How much money do you have in your bank account right now? No matter what you said, you probably gave the answer in the form of a currency—either pounds if you’re in the UK, dollars if you’re in the US, or euros if you’re in the Eurozone. After all, money is just another word for currency, right?

Not exactly.

The terms “money” and “currency” are often used interchangeably—sometimes, even by experts in the field—but they are two distinct terms.

In this article, we will distinguish the two, looking at exactly what makes them different and why these differences are important.

Money vs. Currency

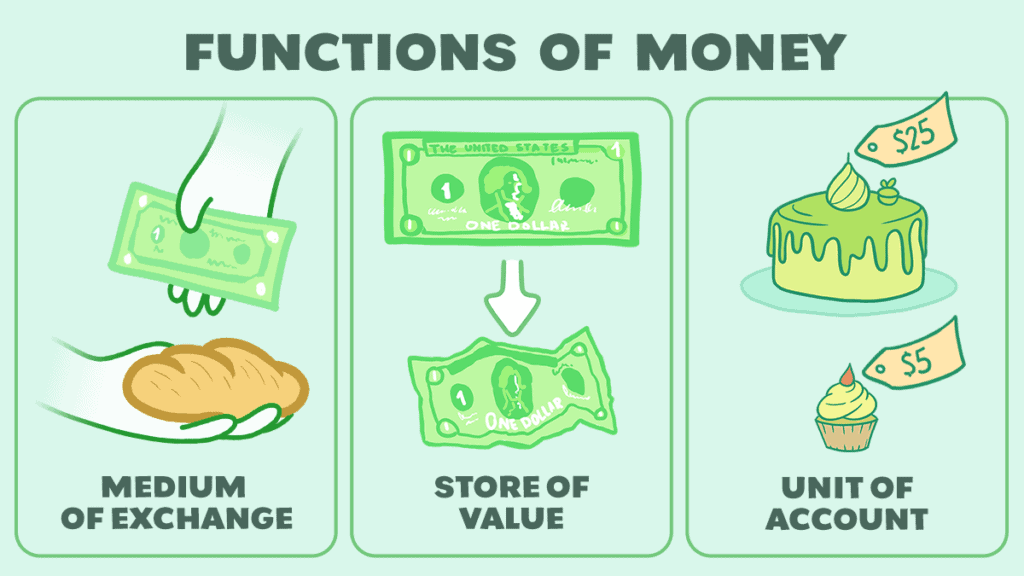

Let’s start with what they have in common. Both currency and money execute the three functions of money—they serve as a medium of exchange, a store of value, and a unit of account. This is because currency is a type of money—in many ways, it is the form of money that has been formally adopted by a nation.

All currency is money; however, not all money is currency. Money can take many different forms, whereas currency takes the form of paper notes or coins.

What is Money?

As we already mentioned, money can be anything that holds its value over time, can be used as a way to measure value, and is widely accepted as a medium of exchange.

There are multiple types of money, including commodity money (commodities such as gold or silver used as money), representative money (money backed by something of value such as gold or silver), commercial money (things like checks or money orders issued by financial institutions), or fiat money (money that has value because the government backing it says so).

Throughout history, money has taken many forms, including:

- shells

- precious metals

- beads

- cocoa beans

- tea

- salt

- peppercorns

However, more than that, money is a broader term than currency. It refers to an intangible system of value that makes the exchange of goods and services possible. Because it is intangible, it can change hands without any physical representation being exchanged.

Think of your last transaction. If you used a debit card or any form of electronic payment, nothing physically changed hands. Simply the number in your bank account decreased. However, that number represents a value that was transferred from you to the seller to pay for the transaction.

What is Currency?

Currencies are a national form of money. They are the paper bills and coins issued by a government to measure and transfer money, though some governments such as Venezuela have experimented with cryptocurrencies.

During the age of the Gold Standard, a nation’s currency was backed by its gold reserves, but today the vast majority are fiat currencies backed only by the word of the issuing government.

Currently, there are over 200 national currencies in circulation, including:

- US dollar

- UK pound

- Euro

- Japanese yen

- South African rand

- Brazilian real

- Argentine peso

Currencies serve the function of money. They hold their value over time, serve as the nation’s unit of monetary account, and are generally accepted within a nation’s jurisdiction as a means of exchange.

In a lot of ways, currencies are simply a particular nation’s way of measuring money. You can convert from one currency to another, but the value will remain the same (minus any fees charged for the conversion transaction). It will simply be expressed in a different currency.

However, because currencies float or change value in relation to one another, it is possible to profit from trading currencies over time or for a currency to become worthless.

Though a dollar will always be worth a dollar, the value of that dollar may decline. That is, you’ll have less money despite holding the same amount of currency. This can occur either through inflation or currency devaluation on currency exchanges.

Inflation

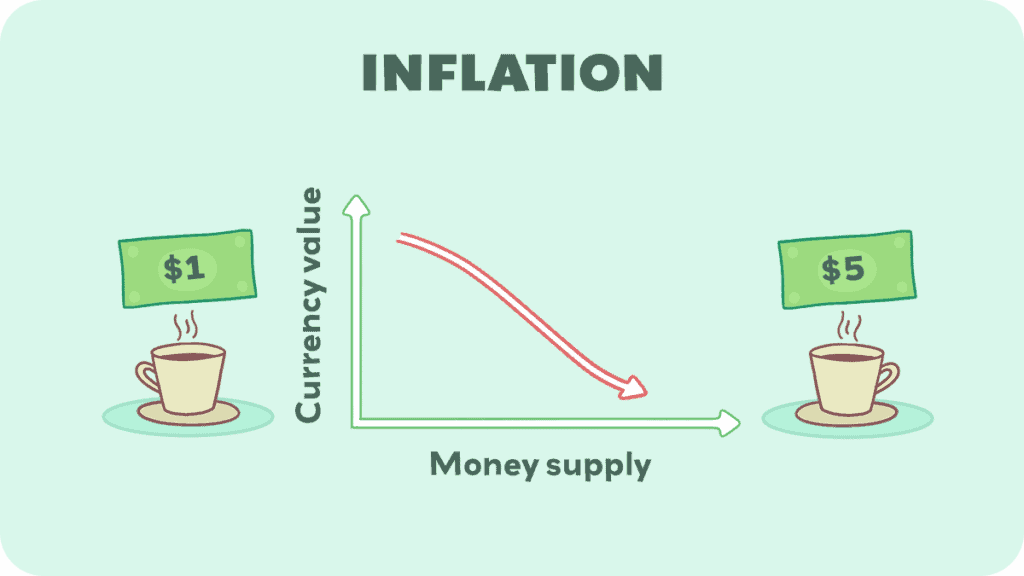

Both phenomena are related to the money supply. A sudden increase in the money supply can cause inflation where the value of the currency rapidly declines.

For example, say you have a simple economy in which there are two goods of equal value: widgets and wadgets. Additionally, there are ten dollars in this economy, so both widgets and wadgets cost five dollars. What happens if the money supply doubles?

Now, you have twice as much money going around, but you have the same number of products. Therefore, people can pay more for each, so the sellers will increase the price. Both widgets and wadgets will now cost ten dollars a piece. Whereas a dollar would have bought you one-fifth a widget previously, now it will only buy you one-tenth.

One of the advantages of fiat money is that the government can more closely control the money supply. This allows the government to keep inflation in check with sound monetary policies.

However, if the government follows reckless policies, inflation can skyrocket, as occurred in 1923 Germany or President Mugabe’s Zimbabwe. Since the government can print money on demand, this is always a temptation for corrupt or short-sighted leaders.

Currency Exchanges

Exchanging currency has been around since people from one region wished to conduct trade in another, but the era of floating exchange rates is relatively recent.

During the Gold Standard, most currencies were backed by gold, which made exchanging from one to another relatively easy. For example, if X amount of gold is worth one UK pound and two US dollars, then it’s easy to see that one dollar will get you half a pound.

Following World War II, the Allied countries agreed to fix their currencies to the US dollar (which was, in turn, fixed to gold) in the Bretton Woods Agreement.

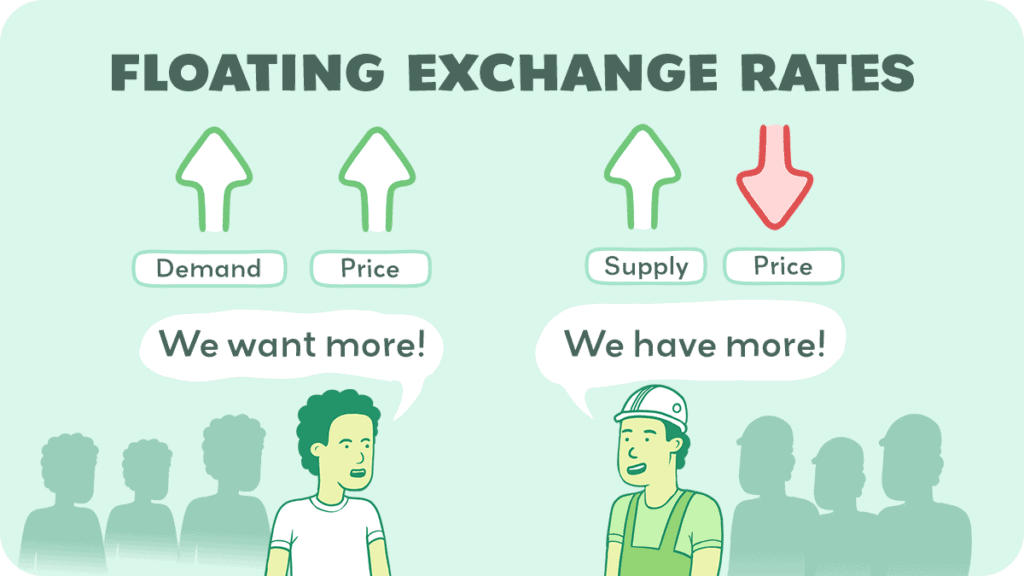

Following the US’s decision to abandon the Gold Standard in 1971, currency exchange rates began to float (though some nations continue to peg their currency to the dollar).

This means that the value of each currency is determined by the relative supply and demand for each currency. This is where the money supply comes in. For a given demand, an increase in the supply of a certain currency will cause a decrease in its value relative to other currencies.

This occurs in a fashion similar to inflation. Say there are an equal number of dollars and pounds in circulation, and one dollar equals one pound. If you were to double the supply of dollars, there would be twice as many dollars as pounds in circulation.

Assuming demand for each remains the same, now two dollars would equal one pound, and one dollar would only get you half a pound. This is how the money supply impacts currency exchange rates.

The demand is determined primarily by economic and political factors. If a nation’s economy is strong, there will be a lot of international demand for its products, thus increasing demand for its currency. This will strengthen the currency.

Likewise, political stability can strengthen a nation’s currency, whereas instability can significantly weaken it. Nobody wants to hold a currency backed by a government that might not be there tomorrow.

Pros & Cons of a Strong Currency

At first glance, it might seem that a nation would want a strong currency. After all, strong means good, right? It turns out that there are advantages and disadvantages to both a strong and weak currency.

Remember, when exchanging currencies, you are taking your money in your current currency and using it to buy the same value in another currency. Thus, though a strong currency means your currency can buy more foreign currency, it also means foreign currency buys less of yours. Here’s how this plays out.

A strong currency primarily benefits consumers by making imports cheaper, as well as those traveling to foreign countries. Imagine you want to buy a Japanese product. The Japanese product costs 500 yen. If the dollar and yen are equal, then it also costs 500 dollars.

However, if the dollar is strong, one dollar might buy you ten yen. Now, that product you want only costs 50 dollars. Likewise, if the dollar were weak and it took ten dollars to buy a yen, that same product is now 5000 dollars.

On the flip side, a weak currency helps manufacturers by making their exports cheaper in foreign countries. Say Ford wants to sell its cars for 10,000 dollars. In the first situation, with an equal dollar and yen, that car costs 10,000 yen.

In the strong dollar situation, the Japanese consumer must now use ten yen to get a single US dollar, driving the price of the Ford vehicle to 100,000 yen, which is probably going to make fewer Japanese consumers interested in it.

However, in the weak dollar situation, one yen gets them ten dollars, and Japanese consumers flock to buy the now dirt-cheap Ford at 1,000 yen. Note that in all situations, Ford gets 10,000 dollars from the transaction.

Similarly, a weak currency can encourage tourism by allowing foreigners to get more of your currency for theirs.

In fact, it is for this reason that nations may follow an intentional policy of devaluing their currency, potentially even setting off a currency war if multiple nations follow this policy simultaneously.

To summarize, a weak currency leads to greater exports and fewer imports, whereas a strong currency has the opposite effect.

Conclusion

Though money and currency are often used interchangeably, the difference between the two has major economic implications.

Basically, currency is a nation’s tangible way of measuring or representing money, whereas money is the intangible value represented. Due to the floating exchange rates of the post-Bretton Woods era, a nation’s currency can appreciate or depreciate in value over time.

We hope you enjoyed this article. Please subscribe to see more info like this, and we hope to see you again.