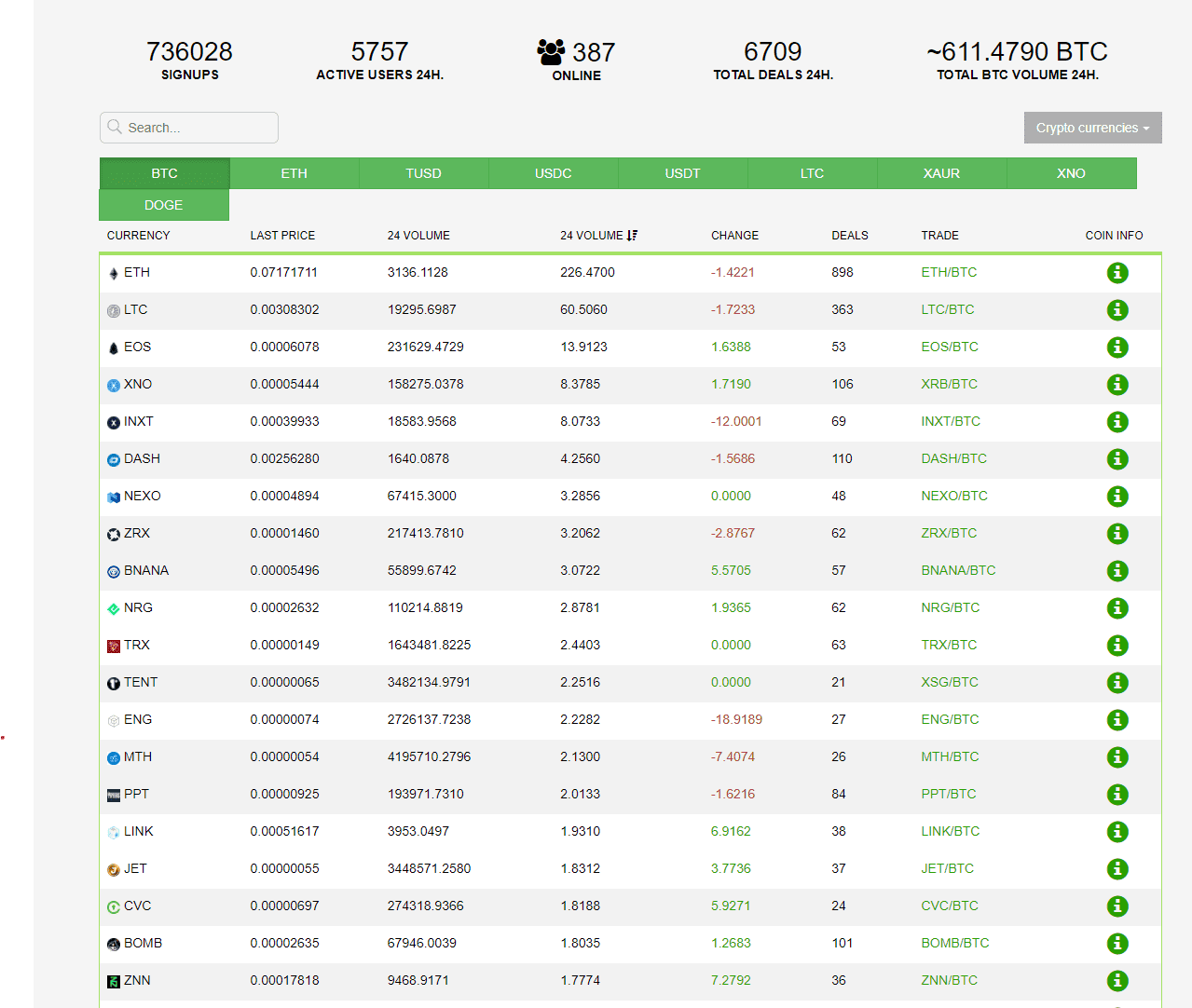

Mercatox is a cryptocurrency exchange launched in 2016 that is based in the UK. To date, the exchange claims to have over 600K users worldwide and is listed as a top 100 exchange on CoinMarketCap.

The exchange does NOT require KYC (Know Your Customer) identity verification or document protocols to be completed for use of the exchange. Note Mercatox only allows crypto-to-crypto trading, with no functionality for fiat deposits or withdrawals and is not regulated. US users are not prohibited from using the exchange.

History of Mercatox

Mercatox started off as a peer-to-peer exchange in 2016. It grew to provide support for many cryptocurrencies without the need for KYC, and even offers margin trading access. Mercatox is not regulated in any jurisdiction and therefore does not deal with any fiat deposits or withdrawals.

The exchange reached an advertised 600K users in 2019 and the users had executed an aggregate of 17M deals worth a total of 651K BTC. As of 2022, Mercatox sees around $24M in daily average trading volume, according to CoinMarketCap.

The Mercatox executive team does not appear to be public which is a red flag, but on its LinkedIn page, the alleged address is shown for its headquarters in the UK.

Mercatox is best for:

-

Cryptocurrency investors and spot/margin traders who desire access to a permissionless, KYC-free exchange with a large selection of cryptos

-

Spot traders and investors who desire a flat fee structure and don’t mind an anonymous and hidden team and old-fashioned exchange infrastructure

PROS

- Moderate coin and trading pair offerings

- Spot, margin, and crypto-to-crypto trading pairs

- Lending platform (though not functioning as of Feb. 2022)

- E-wallet function

- Chatbox in the exchange itself

- Limit, market, and stop orders available

- Open order book

- Complete lack of regulatory compliance or KYC requirements

- Affiliate and loyalty program

- Statistics portal

CONS

- No basic or advanced crypto financial services

- Not great user interface

- Hidden team members

- Lending feature and loading page not functioning at time of writing

- High trading fees with flat fee schedule

- No clear location, regulatory compliance or KYC (also on pros list as personal choice)

- Does not allow fiat deposits

Pros & Unique Features

Mercatox is a relatively simple exchange with a core set of market offerings, with 174 coins and 277 trading pairs offered, with both spot, margin, and crypto-to-crypto trading pairs.

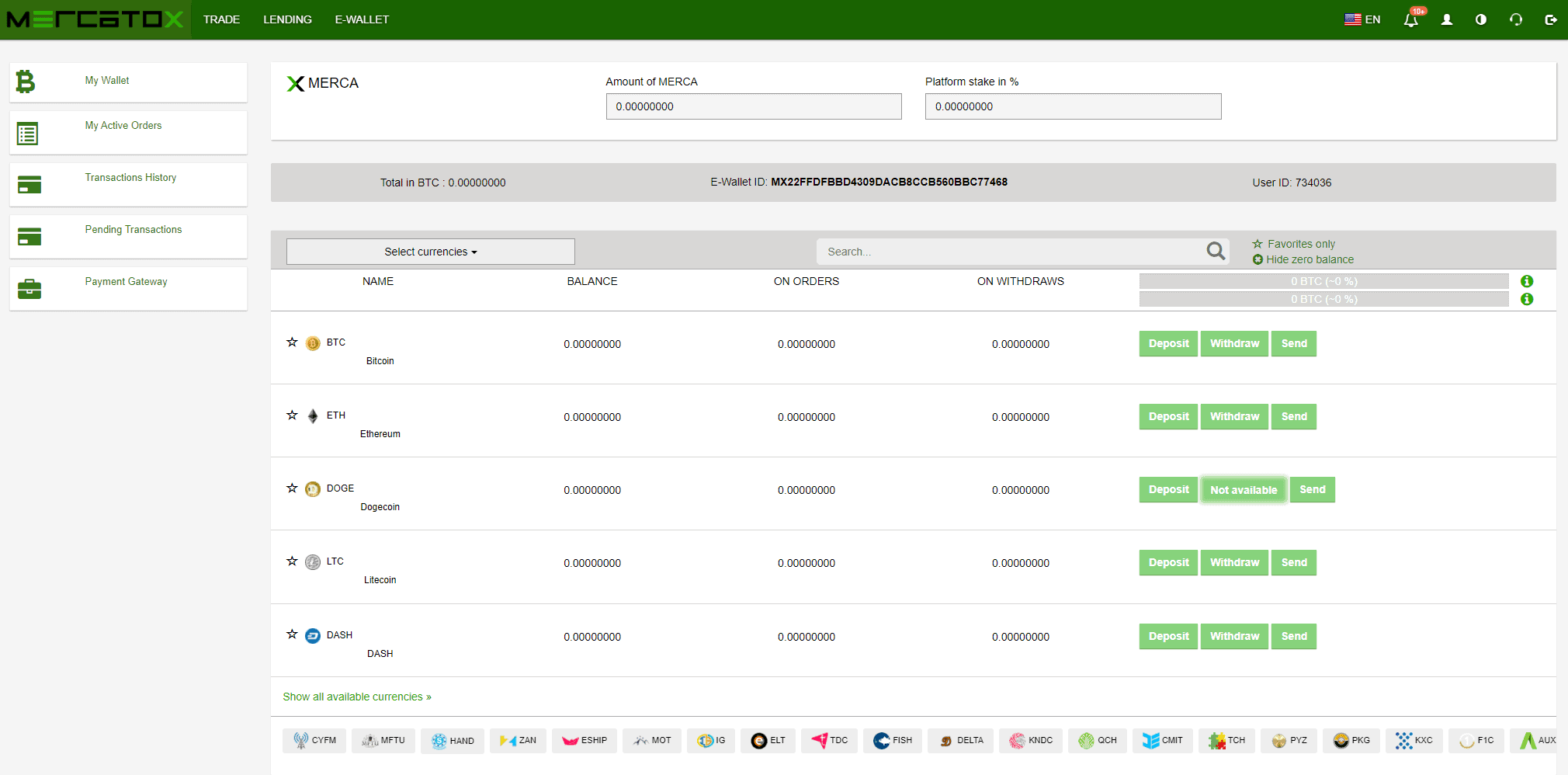

Besides being a trading platform, Mercatox also offers other services such as lending, which does not seem to be functioning as of Feb. 2022. The exchange offers an e-wallet which functions as the one sole wallet for a user’s digital currency needs.

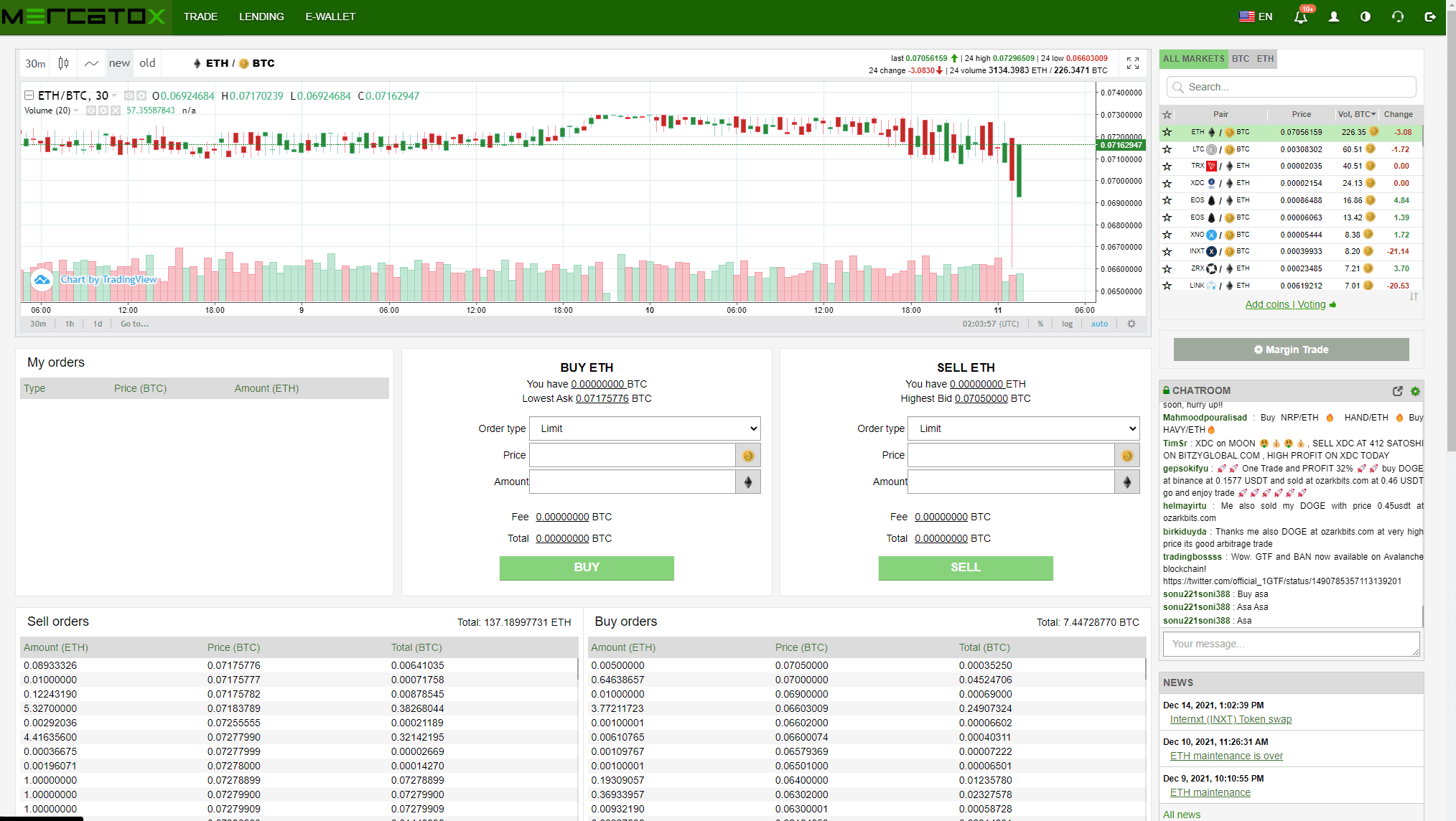

There are no other perks or services that are offered, but a unique feature on the exchange page itself is a chatbox. This is a feature that used to be ubiquitous on crypto exchanges in years past but chatboxes have largely fallen out of favor in modern exchanges.

As far as the exchange functionality, advanced charting features are integrated with TradingView support, and several BTC and ETH trading pairs are offered to trade. Exchange order books are visible to users and clearly laid out for both buy and sell orders, as well as the exchange’s trade history. However, only basic limit, market, and stop orders are present.

The main attractive feature that Mercatox may offer an average user is the complete lack of regulatory compliance or KYC requirements, which may make Mercatox a hub for individuals who are conscious of financial privacy, as well as potentially for illicit funds.

Mercatox also offers an affiliate and loyalty program to users, as well as a portal to check statistics such as top gainers, losers, and volume on its offerings.

As for customer support, Mercatox offers a support service centers customers can access via logging in and submitting a ticket.

Cons & Disadvantages

The main disadvantages of Mercatox are that its exchange services and offerings outside of its moderate range of coins are quite limited. Users will not find any advanced or complex crypto financial services here, or even basic ones such as staking.

In addition, it is one of the few centralized exchanges on the market today that does not have a public team, especially on its LinkedIn page. Some of the exchange’s webpages are also not well developed and the exchange in general has a very old-fashioned feel to its look.

At the time of writing, the lending feature is not functioning or loading the page, and the lack of advanced order types and generally low volume or liquidity as compared to other exchanges make this a poor choice of exchange for active traders of any kind.

The fees for trading are also quite high at 0.25%, irrespective of volume or maker-taker status, which means that liquidity providers and higher volume traders are not incentivized.

Another disadvantage depending on the user’s perspective may be the exchange’s lack of regulatory compliance, clear location, or adherence to KYC/AML procedures that are standard across centralized exchanges today.

While US users are not specifically barred from the exchange, users should note that their funds may not be completely safe in custody at this exchange, especially given the lack of regulatory compliance when compared to a top US-compliant exchange such as Coinbase.

Thus, Mercatox may be an exchange best suited for accessing rare coins that US exchanges do not allow, such as XRP, trading in small amounts, or for international users who have limited availability in exchange choices.

Since Mercatox does not allow any fiat deposits, it may not be suited for new cryptocurrency users, as users would have to first obtain cryptocurrency elsewhere to send to Mercatox.

Mercatox Fees

Mercatox uses a flat fee schedule for trading fees.

Trading fees are 0.25% for both market makers (providers of liquidity) and market takers (takers of liquidity). There are no incentives or tiers based on trading volume, unlike at many other exchanges.

This fee schedule is simple and easy to understand, however it lacks the benefits of reduced fees, rebates, or preferable rates for liquidity providers (market makers) which is the norm at major centralized exchanges.

Trading fees are incurred when an order is filled by the exchange’s matching engine. If an order does not execute, there is no fee charged until it does execute at a later point, or it can be canceled. The full fee schedule can be found here.

Other Fees

Mercatox charges the following deposit, withdrawal, and other fees:

-

No account creation or maintenance fee

-

No deposit fees for any digital asset

-

Withdrawal fees depend on the asset in question. The fee list is here. The BTC withdrawal fee is between 0.0003-0.0005 BTC and that of ETH is 0.008 ETH.

There seem to be no fees for signing up or for having an inactive exchange account, nor any fees for holding funds in an exchange account.

Account Tiers & Limits

Mercatox notes a difference between verified and unverified accounts. Verified accounts receive higher withdrawal limits.

However, unverified accounts may still make BTC withdrawals limited to 0.5 BTC per 24H period. Verified users may withdraw up to 5 BTC per 24H period.

The process to verify an account requires KYC procedures that involve the verification of ID, selfie, and other identifying features.

Crypto Security

Mercatox offers 2-factor authentication that every user should opt for if using this exchange.

Mercatox has noted some past attempts to hack user accounts by third parties and encourages users to use strong passwords and opt for 2-FA to prevent hacking.

Unlike many other top exchanges, Mercatox does not make clear what other security precautions they take to protect user funds. The extent of their security recommendations by their support staff may be found here.

Mercatox Review Conclusion

Mercatox is an exchange that is probably better to be avoided by the average cryptocurrency user for several reasons, unless in the case of being an extremely privacy-conscious user only looking to use an exchange that does not require KYC to trade, or being an international user who does not have access to many other options.

Not only are Mercatox’s range of offerings extremely limited, but also users will not find any advanced or complex crypto financial services here, or even basic ones such as staking, and its trading fees are quite high at 0.25% for all traders, irrespective of market makers or high volume traders.

In addition, it is one of the few centralized exchanges on the market today that does not have a public team, especially on its LinkedIn page. Some of the exchange’s webpages are also not well developed and the exchange in general has a very old-fashioned feel to its look.

At the time of writing, the lending feature is not functioning or loading the page, and the lack of advanced order types and generally low volume or liquidity as compared to other exchanges make this a poor choice of exchange for active traders of any kind.

The one benefit is that Mercatox has over 150+ coins offered and over 250+ trading pairs, however the platform can be be considered to be in the same standard as Binance, FTX, or others and users should exercise some caution if using this exchange, especially due to its relative lack of security considerations and lack of regulatory compliance.

International users looking for lending, borrowing, and staking options, or institutional clients looking for other features may find other competitors more valuable.

- Mercatox offers access to 174 coins and 277 trading pairs, for both spot and margin trading

- Most traders (spot, investors, or margin) who desire access to advanced trading tools and charting would prefer to pick a different exchange especially whether desiring one that requires KYC or not, unless in a country with few other choices, or desire access with only crypto deposits being available

Other Alternatives

For users who desire access to a fiat functionality as well as a modern trading interface with more trading pairs as well, or those who do not desire to participate in cryptocurrency futures/margin trading either Bittrex, FTX, Coinbase, or Voyager can make great alternatives with an equally competitive amount of cryptocurrencies offered to trade along with more competitive trading fees and functionality, plus clear safety and regulatory protocols.

Beginners, buy-and-hold investors, and low volume traders may prefer the easy to use features and functionality of Coinbase with its brand presence, US regulatory approval, and cryptocurrency education that even provides the chance to earn free cryptocurrency for learning.

Coinbase is designed for buy-and-hold investors or casual to intermediate cryptocurrency users, though it has an even larger selection of cryptocurrencies offered compared to Mercatox—402 pairs vs. Mercatox’s 277 pairs—while active traders who need access to order books and advanced charting functionality may prefer using Coinbase Pro, FTX, Binance, or KuCoin though their fee structures and product offerings differ, and they all use volume-tiered fee schedules unlike Mercatox, which uses a flat fee rate.

Typically at any major exchange, one can get lower fees as 30-day trading volume increases and if one provides liquidity to the order book.

For customers who desire to trade and invest in stocks in addition to top cryptocurrencies and do not mind having a smaller selection from which to choose or only desire access to the top 20 cryptos on the market, Webull and Robinhood are brokers that offers US equities and a small selection of cryptocurrencies.

Other competitors to Mercatox include MEXC, OKX, and Kraken.

Mercatox vs Coinbase

Coinbase is better in all aspects of functionality and range of trading coins and products offered if compared to Mercatox.

The most significant difference would be in terms of reputation and safety. Coinbase is a public US company and offers transparency into its industry-leading security along with its brand reputation, while Mercatox is not, though US users are not explicitly banned from using it as per TOS.

Unlike Coinbase, Mercatox does offer some margin trading, but Coinbase wins in the fee department for takers trading more than 100K in 30-day volume and for makers trading 50K or more, as fee rates drop lower than the flat 0.25% at Mercatox.

An advantage for high volume traders will be the volume-tiered fees at Coinbase, since Mercatox does not differentiate between liquidity providers and liquidity takers.

Coinbase also offers about 2x the selection of trading pairs as is offered at Mercatox, with 440 trading pairs, compared to 200+ at Mercatox.

Ultimately, advanced users who desire both competitive fees and a greater selection of trading products than what Coinbase offers may find the choices below equally valuable.

Mercatox vs FTX

FTX will win against Mercatox for even beginner traders unless specifically seeking KYC-free trading, as FTX offers fiat functionality, 323 coins and 492 trading pairs, which is again higher than Mercatox’s selection.

Derivatives traders who want to trade margin, extensive crypto futures pairs, or leveraged tokens and options will prefer FTX since Mercatox offers only minimal margin trading options.

FTX is known for its extensive futures pairs and top-class matching and liquidation engine for advanced derivatives traders, while Mercatox offers an old-fashioned trading experience whose execution speed and liquidity is unknown, however FTX is known for catering to active derivatives traders and optimizing for high order volume and trading execution speed.

FTX cannot be used by US persons but Mercatox can, though FTX offers a US version of its exchange whose trade offerings are far more limited than its parent global exchange and do not at all compare to FTX International’s selection.

International users who can use FTX International may prefer FTX for these reasons over Mercatox. US users trading at FTX US need to do KYC procedures. Fees are far more competitive at FTX, since FTX offers both fee incentives for volume and for holders of its FTT token, so fees can easily reach 0.10% or lower at FTX .

Mercatox vs Gemini

Mercatox and Gemini can be compared in the scope of their offerings, but Mercatox offers even less crypto financial services than Gemini.

There is a slight difference in fees and neither of the two has the edge here: the minimum fee tier at Gemini starts at 0.35% for takers and 0.10% for makers, with a flat transaction fee between $0.99-$2.99 and 1.49% transaction fee for trades over $200, so there are extra fees per transaction and extra “auction” fees, while Mercatox offers only flat fees of 0.25% for both makers and takers and for all volume levels.

US investors and traders are allowed to use Gemini with KYC compliance since Gemini is regulated and based in the USA, however as a result, Gemini offers no margin or futures products, and while US users can trade at Mercatox without KYC, it is unclear if it is safe to d so.

Gemini offers 62 coins and 86 trading pairs which is smaller as compared to that of Mercatox’s 174 coins and 277 trading pairs. Additionally, Gemini’s Gemini Earn product has far more staking selection and higher APY offered than Mercatox’s nonexistent staking services and other financial services products.

Mercatox vs Kraken

Kraken offers margin trading at up to 5X leverage even for US investors and several other margin offerings, which is a win over Mercatox’s unclear and unregulated margin or leverage offerings. Simply put, US users may prefer Kraken for its regulatory compliance and strong track record that make Kraken one of the best and most highly reputed exchanges on the market.

Kraken uses a maker-taker fee schedule, starting at 0.16% maker fees and 0.26% taker fees at the entry level which is already more competitive even at the entry volume tier level than Mercatox’s flat fee structure at 0.25% for both makers and takers. Market makers enjoy reduced fees at Kraken whereas at Mercatox they pay the same fee rates as market takers, plus Kraken offers volume incentives as well.

Kraken offers a large variety of cryptocurrencies and pairs (over 90 coins, over 400 pairs), so users who value a large selection and advanced traders who seek regulated margin will prefer Kraken by far.

If an active trader wishes to trade other instruments beyond crypto and prefers not to KYC, he or she may prefer other exchanges such as Bybit or OKX in addition to Mercatox, but if he or she prefers a much larger selection of crypto only instruments and does not mind KYC, Kraken wins.

Kraken is accessible in 48 US states with KYC and is regulated and licensed by FinCEN in the USA, while US users can also use Mercatox but it is not regulated nor can be deemed as entirely trustworthy.

Mercatox vs Binance

Binance is the leading global crypto established exchange by trading volume, offering a much larger selection of cryptocurrencies than Mercatox—over 351 coins and over 1300 pairs.

Traders looking solely for the most advanced trading options such as high leverage margin and futures products specific to crypto only will prefer Binance, as it offers many USDT futures pairs that are not offered even on FTX or OKX, which are other derivatives exchanges that focus heavily on such products.

Binance’s maker-taker fee schedule is more competitive compared to Mercatox by far, starting at 0.1%, however Binance also offers further 25% reduction in fees if paid in BNB, so this is a huge win for Binance, alongside its offering of reduced fee tiers for higher volume and even maker rebates. Mercatox meanwhile keeps a flat 0.25% with no incentives to reduce this.

Binance also offers a more extensive web and ecosystem of products, support, and liquidity, especially given its larger daily volume as compared to Mercatox. Binance is the most popular and well-known futures market in the global cryptocurrency industry and well-known for its extensive futures pairs.

The Binance exchange is not at all accessible to US persons and US customers will have to use Binance US which is a much more limited version of its global parent site, with only 64 coins and 130 pairs, but it is regulated and users can expect a good brand presence and reputation using it.

Binance requires full KYC now to trade even spot products, and Mercatox requires no KYC, so that is an edge for Mercatox over Binance, however users should understand the risks they take using unregulated exchanges with anonymous teams and no clear safety standards.

Advanced traders and intermediate users alike who value a large selection of cryptocurrencies, products like staking, lending, and more, competitive fee structures, and futures and margin products will prefer Binance.

FAQ – Frequently Asked Questions

Is Mercatox Safe?

It is unclear how safe Mercatox is and no guarantees can be made regarding the safety of user funds.

Mercatox offers 2-factor authentication that every user should opt for if using this exchange.

Mercatox has noted some past attempts to hack user accounts by third parties and encourages users to use strong passwords and opt for 2-FA to prevent hacking.

Unlike many other top exchanges, Mercatox does not make clear what other security precautions they take to protect user funds. The extent of their security recommendations by their support staff may be found here.

How long does Mercatox Withdrawal take?

For crypto withdrawals, on average, it takes from 30 minutes to several hours for a transaction to be confirmed. Your withdrawal will be confirmed by blockchain network first. After the confirmation complete, the withdrawal will be automatically funded to your destination wallet address.

Please note that for crypto, the number of confirmations required for actual depositing of funds is determined by every receiving platform individually, for each particular currency, according to its own security standards.

Is Mercatox a good exchange?

Mercatox is an exchange that is probably better to be avoided by the average cryptocurrency user for several reasons, unless in the case of being an extremely privacy-conscious user only looking to use an exchange that does not require KYC to trade, or being an international user who does not have access to many other options.

Not only are Mercatox’s range of offerings extremely limited, but also users will not find any advanced or complex crypto financial services here, or even basic ones such as staking, and its trading fees are quite high at 0.25% for all traders, irrespective of market makers or high volume traders.

In addition, it is one of the few centralized exchanges on the market today that does not have a public team, especially on its LinkedIn page. Some of the exchange’s webpages are also not well developed and the exchange in general has a very old-fashioned feel to its look.

At the time of writing, the lending feature is not functioning or loading the page, and the lack of advanced order types and generally low volume or liquidity as compared to other exchanges make this a poor choice of exchange for active traders of any kind.

The one benefit is that Mercatox has over 150+ coins offered and over 250+ trading pairs, however the platform can be be considered to be in the same standard as Binance, FTX, or others and users should exercise some caution if using this exchange, especially due to its relative lack of security considerations and lack of regulatory compliance.

International users looking for lending, borrowing, and staking options, or institutional clients looking for other features may find other competitors more valuable.

Where is Mercatox located?

Mercatox claims to have its headquarters located in London, UK, as per its LinkedIn profile page, however there are no public staff that can be verified as legitimate and this detail is not verified on the official website.

Does Mercatox require KYC?

No, however Mercatox notes a difference between verified and unverified accounts. Verified accounts receive higher withdrawal limits.

However, unverified accounts may still make BTC withdrawals limited to 0.5 BTC per 24H period. Verified users may withdraw up to 5 BTC per 24H period.

The process to verify an account requires KYC procedures that involve the verification of ID, selfie, and other identifying features.

All users can trade without restriction of limits, regardless of KYC status or not.

What are the Deposit and Withdrawal Methods and Fees for Mercatox?

Mercatox offers the following deposit and withdrawal methods, with the corresponding fees:

- Only crypto asset deposits allowed, no deposit fees listed. Minimum deposit amounts apply and are listed here in the middle column.

- Only crypto asset withdrawals allowed and minimums are listed here in the third column.

- Withdrawal fees for crypto assets depend on a combination of the blockchain network in question as well as the exchange’s fees and can be noted for each asset here in the left column.

What is the Minimum Withdraw Amount for Mercatox?

The minimum withdrawal amount for crypto assets is 0.001 BTC for BTC and 0.016 for ETH. Other minimums can be noted here on the right hand column.

How do you withdraw from Mercatox?

Instructions for withdrawing from users accounts can be found here from official support.

Users can withdraw from the wallet by navigating to the “My Wallet” section in the E-Wallet or My Account page, selecting their virtual currency, and then selecting the “Withdrawal” button.

From there, the user should select the destination address to which he or she wishes to withdraw, and then go to the user’s email inbox to verify.

Then, fill in the details of the withdrawal including toggling the correct currency and be sure to include a tag or memo if needed.

The withdrawal options including the blockchain network and any associated fees will then populate on the screen.

Finally, the user clicks the “Submit” button, opens his or her email, and confirms the withdrawal.

Is Mercatox a wallet?

Mercatox does offer an e-wallet for custody, however its primary feature is an exchange.

How to use Mercatox?

Using Mercatox can be done by going to mercatox.com, creating an account on the platform, undergoing KYC verification procedures if desired (not required for any functionality besides higher withdrawal limits), and then depositing any trading funds into the account (only crypto assets allowed) and then getting access to the market offerings and begin trading.

User Reviews

- A Reddit user asks what on earth is going on with Mercatox: “It’s been over a year that I have been unable to move my KIN coins.” Other commenters report the same issue, with one clarifying: “My understanding is Mercatox has issues with their Solana node so deposits and withdrawals are open intermittently. Their solana blockchain integration does not follow the instructions published on the solana website. We have pointed this out to them on multiple occasions.”

- Another Reddit user asks, “Anyone else stuck in “maintenance” on Mercatox? … I’m unable to withdraw Zenon since yesterday. Knowing Mercatox this could go on for months.” Other users reported the same issue, with one stating, “Had a reply stating that Mercatox is waiting for the Zenon team to launch Alphanet and to basically wait.”

- One user reports Mercatox possibly leaking their emails. “So I use the myemail+whatever@gmail feature when i sign up for stuff, mainly to see if my email gets sold/leaked and where it occured. … Just seen I got a Coinbase notification to verify my email address from myemail+mercatox.” A commenter says this isn’t the first time they’ve seen this: “I read that some days ago from another user. I transfered everything immediately off mercatox.” Here is another post about the same issue, though saying it may have been a hack/breach.

- When Mercatox disabled ZNN deposits, someone asked how to sell. A helpful user responded: “use Pancakeswap. You’ll have to wrap your ZNN, so I trust you know how to do that.”