![]()

Pionex is a Singapore-based cryptocurrency exchange that launched in 2019 that focuses on bot trading.

The exchange requires KYC (Know Your Customer) identity verification or document protocols to be completed for use of the exchange. US users can use the exchange for spot markets but cannot access leverage.

History of Pionex

Pionex started in 2019 as the world’s first exchange with free, integrated trading bots. It offers the option for an automated crypto trading environment and has been one of the fastest-growing platforms in Asia, with over $1B in trade volume per day as of Feb. 2022.

The exchange today offers 16 free bots to automate trading, but also offers spot and margin market offerings with trading tools and more. On its website, Pionex showcases its features in press such as Bloomberg and Bitcoin.com. The exchange enjoyed its fastest growth and virality during 2021.

Pionex aggregates the liquidity from Binance and Huobi near the ticker price. Pionex is one of the biggest brokers of Binance, and one of the biggest market makers of Huobi in the world. Pionex is invested by Gaorong Capital, Shunwei Capital, and ZhenFund for more than $10M USD. Pionex has also acquired a MSB (Money Services Business) license by FinCEN in the USA.

Pionex is best for:

- All types of cryptocurrency investors and spot/margin traders who desire access to not only a large variety of crypto coins for trading, but also advanced bots with a range of functionality ranging from arbitrage to grid trading, and more.

- Spot traders and investors who desire a simple, flat 0.05% fee schedule, and competitive with the added benefit of regulatory compliance

PROS

- 16 unique trading bots

- 430 coins for spot trading

- Leverages trading

- Lite and advanced trading platform

- Mobile and browser friendly

CONS

- Limited crypto financial services outside of the bots

- No staking option

- No demo feature for the bots

- No fiat deposits

Pros & Unique Features

The best features of Pionex are its product offering of a range of 16 trading bots that every user can make use of in a simple fashion. This is a unique feature core to Pionex’s marketing efforts. Bots users can use range from spot-futures arbitrage bots, for example, to grid trading bots that allow users to automatically make profits from volatility by allowing auto buy and sell orders in a certain price range. There is also an option for a martingale bot and a rebalancing bot.

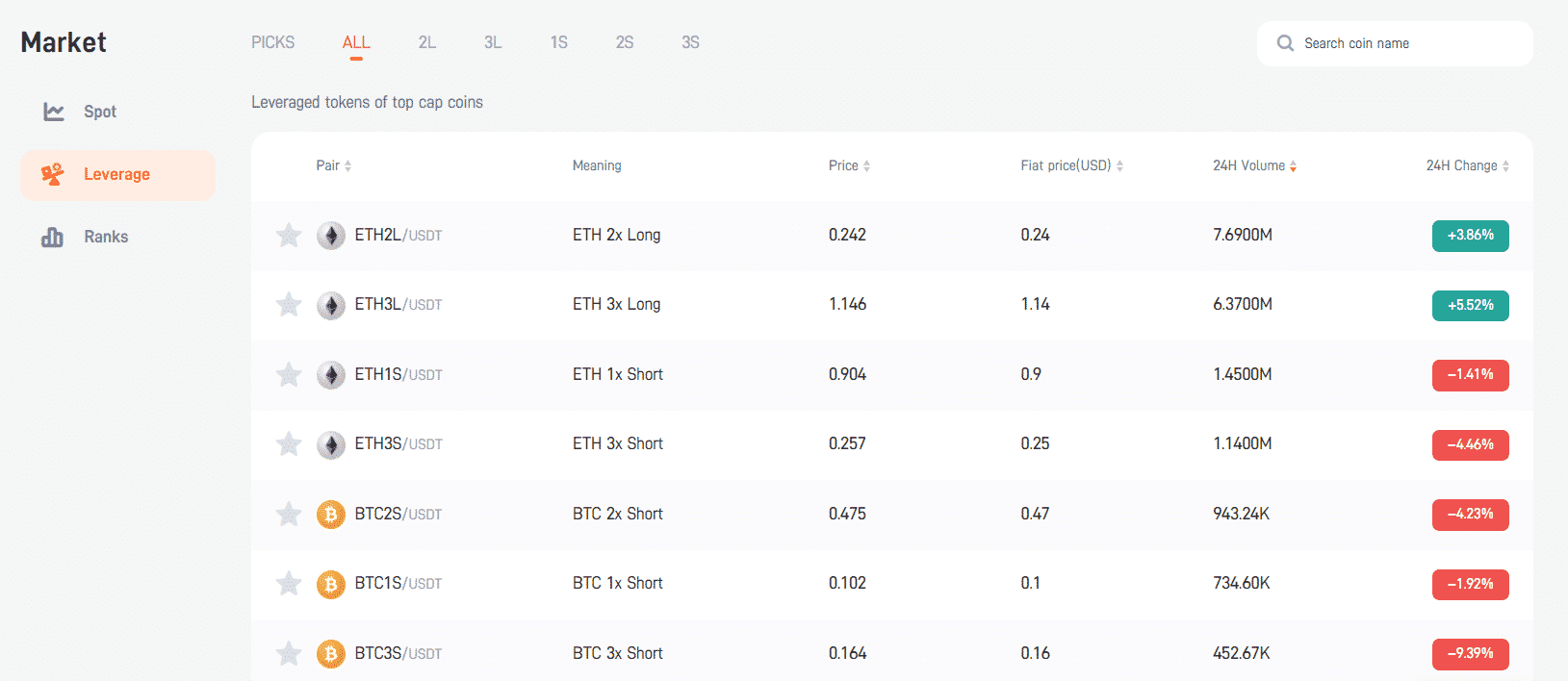

The exchange offers over 430 coins for spot trading alone which even US users can use, but also offers leverage trading using leveraged tokens, which is restricted to international users.

As far as a trading interface, Pionex offers both a “lite” version with full buy-sell functionality, as well as a trading platform online with advanced charting and trading functionality. Users can use the bots easily from within the trading interface, or trade manually.

The lite version is meant to be simpler to use to support USD purchases of BTC and ETH only. This is best suited for casual investors, while the full featured trading option is suited for bot traders. The fees are identical between the products.

There is also a mobile specific app for both Android and iPhone that users can download to trade and use the bots on.

As for customer support, Pionex offers a support service center users can access via logging into the app and submitting a query. The team also maintains a YouTube channel and a blog with news and reports. For users who do not know how bots work or want to learn how to use a specific bot offered at Pionex, they can read the tutorials discussed in the blog.

Cons & Disadvantages

The main disadvantage of Pionex is that it does not offer a whole suite of crypto financial services outside of its bots products, so it is best suited for those looking specifically for bots, which would be more intermediate to advanced crypto traders, and not for casual investors.

Though casual investors can use Pionex Lite to easily buy spot BTC or ETH, the other options are limited and there does not seem to be any option for staking. However, users can use the arbitrage bot to earn similar interest to staking as on other exchanges, but the feature is different.

The other major disadvantage is there is no demo feature with which users can test the bots before using them with real, live money. Additionally, users may only deposit crypto assets to use at Pionex, as fiat deposits are not supported unless using Pionex Lite. So users who are newer to crypto and do not yet own crypto assets will first need to buy them at another exchange before sending them to Pionex to use.

Pionex Fees

Pionex charges a flat fee schedule on trading fees.

Trading fees are 0.05% for both market makers (providers of liquidity) and market takers (takers of liquidity). There are no incentives or tiers based on trading volume, unlike at many other exchanges.

This fee schedule is simple and easy to understand, however it lacks the benefits of reduced fees, rebates, or preferable rates for liquidity providers (market makers) which is the norm at major centralized exchanges.

Trading fees are incurred when an order is filled by the exchange’s matching engine. If an order does not execute, there is no fee charged until it does execute at a later point, or it can be canceled. The full fee schedule can be found here.

Other Fees

Pionex charges the following deposit, withdrawal, and other fees:

- No account creation or maintenance fee

- No deposit fees for any digital asset

- No fees for using bots besides trading fees as noted above

- Withdrawal fees for digital assets depends on the asset. BTC withdrawal fee is 0.0005 BTC, for example. This fee is determined by the blockchain network fees and may vary depending on network usage.

- No fee for wire deposits, wire withdrawal fees are unclear and may exist up to $50 per wire

There are no fees for signing up or for having an inactive account, nor any fees for holding funds in an account, and users may hold assets as long as desired.

Account Tiers & Limits

Users who registered at Pionex after 12/1/2021 were required to complete personal identity verification before starting trading.

There are three tiers of verification at Pionex:

- Unverified: Unverified users may not trade, deposit crypto assets or fiat, and may not withdraw any assets

- Level 1 Verification: Level 1 users may trade (unlimited), deposit (unlimited), and withdraw up to 2000 USD per day

- Level 2 Verification: Level 2 users may trade (unlimited), deposit (unlimited), and withdraw up to 1M USD per day

The verification requirements can be noted here. Level 1 users are required to prove country of residence and SMS verification, while Level 2 users are additionally required to provide government-issued ID and facial recognition as well.

Crypto Security

Pionex custodies its customer funds with partnerships with leading exchanges Binance and Huobi, so the security features of Pionex as far as custody is concerned is identical to that of Huobi.

Pionex has also received a MSB license from FinCEN. There have been no reported hacks of Pionex and users are encouraged as always to use 2-factor authentication, secure passwords, a new email, and always check links for possible phishing attempts.

Pionex Review Conclusion

Pionex is a great choice of crypto exchange for crypto traders and investors who are curious about leveraging the power of automation and bots in their trading. The best feature of Pionex is the range of trading bots that are free to use (besides the flat trading fee of 0.05%) and allow users to do everything from performing grid trading strategies, to martingale, to spot-futures arbitrage bot that allows one to produce 15-50% APR with low risk, to a rebalancing bot, and much more.

This makes bots accessible to the masses without the need for complicated set up or coding experience. Fees are also extremely competitive at only 0.05%, but there are no other fee incentives for market makers or for volume. The coin selection for spot trading is extensive, and US users can also trade spot with KYC, but cannot trade margin or leveraged tokens.

Pionex also offers a easy-to-use “lite” version that allows users to easily buy spot BTC or ETH which is better suited for investors, and there are thorough walkthroughs on how to use the bots in the exchange, however there is a lack of extensive crypto financial services beyond trading. Users also cannot test demo money on these bots, so ultimately Pionex is an exchange best suited to intermediate to advanced traders who do not mind performing KYC.

International users looking for lending, borrowing, and staking options, or institutional clients looking for other features may find other competitors more valuable.

- Pionex offers access to 400+ cryptos and a range of 16 trading bots with no extra fees besides the standard 0.05% trading fee

- Intermediate to advanced traders trading margin or futures who desire access to advanced trading tools and charting would prefer to pick a different exchange especially if desiring one not requiring KYC, and US users cannot trade these markets at Pionex

Other Alternatives

For customers who desire access to a more comprehensive crypto exchange that also offers a host of financial services such as staking and cashback cards, or those who do not desire to participate in bot trading either Crypto.com, Gemini, Coinbase, and Binance can make great alternatives with a similar or greater amount of cryptocurrencies offered to trade along with competitive trading fees but also more functionality.

Beginners, buy-and-hold investors, and low volume traders may prefer the easy to use features and functionality of Voyager and Coinbase with their brand presence, US regulatory approval, and regulatory approval.

Coinbase is best designed for buy-and-hold investors or casual to intermediate cryptocurrency users—Coinbase offers 402 pairs vs. Pionex’s ~430 coins—and offers an advanced desktop trading interface as well as a mobile app. However, Coinbase offers no built-in bot trading, so Pionex is a better option for using bots.

Active traders who need access to order books and advanced charting functionality may prefer using Coinbase Pro, FTX, Binance, or KuCoin though their fee structures and product offerings differ and most exchanges on the market use maker-taker fee schedules that give volume incentives, unlike Pionex.

For customers who desire to trade and invest in stocks in addition to top cryptocurrencies and do not mind having a smaller selection from which to choose or only desire access to the top 20 cryptos on the market, Webull and Robinhood are brokers that offers US equities and a small selection of cryptocurrencies.

Other competitors to Pionex include Kraken, HitBTC, OKX, Bitpanda Pro, Bitvavo, and Binance, which all offer support for bots with their APIs and more.

Pionex vs Coinbase

Coinbase is better in some aspects of trading functionality and products offered if compared to Pionex, since it focuses on a holistic range of services suited for both new users and advanced users with Coinbase Pro, while Pionex focuses more on bot trading.

Pionex offers margin and leveraged tokens while Coinbase does not, but Pionex easily wins in the fee department, as it has a flat 0.05% trading fee, which is much lower than at Coinbase. An advantage for high volume traders will be the volume-tiered fees at Coinbase, which decrease most rapidly over $20M in 30-day trading volume.

Coinbase also offers about the same selection of trading pairs as is offered at Pionex, with 440 trading pairs, compared to 430 at Pionex, as well as advanced charting, accessible order books, and advanced order types, so there are no major benefits here for either.

Coinbase is a public US company and offers transparency into its industry-leading security along with its brand reputation, while Pionex is has an MSB license with FinCEN and requires KYC as well. However, Pionex still lacks the brand presence that Coinbase has achieved.

Ultimately, advanced users who desire both competitive fees and a greater selection of trading products than what either Pionex or Coinbase offer may find the choices below equally valuable but these two are top contenders for spot trading especially with bots.

Pionex vs FTX

FTX will win against Pionex for all intermediate or advanced traders, as FTX offers 323 coins and 492 trading pairs, which is a bit higher than Pionex’s 400+ coins offering.

Derivatives traders who want to trade margin, extensive crypto futures pairs, or leveraged tokens and options will prefer FTX since Pionex does not offer extensive futures pairs besides leveraged tokens and margin trading.

FTX is known for its extensive futures pairs and top-class matching and liquidation engine for advanced derivatives traders, and traders can use third party bots at FTX easily as many advanced traders do, but Pionex offers the unique benefit of built-in trading bots.

FTX is known for catering to active derivatives traders and optimizing for high order volume and trading execution speed. FTX cannot be used by US persons but Pionex can, though FTX offers a US version of its exchange whose trade offerings are far more limited than its parent global exchange and do not at all compare to FTX International’s selection, and are much less than what is offered at Pionex, though it remains competitive in its fee. Pionex wins for US users over FTX US.

International users who can use FTX International may prefer FTX for these reasons over Pionex. US users trading at FTX US need to do KYC procedures and likewise for Pionex. Fees may be slightly more competitive at FTX as a trader’s volume is higher, since FTX offers both fee incentives for volume and for holders of its FTT token, though Pionex offers no incentives but charges fairly low flat fees.

Pionex vs Gemini

Pionex and Gemini are quite different in their product offerings and Gemini is more focused on its holistic crypto financial services and regulatory approval.

There is a major difference in fees to start giving Pionex the edge: the minimum fee tier at Gemini starts at 0.35% for takers and 0.10% for makers, with a flat transaction fee between $0.99-$2.99 and 1.49% transaction fee for trades over $200, so there are extra fees per transaction and extra “auction” fees, while Pionex charges flat 0.05% trading fees only.

US investors and traders are allowed to use Gemini with KYC verification only, since Gemini is regulated and based in the USA, however as a result, Gemini offers no margin or futures products. Pionex wins in this comparison as well, since US users can trade spot at Pionex with basic KYC but cannot trade margin or leverage, and Pionex, while not a US exchange, does have a MSB license from FinCEN.

Gemini offers 62 coins and 86 trading pairs which is much smaller than the amount offered by Pionex. Another major difference is the existence of Gemini’s interest product and credit card, neither of which exist at Pionex.

Pionex vs Kraken

Kraken offers margin trading at up to 5X leverage even for US investors and several other margin offerings, which is a win over Pionex’s lack of any margin or leverage offerings for US users, though Pionex does offer this for international users. US users may prefer Kraken for its regulatory compliance and strong track record if they are traders especially.

Kraken uses a maker-taker fee schedule, starting at 0.16% maker fees and 0.26% taker fees at the entry level which is not quite as competitive even as Pionex’s 0.05% flat fee schedule, however overall compared to the market it is still competitive. Market makers enjoy reduced fees however at Kraken and fees also reduce with volume.

Kraken offers a similar variety of cryptocurrencies and pairs (over 90 coins, over 400 pairs), so users who value a large selection and advanced traders who seek margin will prefer Kraken, but Pionex is a strong contender.

If an active trader wishes to trade other instruments beyond crypto and prefers not to KYC, he or she may prefer other exchanges such as Bybit or OKX, but if he or she prefers a much larger selection of crypto only instruments and does not mind KYC, Kraken wins, unless specifically seeking bot trading, in which case Pionex may be preferred.

Kraken is accessible in 48 US states with KYC and is regulated and licensed by FinCEN in the USA, while US users can also use Pionex also as an MSB license from FinCEN, but is not US-based.

Pionex vs Binance

Binance is the leading global crypto established exchange by trading volume, offering a much larger selection of cryptocurrencies than Pionex—over 351 coins and over 1300 pairs.

The two exchange’s offerings are fundamentally different in their scope, with Pionex being an exchange catering to its bot products primarily, while Binance is focused on being a global leader and fast innovator in every crypto product, and also offers support for bot traders on all of its pairs, but does not have built in bots.

Traders looking solely for the most advanced trading options such as high leverage margin and futures products specific to crypto only will prefer Binance, as it offers many USDT futures pairs not found anywhere else besides potentially OKX or FTX. Pionex offers only leveraged tokens, and not much in the way of futures pairs.

Binance’s maker-taker fee schedule is unique in its competitiveness compared to that of other exchanges, starting at 0.1%, plus Binance also offers further 25% reduction in fees if paid in BNB, alongside offering reduced fee tiers for higher volume and even maker rebates. However, Pionex still wins in the fee department by offering flat 0.05% trading fees. However, if users desire a clear fee schedule with volume incentives and intend to hold BNB, Binance is better.

Binance also offers a more extensive web and ecosystem of products, support, and liquidity, especially given its larger daily volume as compared to Pionex. Binance is the most popular and well-known futures market in the global cryptocurrency industry and well-known for its extensive futures pairs.

The Binance exchange is not at all accessible to US persons and US customers will have to use Binance US which is a much more limited version of its global parent site, with only 64 coins and 130 pairs, so Pionex wins for US users as compared to Binance US, unless saying with the Binance brand is important.

Binance requires full KYC now to trade even spot products, and Pionex requires full KYC compliance as well to use. Advanced traders and intermediate users alike who value a large selection of cryptocurrencies, products like staking, lending, and more, competitive fee structures, and futures and margin products will probably prefer Binance.

FAQ – Frequently Asked Questions

Is Pionex Safe?

Yes, Pionex is safe to use, since the exchange custodies its customer funds with partnerships with leading exchanges Binance and Huobi, so the security features of Pionex as far as custody is concerned is identical to that of Huobi.

Pionex has also received a MSB license from FinCEN. There have been no reported hacks of Pionex and users are encouraged as always to use 2-factor authentication, secure passwords, a new email, and always check links for possible phishing attempts.

How long does Pionex Withdrawal take?

TRC20 USDT withdrawal usually takes less than 5 minutes from submission to completion.

For crypto withdrawals, on average it takes from 30 minutes to several hours for a transaction to be confirmed due to the blockchain.

Please note that for crypto, the number of confirmations required for actual depositing of funds is determined by every receiving platform individually, for each particular currency, according to its own security standards.

Is Pionex a good exchange?

Yes, Pionex is a great choice of crypto exchange for crypto traders and investors who are curious about leveraging the power of automation and bots in their trading.

The best feature of Pionex is the range of trading bots that are free to use (besides the flat trading fee of 0.05%) and allow users to do everything from performing grid trading strategies, to martingale, to spot-futures arbitrage bot that allows one to produce 15-50% APR with low risk, to a rebalancing bot, and much more.

This makes bots accessible to the masses without the need for complicated set up or coding experience. Fees are also extremely competitive at only 0.05%, but there are no other fee incentives for market makers or for volume.

The coin selection for spot trading is extensive, and US users can also trade spot with KYC, but cannot trade margin or leveraged tokens.

Pionex also offers a easy-to-use “lite” version that allows users to easily buy spot BTC or ETH which is better suited for investors, and there are thorough walkthroughs on how to use the bots in the exchange, however there is a lack of extensive crypto financial services beyond trading.

Users also cannot test demo money on these bots, so ultimately Pionex is an exchange best suited to intermediate to advanced traders who do not mind performing KYC.

International users looking for lending, borrowing, and staking options, or institutional clients looking for other features may find other competitors more valuable.

Where is Pionex located?

Pionex is headquartered in Singapore.

Does Pionex require KYC?

Yes, KYC verification is mandatory at Pionex as of December 1st, 2021. There are 2 levels of KYC verification and unverified users may not trade, deposit, or withdraw. US users must also do some form of KYC and are allowed to trade spot markets only.

What are the Deposit and Withdrawal Methods and Fees for Pionex?

Pionex offers the following deposit and withdrawal methods, with the corresponding fees:

- Crypto assets: deposits and withdrawals—no deposit fees. Withdrawal fees depend on the asset in question: the fee list is here and the fees are minimal. 0.0005 BTC for BTC, for example. This fee is determined by the blockchain network fees and may vary depending on network usage.

- Fiat deposits via wire transfer for Pionex Lite are free and the withdrawal fee is not listed

- No option to purchase crypto with a credit or debit card

What is the Minimum Withdraw Amount for Pionex?

The minimum withdrawal amount for crypto assets or stablecoin is listed for each asset in this table, and ranges from 0.001 BTC minimum for BTC to 50 USDT minimum for USDT, which is a bit higher than other exchanges.

How do you withdraw from Pionex?

Instructions for withdrawing from users accounts can be found here from official support.

Users can withdraw from the wallet by navigating to their User account page, then clicking WITHDRAW. Then, the user should select the asset the user wishes to send—either crypto or fiat.

From there, fill in the details of the withdrawal including toggling the correct currency and be sure to include a tag or memo if needed. The withdrawal options including the blockchain network and any associated fees will then populate on the screen.

Finally, the user clicks the “Submit” button, opens his or her email, and confirms the withdrawal. The Google 2FA code is also required for security.

Is Pionex a wallet?

No, Pionex is a cryptocurrency trading exchange with an app that also offers a custodial wallet solution for trading services, but is not a non-custodial standalone wallet.

How to use Pionex?

Using Pionex can be done by going to pionex.com, clicking the “Sign Up” link on the top right, creating an account on the platform, first undergoing KYC verification procedures for Level 1 verification at the minimum, waiting for verification to complete, and then depositing any trading funds into the account (either crypto assets or fiat using Pionex Lite) and then getting access to the market offerings and begin trading.

User Reviews

- A user on Reddit details his experience with Pionex’s Grid Trading Bot. Commenters agree that it works well, though suggest the Rebalancing bot as well.

- When asked which Pionex bot a beginner should use, one user responded: “Start with grid trading and then do some reading on how the other bots work. If you’re new to crypto trading stay away from anything that has the word “leveraged” in it.”

- A user reviews their time on PIonex after using it for two months: “Pionex is a crypto exchange with bots built on multiple exchanges including binance, with very good 0.05% fees on trades.” They specifically recommend the ALGO/USDT grid trading bot.

- On the subreddit, a user asks if its reliable and how easy it is to withdraw. u/Kingeggobandit responds: “You can’t beat the no bot limit. Again look more into it but I belive the company has all paperwork in check.” u/FULLMikeWard says: “Yes, withdrawal from Pionex is very easy and fast, the interface is simple and intuitive” and u/Gullivers-Unravel says: “I’ve had no issues with Pionex. It’s been great. I’ve only been using it for about a month, but I’ve still had no problems. I honestly wish I would’ve been using it sooner.”