Say you own a computer repair shop. One day, you notice the roof is leaking, so you call a roofer to fix it. He comes in to take a look and give an estimate. Of course, you’re expecting him to name a dollar amount.

Instead, he says that he has an old computer with some photographs of sentimental value that crashed. He’ll fix your roof for free if you can fix his computer. After looking at the computer, you realize it’s a simple fix. What would you do?

In all likelihood, you’d agree. It’s a lot cheaper for you to fix the computer than pay the roofing costs, just as it’s cheaper for him to fix the roof than pay a computer repair man.

Additionally, why go through the trouble of charging him money when you would just use that money to pay a roofer anyway? Isn’t it better to cut out the middleman?

What we’ve just described is known as bartering, and it constitutes the oldest form of commerce in which individuals exchange goods or services directly without the use of money or any other medium of exchange.

Though the use of money quickly overtook the barter system as the primary method of economic activity, it by no means rendered bartering obsolete.

In this article, we will look at how the barter system developed, why it fell out of favor, and why bartering is still used to this day.

What is the Barter System?

In the earliest days of commerce, all trade was conducted via bartering. If you needed something, you found someone who had it and worked out a trade with them.

Say you were hungry and needed food. You’d look for someone with extra food and find something you could trade for it. Maybe you had some extra furs that could be used for warmth in a coming winter, or you knew how to build or improve their shelter, or even draw them a pretty picture.

All that mattered was that they were willing to accept whatever you were offering in exchange for their excess food.

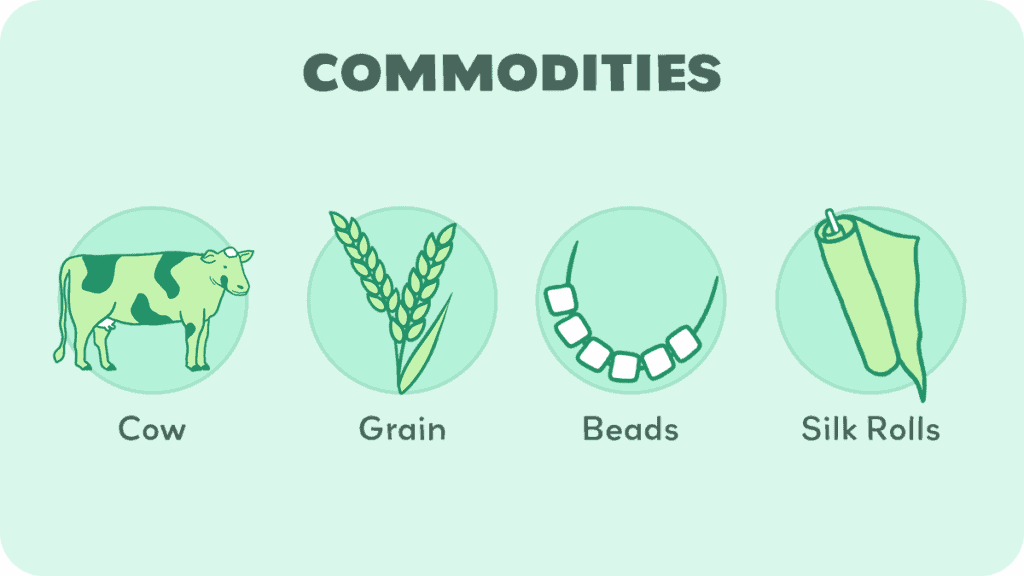

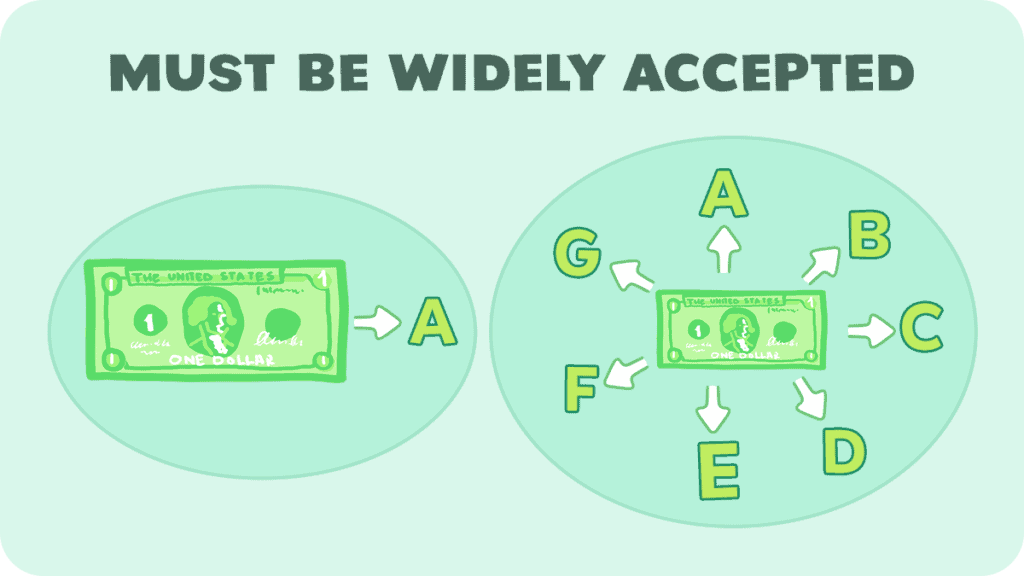

This system of trading quickly gave way to the rise of a commodity money economy, in which one valuable commodity, such as shells, gold, or cocoa beans, is widely accepted in exchange for almost anything.

Even if the individual with whom you are trading doesn’t want it, they know that they can use it to trade with someone else for something they do need.

Why the middleman? If bartering is so efficient, why introduce this extra step?

It turns out that bartering as the sole means of trade is extremely inefficient. In the opening example, it just so happened that you provided a service needed by the exact person who provided the service you needed. How often is this really the case?

If it hadn’t been, you would have had to look around until you could find someone who either needed your service or found something the roofer wanted—which may not have been what you were looking to give up.

Bartering is great when convenient; however, trying to run an entire economy on it can be burdensome and inefficient. Money helps fill in the gaps and allows for the exchange of goods and services even where direct trade might not be in both parties’ best interests.

History of Bartering

Despite the fact that commodity money came on the scene fairly early, bartering still played a key role in trade, particularly across cultures where goods common in one society were rare in another.

During the Middle Ages, European traders would travel to Asia via the Silk Road. There, they would trade goods that were commonplace and cheap in Europe, like furs and crafts, for items that were cheap and common in Asia, such as silk and perfume.

Upon their return to Europe, they could sell these goods for a profit, as they were uncommon in Europe. Barter also played an important role in Europeans’ first contact with native populations in North America, as both sides had goods uncommon—and, therefore, heavily desired—by the other.

Additionally, bartering has become more common and useful during times of economic hardship. For example, during the Great Depression, people often lacked money to pay for necessities and, instead, bartered directly with one another.

Bartering when possible allowed people to save what little money they had to pay for things that had to be paid in cash, such as rent or utilities.

It can also occur during economic crises when people lose faith in the ability of a currency to retain its value.

For example, during Bolivian hyperinflation in 1985, people often engaged in bartering to avoid getting cash that would rapidly lose its value. More recently, bartering saw a comeback during the COVID-19 pandemic.

Bartering Today

During the pandemic, with restrictions in place and a limited ability to get basics like food from traditional shopping stores, many turned to social media platforms such as Facebook to find what they needed.

Additionally, the early stages of the pandemic set off a string of panic-buying that led to many stores with empty shelves and many consumers with an excess of certain goods and a need for others.

For example, some may have stocked up on toilet paper but needed fresh vegetables, while someone else may have had a home garden but forgot to buy toilet paper.

In cases like this, it made sense to turn to bartering. Simply find someone who had an excess of what you needed and find what you could trade for it. This process was aided greatly by recent technologies, specifically the Internet.

The rise of social media made it much easier to find people who had what you wanted or needed what you had. Apps like Facebook allow you to check out a number of potential barter partners with the click of a button, as opposed to in the past when you would have had to do it in person.

In fact, some sites have been developed specifically dedicated to aiding barter transactions. Some examples include:

- Barter Network

- Biz Exchange

- CraigsList

- GoSwap

- IMSBarter

- Listia

- Rehash

- Swap

Advantages and Disadvantages of Bartering

As with anything, there are advantages and disadvantages to bartering. The main disadvantage is the transaction cost of finding someone who wants the exact inverse of the trade you are seeking and negotiating a fair bargain.

Bartering takes time and skill since you must find someone willing to agree to the trade you are proposing and negotiate a fair bargain.

As we just discussed, the internet has greatly eased this and reduced the transaction cost, but it can still be more difficult to determine what a fair trade is than with money, where everything is measured with a standard unit.

Another disadvantage is the trustworthiness of the person with whom you’re dealing. Unlike a store with a known return policy, you may be out of luck if the good you traded for turns out to be defective.

Further, in an exchange of services, one person must go first. Take our opening example of exchanging roofing for computer repair. What’s to prevent the roofer from simply disappearing after you’ve fixed his computer?

Finally, there is no guarantee of quality. The roofer might do a shoddy job of repairing the roof, or you might find yourself unable to fix his computer after you’ve received your new roof.

One advantage of bartering is the flexibility it provides. You can trade related products (such as tablets and laptops), unrelated products (such as tablets and toothbrushes), services (such as computer repair for roof repair), or services for products (computer repair for toothbrushes).

It also allows you to obtain goods and services without spending cash. Keeping cash on hand can be significantly difficult for individuals during tough economic times or for small businesses starting out.

Tax Implications of Bartering

Another advantage might seem to be the tax implications. After all, since no cash is being exchanged, there is no income to be taxed, right?

Going back to our opening example, if you’d charged the roofer for the computer repair, you’d have to report that as income, even if you’d gone right out and spent it on your roof repair. By trading services directly, you could report less income and pay less during tax time.

Not exactly. As the old saying goes, taxes are one of two things in life that can’t be avoided. It turns out that the IRS considers bartering revenue a form of income.

Businesses are expected to report the fair market value of any goods or services they barter throughout the year. At tax time, these “bartered dollars” are treated just like any other dollar for tax purposes.

Conclusion

Bartering is the oldest form of commerce, and, though money greatly eased widespread economic activity, it has never replaced bartering. This is because bartering is the simplest form of economic activity—simply trading what you need for what you have. Its simplicity means that, when it’s possible, it simply can’t be improved upon.

For this reason, it has been a fallback to many through difficult economic times and is used even today. In fact, due to the convenience of internet-based innovations such as barter exchanges, bartering between individuals and businesses has seen a rise in recent years.

Thank you for joining us. We hope you enjoyed this article, and that it helped clear up what bartering is and highlighted the opportunities for barter that exist in today’s internet-based society. We hope you’ll subscribe to see more informative articles like this one.