PrimeXBT is a multi-asset trading exchange that was founded in 2018 and today is based in Seychelles. The exchange today serves clients in more than 150 countries. PrimeXBT provides traders access to other markets as well as crypto, including FX, commodities, and equities as well.

Note that PrimeXBT is a global exchange and US residents are not allowed to use it. The exchange does not require KYC (Know Your Customer) identity verification or document protocols to be completed for use of the exchange. Restricted jurisdictions can be noted here.

History of PrimeXBT

PrimeXBT was created in 2018 and provides its clients with a range of liquidity and trading tools. The exchange was designed with its entire infrastructure meant to facilitate a high number of orders per second and extreme loads, while offering ultra-fast order execution and low latency.

According to the exchange, it offers ultra-fast order execution of <7.12ms on average, an industry-leading trade engine with real-time risk management, and a secure and powerful infrastructure powered by Amazon AWS, the servers for which are located in London and Frankfurt. The exchange was created to connect with multiple liquidity providers to ensure its low latency and smooth pricing on assets.

PrimeXBT is best for:

- Intermediate to advanced cryptocurrency, FX, and commodities traders, futures traders who desire access to global markets’ instruments on a global exchange, along with a core offering of major crypto coins and the PrimeXBT range of products

- Active traders who desire a low latency platform, competitive trading fees with a clearly defined & tiered, trading volume based pricing structure for makers and takers

PROS

- Unique offering of FX pairs, commodities, CFD and global market indexes

- Collateral options

- No KYC with no deposit or withdrawal limits

- Advanced trading platform

- Mobile and desktop friendly

- Covesting option

- Contests & affiliate program

- Academy

CONS

- Only 11 major coins for spot

- Not primarily crypto-focused

- No advanced staking or lending services

- No derivatives products

Pros & Unique Features

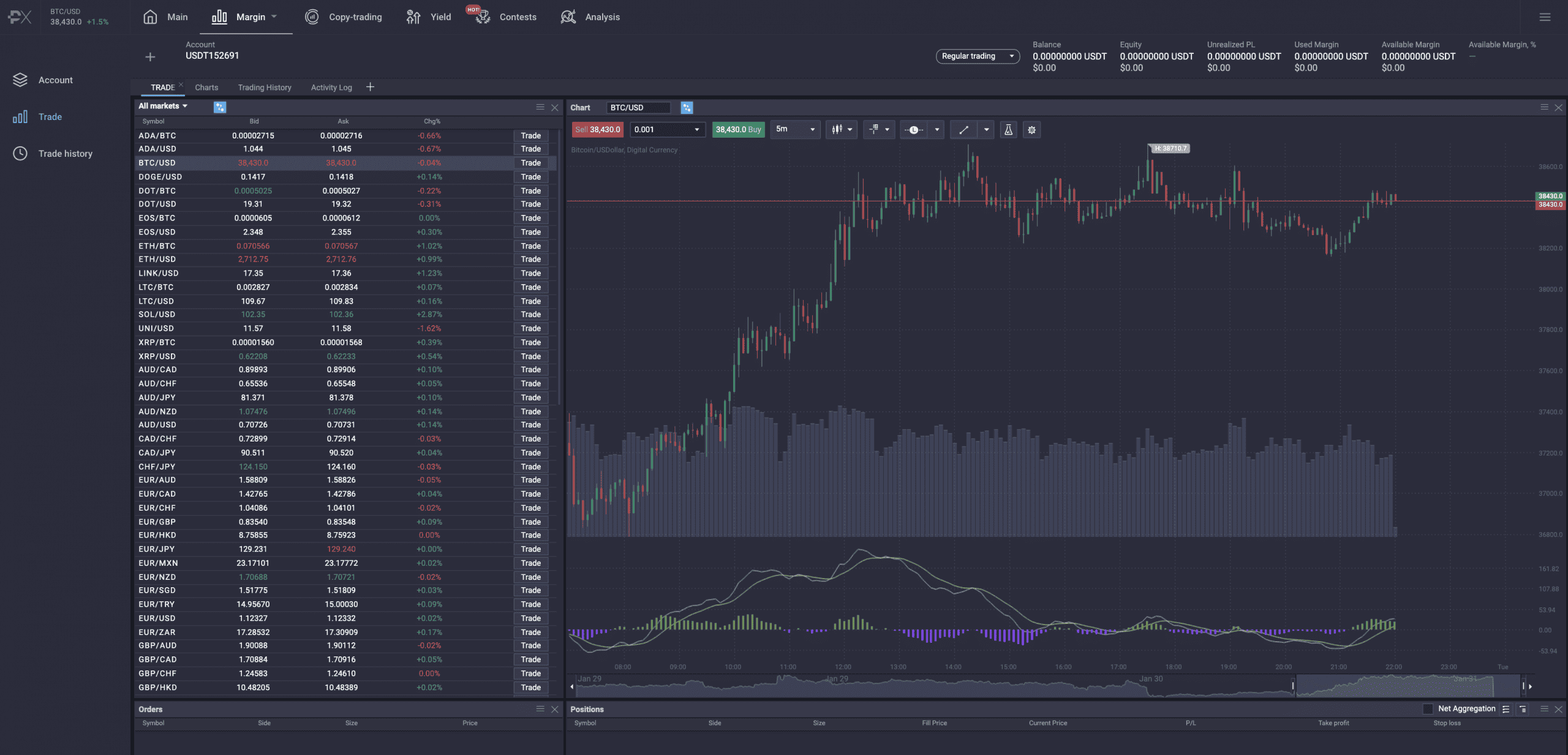

The biggest perks of PrimeXBT are its offering of FX pairs, commodities, CFD and global market indexes, which are very unique offerings compared to other crypto exchanges that do not offer any products outside of crypto. Plus, traders on PrimeXBT can also use Bitcoin and crypto as collateral to trade these other products and markets.

A major benefit of PrimeXBT is permissionless, KYC-free trading with no deposit or withdrawal limits, which is becoming more rare in the market.

Though its entire crypto offerings are limited to only 11 major coins, the exchange also offers additional BTC pairs for its coins, for both spot and margin. Additionally, users can trade global markets such as the S&P500, FTSE10, FX pairs, commodities like gold and silver, and many more offerings that are detailed here.

In regards to its platform, PrimeXBT offers an advanced online trading platform with customizable layout, advanced order and trading tools with professional charting, secure wallets, as well as a full-featured mobile app for both Google Play and the Apple App Store.

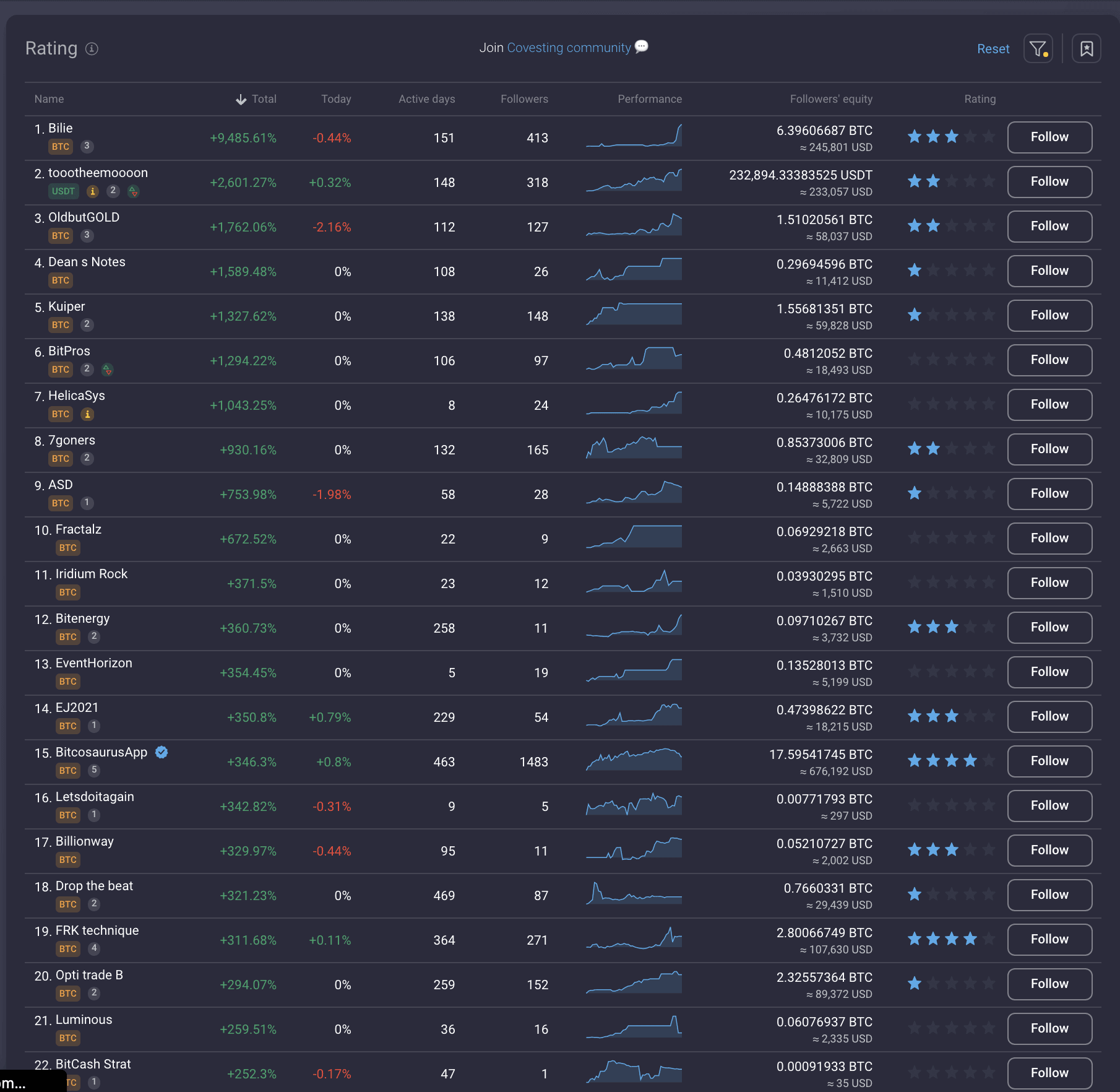

Another unique feature that PrimeXBT offers is called covesting, which allows users to copy other traders’ trading strategies by allocating their own capital into a selected strategy and having it followed using automation. Users can also advertise their own strategy for others to subscribe to with this feature.

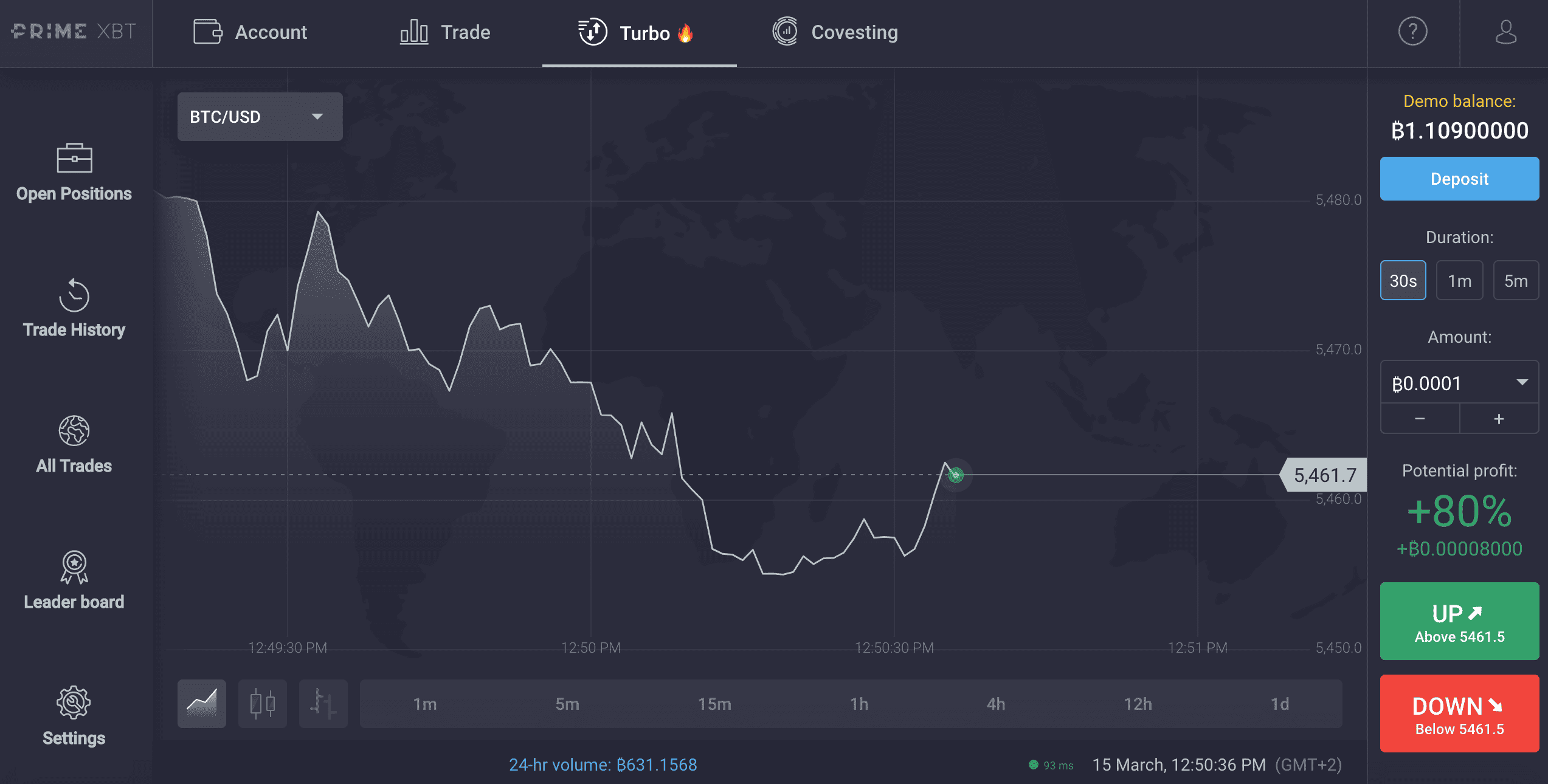

There is also a unique short-term trading feature offered called PrimeXBT Turbo, which allows users to speculate on short-term price movements of various assets.

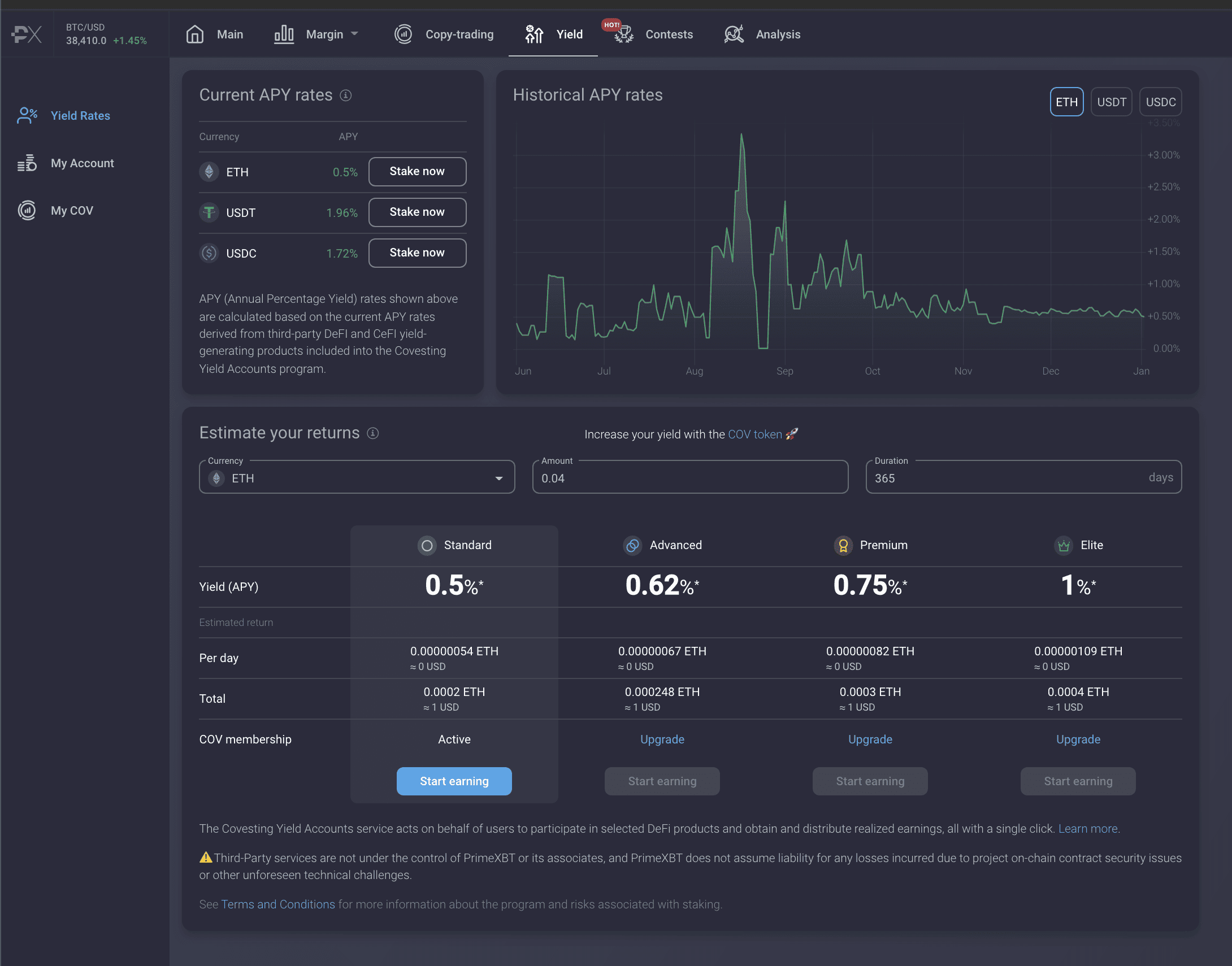

The exchange also offers users the ability to earn yield up to 14% APY on users’ crypto. The team also hosts trading contests for users to win real prizes by outperforming other traders. In addition, PrimeXBT hosts its own trading academy with blog-style instruction to teach users the basics of trading and highlights the importance of risk management.

Lastly, there is an affiliate and ambassador program offered. In addition to the high performance trading engine and capabilities of the platform, PrimeXBT offers traders the ability to use up to 100X leverage. There are no other major crypto financial services offered besides these features.

As for customer support, PrimeXBT offers support via website, chat, or email, 24/7. The team also maintains a blog that is updated weekly with news and research.

Cons & Disadvantages

The main disadvantage of PrimeXBT is because it’s not a primarily crypto-focused exchange like the other crypto exchanges on the market, its crypto pairs selection is quite limited to only the top 10 or so coins, but the exchange offers both USD and BTC pairs for these coins, along with both spot and margin options.

Besides the services noted, there are no other staking or lending services offered or other extensive crypto financials services, as the use case of PrimeXBT is more focused on the purpose of trading.

Additionally, there are no other advanced derivatives products offered such as futures pairs leveraged tokens, so advanced derivatives traders will prefer other exchanges for this purpose, such as FTX and Binance. However, PrimeXBT does offer CFD’s (contracts for difference, which are similar to perpetual futures instruments).

US users who wish to transact with more functionality without KYC may opt to use competitors like ByBit, thereby gaining access to a much wider selection of trading instruments such as margin and futures as well. International users do not have to do full KYC to use PrimeXBT.

PrimeXBT Fees

PrimeXBT uses a flat fee model, charging a “commission” for crypto products. This model is irrespective of trading volume or maker-taker status like with other exchanges.

Crypto Fees

Crypto margin trading fees are charged a commission of 0.05%. Minimum order sizes, trade sizes, max exposure, leverage, and funding rates for longs and shorts, can be found here. Copy-trading fees are also charged similarly.

FX Fees

Forex pair fees include a commission of 0.001%. Minimum order sizes, trade sizes, max exposure, leverage, and funding rates for longs and shorts, can be found here. Copy-trading fees are also charged similarly.

Index Fees

Index fees include a commission of 0.01%. Minimum order sizes, trade sizes, max exposure, leverage, and funding rates for longs and shorts, can be found here. Copy-trading fees are also charged similarly.

Commodity Fees

Commodity fees include a commission of 0.01%. Minimum order sizes, trade sizes, max exposure, leverage, and funding rates for longs and shorts, can be found here. Copy-trading fees are also charged similarly.

Trading fees are incurred when an order is filled by the exchange’s matching engine. If an order does not execute, there is no fee charged until it does execute at a later point, or it can be canceled.

Note that trade fees can be reduced by up to 50% based on turnover within the last 30 days or by activating various promotional codes.

Other Fees

Besides the trade fees noted above on margin trading accounts, PrimeXBT also charges overnight financing fees. These are fees charged for any positions held into a new trading day (past midnight UTC). Overnight financing is not charged on weekends for markets that are closed during this time, however a triple financing rate is due on Thursday 00:00 UTC.

Trade fees on Covesting Strategy accounts depend on currency Followers’ Equity of a Strategy, as explained here.

PrimeXBT charges the following deposit, withdrawal, and other fees:

- No deposit fees for crypto or fiat

- Flat withdrawal fees in small amounts: 0.0005 BTC, 0.01 ETH, 30 USDT, 30 USDC, 5 COV

There are no fees for signing up or for having an inactive exchange account, nor any fees for holding funds in an exchange account, and users may hold assets as long as desired.

Account Tiers & Limits

PrimeXBT does NOT require KYC procedures for traders.

PrimeXBT reserves the right at any time to conduct a verification of a client’s identity or source of funds, known as Customer Due Diligence (CDD), to ensure that PrimeXBT services are not abused and the user does not violate AML requirements. PrimeXBT implements industry-standard financial monitoring procedures as a part of their KYC/AML policies to identify activities that might require additional CDD review.

If a CDD procedure is initiated for an account, PrimeXBT may request a user to produce some or all of the following documentation:

- Proof of Identity

- Proof of Address

- Proof of source of funds

PrimeXBT may impose trading or deposit and withdrawal limits on an account until the requested documents are provided and the CDD is completed.

Otherwise, there are NO withdrawal or deposit limits. Limits on trading pairs (minimum trade sizes and maximum risk/exposure can be found here for each pair).

Crypto Security

PrimeXBT utilizes stress tests, security audits, and extensive cyber-security frameworks to ensure that strict measures and practices are in place to protect customer assets against any threats.

Users are provided with 2FA features to ensure account security, mandatory Bitcoin address whitelisting, cold storage of digital assets with multi-sig technology, hardware security modules with rating of FIPS PUB 140-2 Level 3 or higher, full risk checks after every order placement and execution, encrypted SSL (https) to encrypt and secure website traffic, cryptographically hashed passwords, and more.Other procedures PrimeXBT maintains for its security are detailed here. There have been no reported hacks or security breaches in the exchange’s history.

PrimeXBT Review Conclusion

PrimeXBT is a great choice of multi-asset exchange for crypto and other asset traders who wish to trade in a permissionless manner without KYC being required, and while being able to use crypto as collateral for trading global indices, commodities, and even FX pairs, as well as margin crypto pairs.

However, traders and investors alike who value access to an extensive spot market selection, advanced trading tools with high liquidity in major futures markets plus advanced derivatives products such as leveraged tokens, with volume-tiered fee models and rebates may prefer other crypto-focused exchanges, as PrimeXBT is more focused on being a multi-asset trading exchange.

US users could unofficially access PrimeXBT using a VPN since KYC is not required, however this does put the user’s funds at risk significantly since assets could be frozen to ask for verification, and users from the US are technically banned as per the terms of service.

International users looking for lending, borrowing, and staking options, or institutional clients looking for other features may find other competitors more valuable.

- PrimeXBT offers access to only about 12 crypto coins and several other multi-asset trading pairs, which is a smaller selection if compared to other top crypto exchanges on the market

- Intermediate to advanced traders trading margin who desire access to advanced trading tools and reporting will enjoy using PrimeXBT with up to 100X leverage offered, without KYC

Other Alternatives

For customers who desire access to a simpler user interface with far more trading pairs, or those who do not desire to participate in cryptocurrency futures trading either Bittrex, Coinbase, and Voyager can make better alternatives with a more competitive amount of cryptocurrencies offered to trade and similarly competitive trading fees and functionality.

Beginners, buy-and-hold investors, and low volume traders may prefer the easy to use features and functionality of Coinbase with its brand presence, US regulatory approval, and cryptocurrency education that even provides the chance to earn free cryptocurrency for learning.

Coinbase is best designed for buy-and-hold investors or casual to intermediate cryptocurrency users though has a much larger selection of cryptocurrencies offered compared to PrimeXBT—402 pairs vs. PrimeXBT’s 12 coins—while active traders who need access to order books and advanced charting functionality may prefer using Coinbase Pro, FTX, Binance, or KuCoin though their fee structures and product offerings differ.

For customers who desire to trade and invest in stocks in addition to top cryptocurrencies and do not mind having a smaller selection from which to choose or only desire access to the top 20 cryptos on the market, Webull and Robinhood are brokers that offers US equities and a small selection of cryptocurrencies.

Other competitors to PrimeXBT include Bitmex, Bybit, and Phemex.

PrimeXBT vs Coinbase

The major advantage PrimeXBT offers over Coinbase is its availability of margin trading, as well as offering FX, indices, and commodities to cater to more of an active trading audience.

PrimeXBT also offers a lower flat fee schedule, but both exchanges offer the option of advanced charting and crypto-to-crypto trading pairs using Coinbase’s Coinbase Pro product and PrimeXBT’s online and mobile platform.

However, whereas Coinbase offers no margin or futures products, PrimeXBT offers up to 100X leverage. Coinbase however offers a far more extensive selection of spot crypto coins.

Coinbase is a public US company and offers transparency into its industry-leading security along with its brand reputation, while PrimeXBT is not regulated and US users cannot use it.

Ultimately, advanced users who desire both competitive fees and a greater selection of trading products than what either FTX or Coinbase offer may find the choices below equally valuable.

PrimeXBT vs FTX

FTX may win out against PrimeXBT for even intermediate traders, as it offers 323 coins and 492 trading pairs, which is higher than PrimeXBT’s 12 cryptos and handful of other instruments across major global markets, commodities, and FX pairs.

Derivatives traders who want to trade margin, extensive crypto futures pairs, or leveraged tokens and options will prefer FTX since PrimeXBT only offers limited crypto margin choices, but does not offer leverage tokens.

FTX is known for its extensive futures pairs and top-class matching and liquidation engine for advanced derivatives traders, while PrimeXBT is also known for catering to traders, however FTX is more well-respected in terms of regulations and security in crypto.

Neither PrimeXBT nor FTX can be used by US persons, and FTX instead offers a US version of its exchange whose trade offerings are far more limited than its parent global exchange and do not at all compare to FTX International’s selection.

International users who can use FTX International may prefer FTX, and international users at both FTX and PrimeXBT can trade without KYC as a bonus. US users trading at FTX US need to do KYC procedures. Fees are competitive and similar across both exchanges.

PrimeXBT vs Gemini

PrimeXBT and Gemini are very different exchanges with different focuses for their users.

There is a slight difference in fees to start: the minimum fee tier at Gemini starts at 0.35% for takers and 0.10% for makers, with a flat transaction fee between $0.99-$2.99 and 1.49% transaction fee for trades over $200, so there are extra fees per transaction and extra “auction” fees, which PrimeXBT offers flat fees irrespective of volume or rebates, and fees differ depending on the instruments being traded.

US investors and traders are allowed to use Gemini with KYC compliance since Gemini is regulated and based in the USA, however as a result, Gemini offers no margin or futures products, but PrimeXBT does offer up to 100X margin, but US users are not allowed to use it as per TOS.

Gemini offers 62 coins and 86 trading pairs which is larger compared to that of PrimeXBT’s crypto offering, and Gemini’s Gemini Earn product has far more staking selection and higher APY offered than PrimeXBT’s staking services and other financial services products currently offered.

PrimeXBT vs Kraken

Kraken offers margin trading at up to 5X leverage even for US investors and several other margin offerings, while PrimeXBT offers up to 100X margin for only international users (no KYC needed) but not for US users. Simply put, US users will prefer Kraken for its regulatory compliance and strong track record.

Kraken uses a maker-taker fee schedule, starting at 0.16% maker fees and 0.26% taker fees at the entry level which is not quite as competitive as the fee schedule for PrimeXBT which uses a flat fee schedule. Kraken offers no other fee incentives such as rebates or reductions except for volume, but PrimeXBT only uses a flat fee structure.

Kraken offers a much larger variety of cryptocurrencies and pairs (over 90 coins, over 400 pairs), so users who value a large selection and advanced traders who seek margin may be ok with either exchange depending on their willingness to KYC and jurisdiction. If an active trader wishes to trade other instruments beyond crypto and prefers not to KYC, he or she may prefer PrimeXBT, but if he or she prefers a much larger selection of crypto only instruments, Kraken wins.

Kraken is accessible in 48 US states with KYC and is regulated and licensed by FinCEN in the USA, while PrimeXBT is not.

PrimeXBT vs Binance

Binance is the leading global crypto established exchange by trading volume, offering a much larger selection of cryptocurrencies than PrimeXBT—over 351 coins and over 1300 pairs.

Traders looking solely for the most advanced trading options such as high leverage margin and futures products specific to crypto only will prefer Binance, as it offers many USDT futures pairs that are not offered even on PrimeXBT or on FTX, the other derivatives leader, at the moment.

Binance’s base maker-taker fee is not quite as competitive as that of PrimeXBT, starting at 0.1% (compared to 0.05% flat irrespective of volume), and Binance offers further 25% reduction in fees if paid in BNB.

Binance also offers a more extensive web and ecosystem of products, support, and liquidity, especially given its larger daily volume as compared to PrimeXBT. However, PrimeXBT has an edge if the user seeks to trade other instruments such as FX, commodities, and global market indices.

Binance is the most popular and well-known futures market in the global cryptocurrency industry and well-known for its extensive futures pairs. The Binance exchange is not at all accessible to US persons and US customers will have to use Binance US which is a much more limited version of its global parent site, with only 64 coins and 130 pairs.

Binance requires full KYC now to trade even spot products, and PrimeXBT has the advantage here of not requiring KYC for trading at all.

Advanced traders and intermediate users alike who value a large selection of cryptocurrencies, products like staking, lending, and more, competitive fee structures, and futures and margin products will probably prefer Binance.

FAQ – Frequently Asked Questions

Is PrimeXBT Safe?

Yes, there have been no large-scale hacks or security breaches at PrimeXBT.

PrimeXBT utilizes stress tests, security audits, and extensive cyber-security frameworks to ensure that strict measures and practices are in place to protect customer assets against any threats.

Users are provided with 2FA features to ensure account security, mandatory Bitcoin address whitelisting, cold storage of digital assets with multi-sig technology, hardware security modules with rating of FIPS PUB 140-2 Level 3 or higher, full risk checks after every order placement and execution, encrypted SSL (https) to encrypt and secure website traffic, cryptographically hashed passwords, and more.Other procedures PrimeXBT maintains for its security are detailed here. There have been no reported hacks or security breaches in the exchange’s history.

How long does PrimeXBT Withdrawal take?

For security reasons, PrimeXBT maintains limited cryptocurrency balances in its on-line hot wallet and processes all pending withdrawals once a day, between 12:00 and 14:00 UTC.

A withdrawal requested before 12:00 UTC will be processed on the same day. Any withdrawal requested after 12:00 UTC will be processed the next day.

Withdrawals can therefore take up to 24 hours to fully process. After processing, the usual timeframe for ACH withdrawals to reach the user’s bank is 2-4 business days, excluding weekends and holidays.

Is PrimeXBT a good exchange?

PrimeXBT is a great choice of multi-asset exchange for crypto and other asset traders who wish to trade in a permissionless manner without KYC being required, and while being able to use crypto as collateral for trading global indices, commodities, and even FX pairs, as well as margin crypto pairs. The exchange also offers up to 100X leverage which is a strong point compared to competitors.

However, traders and investors alike who value access to an extensive spot market selection, advanced trading tools with high liquidity in major futures markets plus advanced derivatives products such as leveraged tokens, with volume-tiered fee models and rebates may prefer other crypto-focused exchanges, as PrimeXBT is more focused on being a multi-asset trading exchange.

Where is PrimeXBT located?

PrimeXBT is registered in Seychelles as Prime Technology Ltd., as well as in St. Convent and the Grenadines as PrimeXBT Trading Services LLC.

Does PrimeXBT require KYC?

No, PrimeXBT does NOT require KYC procedures for traders.

However, PrimeXBT reserves the right at any time to conduct a verification of a client’s identity or source of funds, known as Customer Due Diligence (CDD), to ensure that PrimeXBT services are not abused and the user does not violate AML requirements.

If a CDD procedure is initiated for an account, PrimeXBT may request a user to produce some or all of the following documentation:

- Proof of Identity

- Proof of Address

- Proof of Source of funds

PrimeXBT may impose trading or deposit and withdrawal limits on an account until the requested documents are provided and the CDD is completed.

What are the Deposit and Withdrawal Methods and Fees for PrimeXBT?

PrimeXBT offers the following deposit and withdrawal methods, with the corresponding fees:

- Crypto asset deposits and withdrawals – no fees for deposits, withdrawal fees are: Flat fees: 0.0005 BTC, 0.01 ETH, 30 USDT, 30 USDC, 5 COV

- Credit/debit card: Fees depend on the payment processor here (third party), KYC may be required by processor

- Bank transfer: fees not listed

- SEPA transfer: fees not listed

What is the Minimum Withdraw Amount for PrimeXBT?

There is no minimum withdrawal. Withdrawals are charged flat fees: 0.0005 BTC, 0.01 ETH, 30 USDT, 30 USDC, 5 COV, in accordance with the asset being withdrawn.

How do you withdraw from PrimeXBT?

Instructions for withdrawing from users accounts can be found here from official support sources.

Users can withdraw from the wallet trading account by navigating to the Main page of their account and clicking “Withdraw” for the currency they wish to withdraw.

From there, the user should select the destination address to which he or she wishes to withdraw. Then, fill in the details of the withdrawal including toggling the correct currency and be sure to include a tag or memo if needed.

The withdrawal options including the blockchain network and any associated fees will then populate on the screen.

Finally, the user clicks the “Submit to withdraw” button, opens his or her email, and confirms the withdrawal.

Is PrimeXBT a wallet?

No, PrimeXBT is a full-featured multi-asset trading exchange, but offers users wallets as part of its exchange services with which to custody cryptocurrency for trading.

How to use PrimeXBT?

Using PrimeXBT can be done by going to primexbt.com, creating an account on the platform, depositing any trading funds into the account via crypto assets or via third party payment processors if using debit/credit cards, and then getting access to the market offerings and begin trading.

User Reviews

- OP asks if anyone has used the covesting features on PrimeXBT. One respondent notes there is a waiting list, so you can’t just follow whoever you want. Another says: “Yeah and it’s slick as hell. Way better than the competition IMO 👍”

- u/mantonchak explains the Turbo product PrimeXBT offers that allows users to speculate on short-term price movements and “generate previously unthinkable amounts of profit in a matter of a few minutes.”

- The PrimeXBT subreddit is small but the primary place on Reddit for crypto and other traders to discuss the platform.

- When asked on its own subreddit if PrimeXBT will release an API, no official response was given.