In this article we are going to explain who Taiki is, what his humble farmer thesis is, and how it might help you make money in crypto by doing something called “yield farming.”

Who is Taiki?

First of all, Taiki was a college student a few years ago, when he started to get interested in Poker. He said he was under 21 so he couldn’t go into a casino yet, but he started studying poker theory.

Interestingly, poker theory translates really well into the DeFi investing space. Anyways, when he turned 21, Taiki realized he was better than a lot of other players and spent a lot more time practicing.

In early 2021, he realized the potential returns from crypto were more than the potential returns from his poker career, so he started his channel where he basically just shares his process of investing in crypto and DeFi projects.

Here’s where the fun starts, I found Taiki a few years ago, and so far he’s made a ton of really good predictions and moves. For example, he farmed around $17,000 worth of MATIC with around like $20,000 worth of crypto invested.

Another good bet he got right was Dinoswap, where he not only earned returns from yield farming, but the ‘farm token’ also appreciated in price.

Lastly, his latest good bet is Luna on the Terra ecosystem. This is actually the reason we covered Terra on this channel, I saw his videos and realized that blockchain has potential and I wanted to do research on it. (Terra/Luna has since crashed, but it was still a good learning opportunity!)

Finally, I want to brag on Taiki for a bit. He’s not like other crypto Youtubers. He doesn’t put big shocked faces on his thumbnails and spout out price predictions every half hour. His content is very good. He thinks deeply about mistakes he has made and shares them with his channel, which is very rare.

His channel also has a ton of interviews with top crypto people, where he definitely asks some uncomfortable questions. He’s never done a sponsorship and currently doesn’t have anything to sell us, so I figured we would share some of the useful things he’s taught us and maybe you can go check out his channel later.

What is Yield Farming?

I actually have an entire video on what Yield Farming is, so check out that video if you want five specific examples of it.

Basically, you know how you can invest in companies on the stock market? When you buy them, sometimes they pay dividends, i.e., they pass their profits onto you for investing in them.

You can do the same thing in crypto, except instead of businesses, it’s crypto projects. Yield farming is the practice of investing your crypto to earn more crypto.

First off, there are a ton of scams when it comes to this. Tons of places going, “Give us your crypto… we have 20,000% APY! We promise!” How can you find out what’s a scam and what’s not? Let’s find out!

Where is the Money Coming From?

If I had to name the biggest lesson I’ve learned from Taiki so far, and even from my own mistakes in investing in scammy stuff, it’s to always ask the one big famous question: “Where is the money coming from?” Let me show you why this is important.

AAVE is our first example. You know how when you give your money to a bank and set up a savings account, you earn like .005%? You earn that interest because the bank takes your money and lends it out to other people, charging them interest.

The bank takes most of the interest, but then a little extra is given to you for sharing your money. AAVE is pretty much a DeFi version of that. Borrowers pay an interest rate to use your money, and you get paid an interest rate.

So, when it comes to yield farming on AAVE, the money is coming from people who are borrowing your money.

For a short period of time, like a few months, AAVE on the Polygon network actually paid you money to borrow. This sounds crazy, right? I get paid to take money?

Let’s apply our famous question, “Where’s the money coming from?”

It came from an incentive program from Polygon, meaning Polygon was basically giving away a ton of tokens to people using the platform as advertising.

Instead of the Polygon network spending their money on Youtube ads or billboards or buying those stupid crazy spammy Discord bots, they quite literally just said, “Come try us out, we’ll pay you!” And they did.

In fact, I think Taiki successfully yield farmed like $15,000 using that exact method. He explains it in his most popular video.

Curve is a different beast. Here is a simple explanation of how Curve works. You give your money to Curve in a few different assets—USDC, DAI, wrapped Ethereum and Bitcoin—and they let traders use your money to trade back and forth.

To do this, they pay a very small fee, and that fee goes to the investors. You can consistently earn like 4-8% APYs by collecting these fees. Even more so, Polygon did the same thing with Curve they did with AAVE, basically giving away a bunch of free money as a form of advertising to get people to use it.

There have been times you can earn 30% APYs using Curve. So Curve and AAVE are called “blue chip yield farms” because it is very clear where the money is coming from.

Compare both of these to the massive amount of Degen Yield Farms out there.

CryptoMoonshotFarm

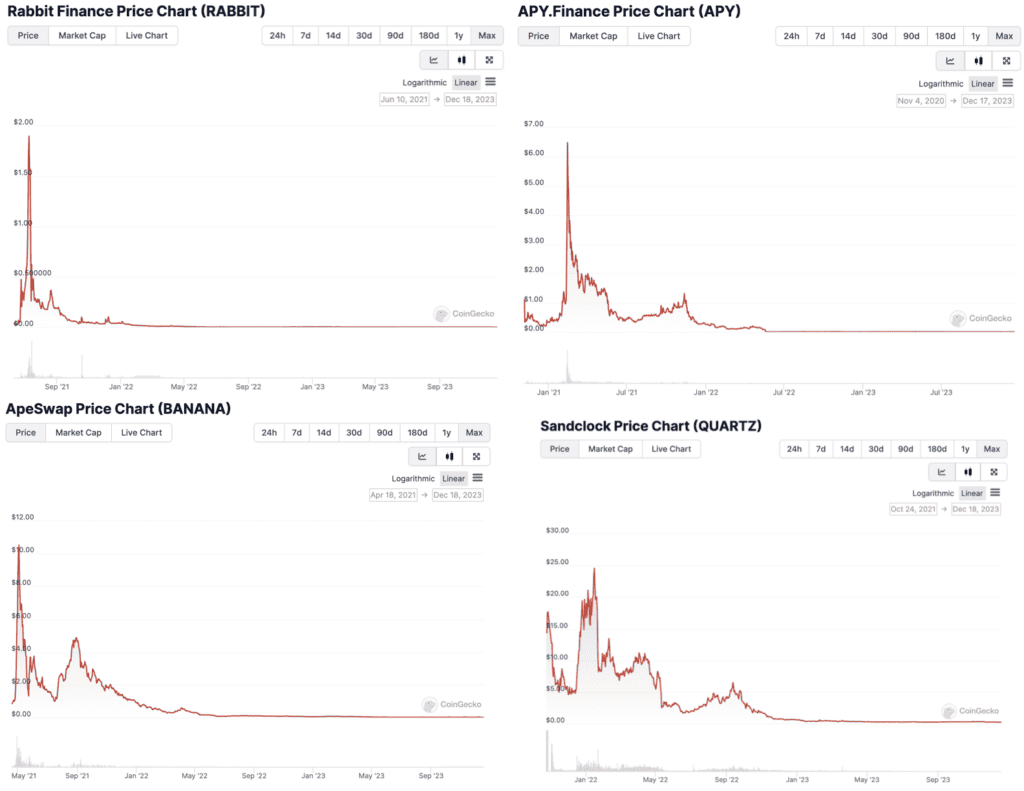

This is an example of a degen yield farm, and let me explain how they work. Basically, they have a launch date. On that launch date, they will start minting and giving away a ton of their tokens to investors who have deposited assets into the farm.

Usually there’s a 4% fee too, so you deposit $100 of Ethereum, and instantly your investment is $96. Now the farm pays you in their tokens for investing in them. Long story short, everyone that gets the tokens immediately sells them to cash out this CryptoMoonshotFarm token into ETH or USDC to lock in their value.

Any degen yield farm token price will always crash because they literally keep printing more and more and more, and there’s no reason to buy them, so people keep selling them.

Where does the money come from? Well, the money comes from that 4% fee you paid, and some sore sucker who’s actually buying their worthless token. Technically, you can make money on these, and I have, but man they are risky and I’ve lost money on them too.

You only make money if more suckers come along and buy the token, basically a ponzi scheme. Always ask where the money is coming from.

When to Take Money Out?

When you yield farm, one of the most important questions to ask is, “When do you cash out?”

Taiki seems to follow the belief that you should be humble when selling to cash out. This makes sense, if everyone cashed out at once, a ton of systems would crash, so taking profits slowly seems to be a good overall idea.

Conclusion

Hopefully you can see now why we call this thesis the humble farmer thesis. When you take your money out is as important as when you put it in, if not more so. It’s best to be humble rather than saying, “I’m so smart, I know when the best time to sell is!”. No one knows that.

Thanks for reading, we hope you enjoyed it, and we really hope you learned something.