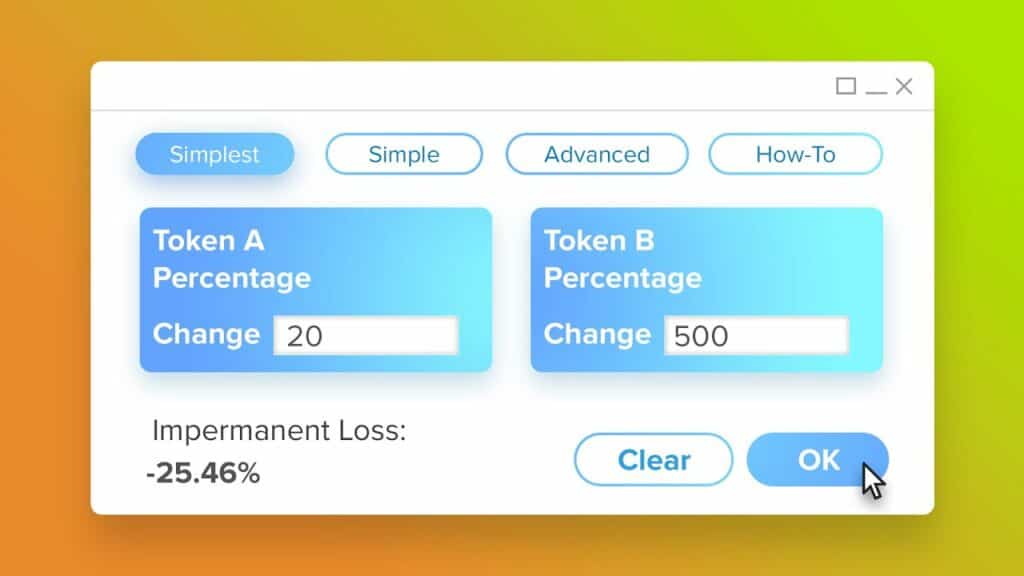

Simplest Impermanent Loss Calculator

Impermanent Loss:

Simple Impermanent Loss Calculator

Price Change A:

Price Change B:

Impermanent Loss:

Impermanent Loss Calculator

0

0

Total Invested

0

Liquidty Pool Value

0

0

Value after Price Changes

0

HODL Value

0

0

HODL Value

0

Value in LP

0

Value HODLing

0

Difference

0

How To Use this Impermanent Loss Calculator

This impermanent loss calculator is very easy to use. Just select the complexity option (Simplest, Simple or Advanced), input your token data, and view the results. Using this calculator, you can start to understand how liquidity pools work.

First off, you should know this:

Impermanent Loss is a very confusing concept to understand. It’s okay to feel overwhelmed or confused by the idea at first.

The best way to learn how to use the tool above is to simply watch the tutorial video:

However, you can start on the Simplest tab first. Input your percentage change of token A and percentage change of token B to get the total impermanent loss.

Next, you can try the Simple tab, which has 4 inputs. Start with Token A by inputting the starting price and the ending price. Then continue with Token B by doing the same. The calculator will automatically figure the percentage change and use this to find the impermanent loss for the situation.

When you want to see what happens behind-the-scenes, check out the Advanced tab. Here you can see how all the numbers work together. There are two rules that these numbers must follow:

- After the price changes, both assets must be equal in value (price * quantity)

- After the price changes, the quantity of both assets must multiply to equal the same number as before the price changes

This ends up looking like a curve:

What is Impermanent Loss?

To put it simply, impermanent loss is the opportunity cost of what you lose when you provide liquidity for traders to use your coins or tokens to trade.

If you invest, you will earn the fees, but may lose out on potential profits from coins appreciating in value. If you HODL, you get complete exposure to the coins increasing in value, but you do not earn any extra incentives.

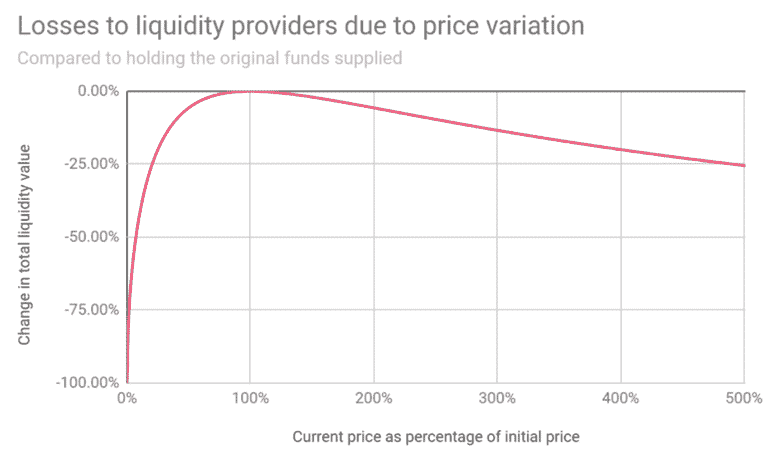

Due to how the AMM formula works, you would have gained more money if you just held the asset instead of providing liquidity. However, impermanent loss can also protect you from large crashes, and while you’re providing liquidity you earn the fees of traders, which can often offset the unrealized loss.

Some pairs of cryptocurrency tokens have far less exposure to impermanent loss than others. For example, two stablecoins (which are tokens pegged to $1) rarely experience losses or gains more than 1% at a time. This means impermanent loss won’t be as drastic as long as the prices stay the same.

Here are 3 ways you will get wrecked with impermanent loss:

- If one token drastically increases in price

- If one token drastically decreases in price

- If one token increases, while the other decreases

Here are 2 ways that you can minimize your risk:

- If two tokens eventually return to the price you initially provided liquidity

- If two tokens increase or decrease at the same rate

Liquidity providers are often incentivized by third-parties. When you deposit your tokens into a decentralized exchange like Uniswap, they give you a token in return to prove that you have ownership of that pool.

Some places will allow you to “lock up” these LP tokens to earn an extra incentive. Places like TraderJoe and Sushiswap often give better incentives to invest in their platforms than the trading fees alone.

This is already too complicated for this page, but if you want to learn more, make sure to subscribe to our Youtube channel and sign up to our newsletter on the homepage!

How does an AMM work?

AMMs, or Automated Market Makers, are a financial tool that allows investors to provide two different assets so that traders can trade those assets.

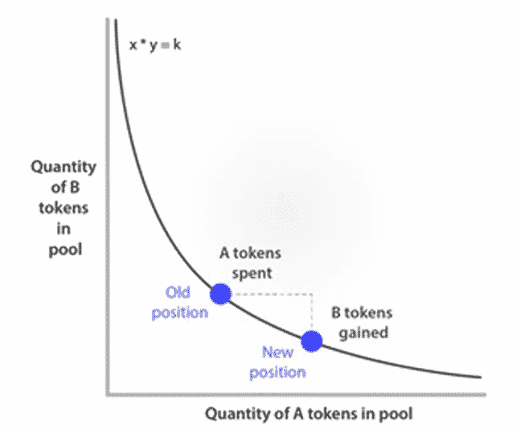

An AMM uses an algorithm and the most common algorithm used by big decentralized exchanges is called a “constant-product market maker.”

A liquidity provider (LP) is someone who deposits their assets into a pool of money (usually a smart contract) in hopes to earn fees that traders pay.

Traders will swap one token for another by using an AMM like Uniswap or Sushiswap and pay a very small fee to do so. That fee is collected and paid to the liquidity providers. If enough money is transacted each day, the fees can add up to be substantial amounts, from 10% for large pools to 1000% for exotic pools.

The way an AMM works is that as you buy more of one token, the algorithm will charge you more to continue buying. This exponential curve keeps increasing the price of the asset you are buying, but also lowers the price of the asset you are selling.

Once I understood this, it made a lot more sense. Here is a visual representation of the constant-product formula that follows the (x*y=K) equation:

What is Whiteboard Crypto?

WhiteboardCrypto started as a Youtube channel explaining complicated cryptocurrency terms using animations and examples so that anyone could understand.

After experiencing a lot of growth, the team has grown to include a website and plan to continue to create useful content and tools (like this calculator) for the community to use to learn.

Let’s Collab!

If you want to collaborate with WhiteboardCrypto, feel free to reach out to the official twitter account @whiteboardCryp1 or use the email found on the official Youtube page. You can also use these to submit a bug you find on this page!

Things planned to be added to this page:

- Add in “grab real data from Uniswap/Sushiswap” feature

- Pools other than 50/50 ratios

- Add a reset button