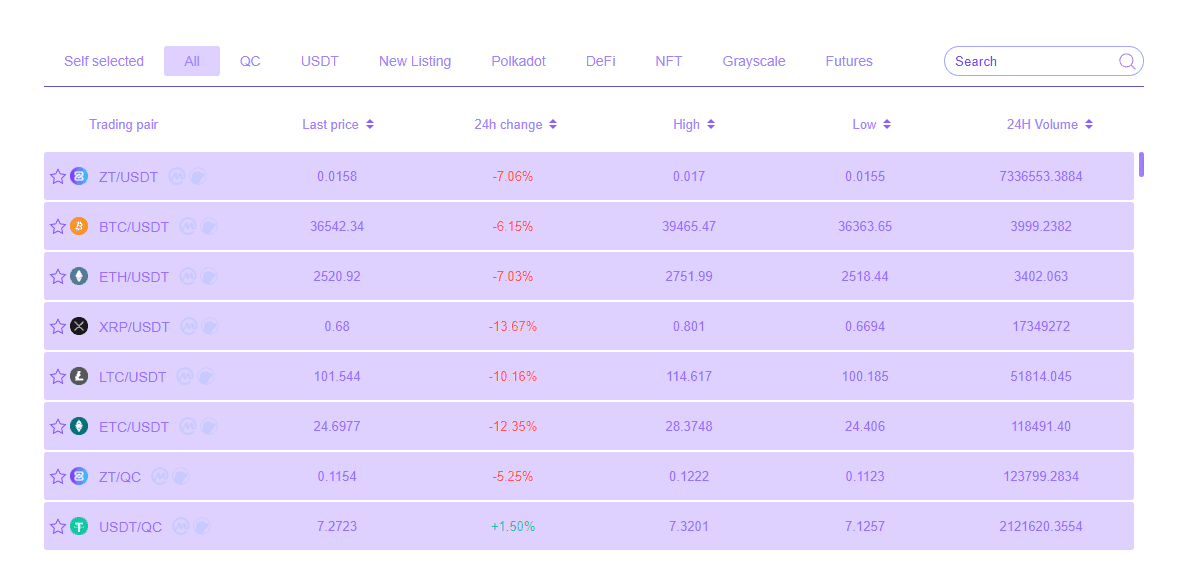

ZBG’s products include a full-featured exchange with advanced charting and trading features. The exchange offers 82 coins and 127 pairs for trading, which is a moderate offering size. Charting is integrated with TradingView and order books are present for more advanced traders to use. Users can easily transfer fiat through the fiat area and connect to the exchange via an API.

In addition to spot trading, ZBG offers a range of perpetual futures contracts, as well as margin access with upto 100X leverage, which is a rare find these days in the global crypto markets.

Other unique products that ZBG offers include cloud mining, which allows users to subscribe to the power contract and start digital currency mining through leveraging the exchange’s services.

The ZBG Launchpad (also called the SuperLaunchpad) allows blockchain projects to launch and for quality projects to get listed. The Rocket plan is ZBG’s original price limit mechanism for new listing coins.

A product called Savings allows the support of multi-currency fixed and flexible savings, with low risk, and stable returns. This is offered alongside other crypto financial management services offered by the exchange.

ZBG also offers asset management services by a professional quantitative asset management team, under a product called Strategy Plaza.

ZBG’s native exchange token, called ZT (ZBG Token), allows for deducted service charges and discounts. As per ZBG’s official medium post, ZT is first used for processing fee deductions, and then if the user’s held ZT is not sufficient to pay the corresponding handling fee, the system charges according to the base rate.

Lastly, ZBG also offers mobile apps for users to be able to trade anywhere and anytime with the ZBG app for both Android and iOS.

As for customer support, ZBG offers support via live chat and email in multiple languages and users can also access support via logging into the exchange. Users can also enjoy commissions and rebates from inviting their friends to trade at ZBG.

Cons & Disadvantages

The main disadvantage of ZBG is that some of its web pages and product offerings seem a bit underdeveloped based on the website, but it is still an active exchange that serves emerging markets with both spot and margin products, and has been recognized as such by third party publications.

While its host of crypto financial services are limited beyond offering staking, and its market offerings are also not comparable to larger exchanges such as Binance or KuCoin, ZBG does offer these coins to almost any country in the world, for users who otherwise would be unable to buy them.

Another disadvantage of ZBG is in its flat maker-taker fee model, without any tiered volume incentives or additional maker rebates. While market makers, or liquidity providers are rewarded in this fee structure, high volume traders, especially liquidity takers, cannot achieve lower fees than the standard fee model.

Lastly, ZBG does require KYC requirements to be completed to use the exchange for all jurisdictions as per its KYC/AML policy, but as per its TOS, not many jurisdictions are explicitly banned, which makes ZBG one of the few exchanges that can be used essentially all across the world.

ZBG Fees

ZBG charges a flat fee schedule on trading fees, with the fee differing for market makers and for market takers.

Trading fees are 0.025% for market makers (providers of liquidity) and 0.075% for market takers (takers of liquidity). There are no incentives or tiers based on trading volume, unlike at many other exchanges.

Additionally, unlike other exchanges, ZBG does not offer any additional rebates for market makers, which means while the fees are more advantageous for market makers than for takers, it is not the ideal exchange for very high volume traders who could otherwise receive net rebates or pay 0 fees at other top exchanges.

Trading fees are incurred when an order is filled by the exchange’s matching engine. If an order does not execute, there is no fee charged until it does execute at a later point, or it can be canceled. The full fee schedule can be found here.

ZBG does offer reduced trading fees for users holding its exchange token ZT. Reductions can be seen in the table below.

Reduced Trading Fees Based on ZT Holdings

| Level | ZT Holdings | Basic Fee | ZT Deduction Fee |

|---|---|---|---|

| LV 1 | ≥ 0 | 0.2% | 0.20% |

| LV 2 | ≥ 10,000 | 0.2% | 0.18% |

| LV 3 | ≥ 50,000 | 0.2% | 0.16% |

| LV 4 | ≥ 100,000 | 0.2% | 0.14% |

| LV 5 | ≥ 500,000 | 0.2% | 0.12% |

| LV 6 | ≥ 1,000,000 | 0.2% | 0.09% |

Note that ZBG previously has trialed a tiered trading fee structure as noted here, but the current fee structure as of Feb. 2022 is based on flat fees as noted above.

Other Fees

ZBG charges the following deposit, withdrawal, and other fees:

- No account creation or maintenance fee

- No deposit fees for any digital asset (not shown but a third-party site lists them as free)

- Withdrawal fees for digital assets are not shown publicly, but depend on the asset and are listed on this third-party site. This fee is determined by the blockchain network fees and may vary depending on network usage

- Fees range from 5 USDT to 0.001 BTC for the respective assets

- ZBG does not allow bank wires or credit/debit card usage to fund accounts, but crypto assets and stablecoins are allowed

There are no fees for signing up or for having an inactive account, nor any fees for holding funds in an account, and users may hold assets as long as desired.

Account Tiers & Limits

All users of ZBG are required to undergo the same KYC verification procedures as per its KYC/AML terms. The requirements for documents for KYC can be noted below.

For KYC, users are required to submit their name, address, DOB, nationality, government-issued ID, and a valid photo holding said ID, in addition to a valid email address and a mobile phone number.

As far as account limits, since all accounts must undergo KYC, account limits are the same across accounts. If a user is withdrawing the ZBG token, ZT, the single withdrawal limit is 50,000 while the 24H withdrawal limit is 500,000.

If withdrawing BTC, the single withdrawal limit is 5, while the 24H withdrawal limit is 100. Other deposit or withdrawal limits are not publicly listed on the exchange.

Crypto Security

ZBG does not list much information publicly on its website about its security precautions and it is not a regulated exchange, and does not have a MSB license.

ZBG seems to use multiple technologies to protect its users and assets including SMS authorization, e-mail authorization, whitelisted addresses, two-factor authentication, and storing 95% of digital assets in cold wallets to help to provide a high level of security.

Lastly, ZBG also supports SSL protocols. As far as the exchange’s reputation goes, ZBG’s social media presence is quite muted but volume can be seen on leading crypto market aggregators such as CoinMarketCap and CoinGecko.

There have been no reported hacks of ZBG and users are encouraged as always to use 2-factor authentication, secure passwords, a new email, and always check links for possible phishing attempts, as always.

ZBG Review Conclusion

ZBG can be a good choice of exchange for users in emerging countries in Europe, Asia, and the Middle East who otherwise cannot access more reputable or top exchanges such as Binance due to regulatory rules. Either way, ZBG does offer a relatively high quality product offering for global crypto markets and does not bar any jurisdiction around the world from using its products, but does require KYC.

Users can enjoy both a moderate amount of spot trading options as well as futures trading pairs at ZBG with up to 100X leverage offered, as well as the rest of ZBG’s suite of products, such as Launchpad, cloud mining, Savings, asset management services, and more.

Its fees are also fairly competitive at only 0.025% for market makers and 0.075% for market takers, but there are no other rebate incentives for market makers or for high volume traders. ZBG does also offer reduced fees for holders and users of its native ZT exchange token.

International users looking for lending, borrowing, and staking options, from a more reputable exchange with clear security protocols and regulatory compliance, or institutional clients looking for other features may find other competitors more valuable.

-

ZBG offers access to 80+ cryptos and competitive 0.025-0.075% flat trading fees for both spot and leverage markets

-

Intermediate to advanced traders trading margin or futures who desire access to advanced trading tools, volume-based fee tiers, improved reputation and security protocols, and advanced charting would prefer to pick a different exchange especially if desiring one not requiring KYC, but users all around the world can technically use ZBG without an issue

Other Alternatives

For customers who desire access to a more comprehensive crypto exchange that also offers a host of financial services such as staking and cashback cards, either Crypto.com, Gemini, Coinbase, and Binance can make good alternatives, and all of these also offer greater amount of cryptocurrencies to trade along and better reputation and security.

Beginners, buy-and-hold investors, and low volume traders may prefer the easy to use features and functionality of Voyager and Coinbase with their brand presence, US regulatory approval, and security.

Coinbase is best designed for buy-and-hold investors or casual to intermediate cryptocurrency users—Coinbase offers 402 pairs vs. ZBG’s 82 coins—and offers an advanced desktop trading interface as well as a mobile app, but no futures or margin.

Active traders who need access to order books and advanced charting functionality may prefer using Coinbase Pro, FTX, Binance, or KuCoin though their fee structures and product offerings differ and most exchanges on the market use maker-taker fee schedules that give volume incentives, unlike ZBG which uses a flat fee model, albeit different for makers and takers.

For customers who desire to trade and invest in stocks in addition to top cryptocurrencies and do not mind having a smaller selection from which to choose or only desire access to the top 20 cryptos on the market, Webull and Robinhood are brokers that offers US equities and a small selection of cryptocurrencies.

Other competitors to ZBG include OkCoin, Kraken, OKX, Bitvavo, and Binance.

ZBG vs Coinbase

Coinbase is better for many core aspects of crypto trading and products offered if compared to ZBG, since it focuses on a wider range of services suited for both new users and advanced users with Coinbase Pro, while ZBG focuses more on emerging markets with more limited coins and a smaller scope of financial services.

ZBG and Coinbase both offer spot trading, but ZBG also offers margin with up to 100X leverage. ZBG offers better fees with the standard tier offering as low as 0.025% for market makers, without any volume or rebates. Coinbase’s fee schedule requires significantly more volume to achieve such a low fee.

However, an advantage for high volume traders will be the volume-tiered fees at Coinbase, which decrease most rapidly over $20M in 30-day trading volume. The one benefit ZBG has over Coinbase is its availability to every country in the world, but both exchanges require KYC to use.

Coinbase also offers much more of a selection of trading pairs compared to that offered at ZBG, with 440 trading pairs, compared to 82 coins at ZBG, as well as advanced charting, accessible order books, and advanced order types, which both exchanges offer.

Coinbase is a public US company and offers transparency into its industry-leading security along with its brand reputation, while ZBG is not regulated nor as highly regarded as Coinbase, so Coinbase is a far more trustworthy name.

Advanced users who desire both competitive fees and a greater selection of trading products than what either ZBG or Coinbase offer may find the choices below equally valuable.

ZBG vs FTX

FTX will win against ZBG for all intermediate or advanced traders, as FTX offers 323 coins and 492 trading pairs, which is far higher than ZBG’s 82 coins and more limited futures pairs.

Derivatives traders who want to trade margin, extensive crypto futures pairs, or leveraged tokens and options will prefer FTX since ZBG’s offerings here are quite limited, despite the 100X leverage. Meanwhile, FTX offers a max of 20X leverage now.

FTX is known for its extensive futures pairs and top-class matching and liquidation engine for advanced derivatives traders, and traders can use third party bots at FTX as well, while ZBG does offer advanced charting and order books access, but the exchange performance and reliability cannot be compared to that of FTX.

FTX is known for catering to active derivatives traders and optimizing for high order volume and trading execution speed. While FTX cannot be used by US persons, ZBG can, but users must undergo KYC.

FTX offers a US version of its exchange whose trade offerings are far more limited than its parent global exchange and do not at all compare to FTX International’s selection, but are about equivalent to what ZBG offers, though it remains competitive in its fee. FTX US wins for US users over ZBG due to features and reputation.

International users who can use FTX International may prefer FTX. US users trading at FTX US need to do KYC procedures and likewise for ZBG. Fees may be slightly more competitive at FTX as a trader’s volume is higher, since FTX offers both fee incentives for volume and for holders of its FTT token.

ZBG vs Gemini

Gemini is more focused on its holistic crypto financial services for Americans, while ZBG serves emerging countries and is not regulated, unlike the Gemini brand.

There is a difference in fees to start, giving ZBG the clear edge: the minimum fee tier at Gemini starts at 0.35% for takers and 0.10% for makers, with a flat transaction fee between $0.99-$2.99 and 1.49% transaction fee for trades over $200, so there are extra fees per transaction and extra “auction” fees, while ZBG charges flat 0.025% trading fees for market makers and 0.075% takers, which is still much lower than Gemini, even without any volume-based incentives.

Gemini offers volume incentives while ZBG does not, both as far as fees go, neither platform is competitive as compared to the global crypto market offerings, but at least the Gemini brand name is reputable.

US investors and traders are allowed to use Gemini with KYC verification only, since Gemini is regulated and based in the USA, however as a result, Gemini offers no margin or futures products. ZBG offers spot and margin to users across the world.

Gemini offers 62 coins and 86 trading pairs which is about the same, though a bit smaller than the amount offered by ZBG. Another major difference is the existence of Gemini’s interest-earning product and credit card, neither of which exist at ZBG at the same capacity, though ZBG does offer some minor staking services.

ZBG vs Kraken

Kraken offers margin trading at up to 5X leverage even for US investors and several other margin offerings, while ZBG offers unregulated 100X leverage. US users may prefer Kraken for its regulatory compliance and strong track record if they are traders especially, or they can opt to use ZBG, despite its reduced reputation and unclear security protocols.

Kraken uses a maker-taker fee schedule, starting at 0.16% maker fees and 0.26% taker fees at the entry level which is not quite as competitive even as ZBG’s 0.025-0.075% flat fee schedule. Market makers enjoy reduced fees however at Kraken and fees also reduce with volume, which is not the case at ZBG as far as volume tiers go.

Kraken offers a greater variety of cryptocurrencies and pairs (over 90 coins, over 400 pairs), so users who value a large selection and advanced traders who seek margin will prefer Kraken over ZBG.

If an active trader wishes to trade other instruments beyond crypto and prefers not to KYC, he or she may prefer other exchanges such as OKX, but if he or she prefers a much larger selection of crypto only instruments and does not mind KYC, Kraken wins.

Kraken is accessible in 48 US states with KYC and is regulated and licensed by FinCEN in the USA, while worldwide users can use ZBG with KYC.

ZBG vs Binance

Binance is the leading global crypto established exchange by trading volume, offering a much larger selection of cryptocurrencies than ZBG—over 351 coins and over 1300 pairs.

The two exchange’s offerings are varied in their scope, with ZBG being an exchange catering primarily to emerging markets and other countries that may even be banned from Binance, while Binance is focused on being a global leader and fast innovator in every crypto product, and does so with unofficial regulatory approval now, along with its notable brand name.

Traders looking solely for the most advanced trading options such as high leverage margin and futures products specific to crypto only will prefer Binance, as it offers many USDT futures pairs not found anywhere else besides potentially OKX or FTX. ZBG actually offers higher leverage than Binance today, at 100X, while Binance has limited their max leverage to 20X in 2021.

Binance’s maker-taker fee schedule is unique in its competitiveness compared to that of other exchanges, starting at 0.1%, plus Binance also offers further 25% reduction in fees if paid in BNB, alongside offering reduced fee tiers for higher volume and even maker rebates.

Binance and ZBG are roughly tied in the fee department as ZBG’s fees are a flat 0.025-0.075% for makers and takers with almost no incentives for reductions.

Binance also offers a more extensive web and ecosystem of products, support, and liquidity, especially given its larger daily volume as compared to ZBG. Binance is the most popular and well-known futures market in the global cryptocurrency industry and well-known for its extensive futures pairs.

The Binance exchange is not at all accessible to US persons and US customers will have to use Binance US which is a much more limited version of its global parent site, with only 64 coins and 130 pairs, which is about equal to ZBG, but Binance US has a better reputation.

Binance requires full KYC now to trade even spot products, and ZBG requires full KYC as well to use. Advanced traders and intermediate users alike who value a large selection of cryptocurrencies, products like staking, lending, and more, competitive fee structures, and futures and margin products will probably prefer Binance.

FAQ – Frequently Asked Questions

Is ZBG Safe?

It is not possible to determine ZBG’s exact safety profile at this time. ZBG does not list much information publicly on its website about its security precautions and it is not a regulated exchange, and does not have a MSB license.

ZBG seems to use multiple technologies to protect its users and assets including SMS authorization, e-mail authorization, whitelisted addresses, two-factor authentication, and storing 95% of digital assets in cold wallets to help to provide a high level of security.

Lastly, ZBG also supports SSL protocols. As far as the exchange’s reputation goes, ZBG’s social media presence is quite muted but volume can be seen on leading crypto market aggregators such as CoinMarketCap and CoinGecko.

On the plus side, there have been no reported hacks of ZBG and users are encouraged as always to use 2-factor authentication, secure passwords, a new email, and always check links for possible phishing attempts, as always.

How long does ZBG Withdrawal take?

All crypto transactions at ZBG on average can take from 30 minutes to several hours for a transaction to be confirmed due to the blockchain. BTC withdrawals take 3 confirmations, while ETH withdrawals take 12, for example. Note that for the ZBG Exchange to approve a withdrawal before its processes can take longer, so the waiting period can be in the 1+ days’ range.

Please note that for crypto, the number of confirmations required for actual depositing of funds is determined by every receiving platform individually, for each particular currency, according to its own security standards.

Is ZBG a good exchange?

ZBG can be a good choice of exchange for users in emerging countries in Europe, Asia, and the Middle East who otherwise cannot access more reputable or top exchanges such as Binance due to regulatory rules. Either way, ZBG does offer a relatively high quality product offering for global crypto markets and does not bar any jurisdiction around the world from using its products, but does require KYC.

Users can enjoy both a moderate amount of spot trading options as well as futures trading pairs at ZBG with upto 100X leverage offered, as well as the rest of ZBG’s suite of products, such as Launchpad, cloud mining, Savings, asset management services, and more.

Its fees are also fairly competitive at only 0.025% for market makers and 0.075% for market takers, but there are no other rebate incentives for market makers or for high volume traders. ZBG does also offer reduced fees for holders and users of its native ZT exchange token.

International users looking for lending, borrowing, and staking options, from a more reputable exchange with clear security protocols and regulatory compliance, or institutional clients looking for other features may find other competitors more valuable.

Where is ZBG located?

ZBG is located in Hong Kong as per its LinkedIn and website information.

Does ZBG require KYC?

Yes, all users of ZBG are required to undergo the same KYC verification procedures. For KYC, users are required to submit their name, address, DOB, nationality, government-issued ID, and a valid photo holding said ID, in addition to a valid email address and a mobile phone number.

What are the Deposit and Withdrawal Methods and Fees for ZBG?

ZBG offers the following deposit and withdrawal methods, with the corresponding fees:

- Crypto assets: deposits and withdrawals—no deposit fees (free). Withdrawal fees depend on the asset (and blockchain network) in question: fees are listed on this third-party site

- Fiat deposits are not accepted at this time, or the availability of this is unclear, or only available in CNY with unclear fees. Users should use stablecoin or crypto asset deposit and withdrawal for ease of use

- No bank wire support

- No option to purchase crypto with a credit or debit card

What is the Minimum Withdraw Amount for ZBG?

The minimum withdrawal amount for crypto assets at ZBG is listed for each asset in this page.

For crypto assets, the minimum withdrawal depend on the asset in question. For BTC, the minimum is 0.0011 BTC, and for ETH it is 0.011 ETH, for example, and 6USDT for USDT.

How do you withdraw from ZBG?

Users can withdraw from the wallet by navigating to the “Wallet” section of their account page, then clicking the crypto the user wishes to withdraw.

From there, fill in the details of the withdrawal including toggling the correct currency and be sure to include a tag or memo if needed. The withdrawal options including the blockchain network and any associated fees will then populate on the screen.

Finally, the user clicks the “Submit” button, opens his or her email, and confirms the withdrawal. The 2FA code is also required for security if this feature is turned on by the user.

Once ZBG approves the transaction, it will show in the blockchain network in question and process therein.

Is ZBG a wallet?

No, ZBG is a cryptocurrency trading exchange that also offers one custodial wallet for trading services, but is not a non-custodial standalone wallet.

How to use ZBG?

Any user from any country can use ZBG as per Terms of Service, however KYC must be done.

Using ZBG can be done by going to https://www.zbg.com, clicking the “Sign Up” link on the top right, creating an account on the platform, first undergoing KYC verification procedures, waiting for verification to complete, and then depositing any crypto asset trading funds into the account (fiat no supported at this time) and then getting access to the market offerings and begin trading.

User Reviews

- When a Reddit user details their experience on ZBG exchange requiring a high “tax” fee to withdraw their funds, another user suggests that they may be using a fake site. “ZBG exchange (zbg.com) is a legit exchange. The domain has more than 21 years and coinmarketcap lists the exchange. Maybe You used a fake ZBG link.”

- Someone on Reddit says that someone suggested they register for ZBG and are wondering if it’s safe. The responses seemed mostly concerned with the morals of it rather than the exchange itself, but one user actually looked into it. “I checked it out. It looks like something someone threw up in a day. Either it is brand new and they don’t have any experience or it is a scam site meant to look legit. Either way there is no way I would use it personally but hey, if you’re a gambler…..”

- A user on Quora asked about ZBG’s reputation. A self-described crypto analyst responded: “ZBG is a Hong Kong based Chinese cryptocurrency exchange. It was launched in July 2018. It is actually a sub platform and subsidiary of ZB .com ZBG does not accept any deposits of fiat currency.”

- There are two reviews for ZBG on Trustpilot.com that average 3/5 stars. One was 5/5 and the other was 1/5.