If you’ve ever found it arbitrary that people will work or give up useful items in exchange for small pieces of paper with pictures of presidents on them, well, in some ways you’re right. It is arbitrary. After all, you could print out pieces of paper with your picture on them—why doesn’t anybody seem to want that? What makes the money printed off by the central bank so valuable? Is it just because the government says so?

Yeah, basically. What you’ve just described is known as fiat money and it forms an important role in virtually every modern economy.

In this article, we will explore what fiat money is, how it came to be, and why almost every modern economy uses it. We’ll also take a look at both the advantages and disadvantages of such a system. Hopefully, by the end, you’ll have a better understanding of why people place such importance on green pieces of paper or a number on a computer screen.

What is Fiat Money?

The term “fiat” comes from the Latin for “it shall be”. In modern English, it means an authoritative or arbitrary order.

This is pretty much what fiat money is.

Fiat Money is when government issues currency and says that this will be used as money—that is, it will be accepted as a medium of exchange, a store of value, and a unit of account.

People will then use it to purchase goods or pay for services rendered. It has no intrinsic value and is not backed by anything of value like gold or silver. Rather, it’s backed by the government that issued it.

Why would this be? Why would people around the world accept something with no intrinsic value as payment for something that has value?

Fiat money is backed by people’s full faith and trust in the government—in other words, people trust that the government is stable and the currency it issues will continue to be worth something.

However, it’s also important to understand that fiat money didn’t come out of the blue. Rather, state-issued currency was originally backed by something possessing intrinsic value—namely precious metals, especially gold.

It was only over time that this link was removed. To truly understand why people accept this as the common currency, let’s take a brief look at the evolution of money throughout history.

Evolution of Money

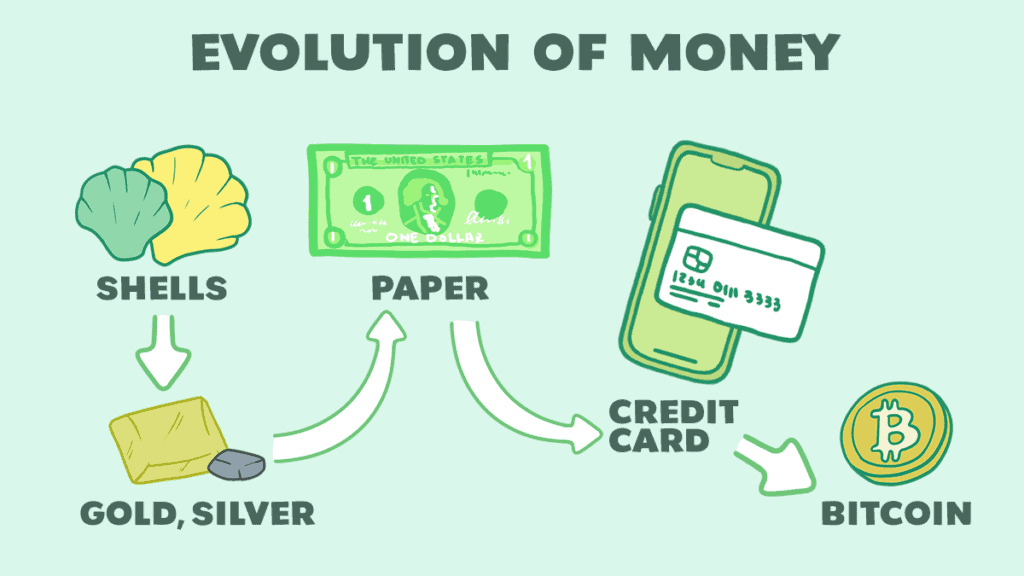

In the early stages of civilization, people relied on a barter system in which they traded goods and services for one another.

For example, I might trade some grain to you for a couple of shirts. Since this could get complicated, people began to accept commonly traded commodities such as livestock for goods and services.

Even if they didn’t have immediate use for the commodity being traded, they would accept it since they knew that they could later trade it to someone else for whatever they actually needed.

Some examples of this early form of money include:

- shells

- beads

- animal skins

- salt

- tea

- silk

Eventually, precious metals, such as gold and silver, took precedence as the foremost form of money. As gold and silver became more widely accepted and governments became more powerful and centralized, governments began to mint coins from these metals, starting with the Lydian stater.

This helped facilitate trade by creating a standardized currency that could quickly be exchanged without having to measure and divide the gold with each transaction. However, the money being used still possessed value in and of itself.

Representative Money and the Gold Standard

As people accumulated more and more wealth, carrying a large number of coins with them became burdensome. Banks allowed individuals to deposit their gold and precious metals in exchange for paper notes that claimed ownership of that metal.

They could then carry these paper notes around and use them to conduct their daily transactions. This was the first form of representative money. Though the paper notes themselves had no value, they were valuable because they could be exchanged for the precious metal backing them.

Eventually, governments began to get into the act. In fact, for a long time, national currencies were backed by gold. Governments began issuing currencies backed by a specific amount of gold and people accepted and used these currencies because they knew they could exchange them for gold at any time.

For example, if the United States said an ounce of gold is worth $100, then you knew that, at any time, you could exchange that dollar in your pocket for 1/100 an ounce of gold. This was more or less the case up through the Great Depression and the 1930s, with a few hiccups that we’ll touch on later.

Bretton Woods and the Collapse of the Gold Standard

Following World War II, forty-four Allied countries met in Bretton Woods, New Hampshire to devise a more stable international monetary system. What they came up with was the aptly named Bretton Woods Agreement.

Under this agreement, the United States set the price of gold at $35/troy ounce. The other signatories to the agreement then set their currency at a fixed rate to the US dollar. This created a kind of secondary gold standard in which a nation’s currency was set to the US dollar which was set to gold (the United States was the exception, as it remained on the gold standard).

This agreement held until 1971 when President Nixon single-handedly took the United States off the gold standard. This marked the emergence of fiat money as the US dollar was now backed only by the “full faith and credit” of the US government.

The value of all currencies, including the US dollar and the currencies that had previously been pegged to it, entered a system of floating exchange rates, where the value of each was determined by its supply and demand relative to other currencies.

That’s why most countries around the world are happy to take their own currency, or US dollars, for payments. And that’s also why you always hear about the value of a currency compared to USD—because that’s how they are measured.

Why Fiat Currency?

So, why end the link between money and anything of intrinsic value? Basically, the supply of money outgrew the supply of gold. As nations recovered economically, the demand for American goods and, as a result, US dollars decreased; at the same time, American military spending and foreign aid flooded the international market with US dollars.

Because there were more dollars than their equivalence of gold, confidence in the ability of the United States to meet its obligations under the agreement dwindled. President Nixon’s actions were intended to stop the foreseeable “gold run,” as well as address inflation in the US.

A “gold run” is essentially the same as a “run on the bank,” which you’ve probably heard about lately in the news. It’s when everyone tries to turn in their “I Owe You”s (IOUs) for the gold, or lately, for the hard cash from the bank. This is done because people believe the gold reserves, or bank, don’t have enough money to cover all possible withdrawals, so they want to get in first to make sure they get their IOU.

However, this wasn’t the first time the government’s need for money outpaced its supply of gold. Remember those hiccups to the gold standard we mentioned earlier? Well, many of them occurred during World War I when various governments’ need for money was greater than their supply of gold.

To cope with this, governments simply ended the convertibility of money to gold and printed the money they needed to deal with the immediate demands of the war. The same thing led to the end of the standard during the Great Depression of the 1920s; governments left the gold standard and printed the money they needed to deal with the economic crisis.

Advantages of Fiat Money

This isn’t to say that fiat money isn’t without its advantages. Specifically, modern governments favor fiat money because it gives them something all governments rely upon—control.

The government is the only one that can produce their currency. Technically, other people could try to produce a given government’s currency, but not without risking long prison sentences for counterfeiting. This gives the government exclusive control over the supply of money.

Additionally, fiat money is cheap to produce. If the money had to be backed by gold, then producing more money would require spending time and resources mining the gold needed to back the increase in money.

Instead, with fiat money, the government can simply print more. This control over the money supply gives governments flexibility in dealing with economic issues, such as credit supply, liquidity, interest rates, and money velocity.

Well-run monetary policies can help manage an economy; for example, the US Federal Reserve works to simultaneously keep both inflation and unemployment low by managing the money supply.

Disadvantages of Fiat Money

As you can imagine, money that isn’t backed by anything of value also has its risks. Because the government can always print more, there is always the temptation for corrupt or poorly managed governments to do so.

Such an increase in the money supply can lead to hyperinflation, as occurred in Zimbabwe under President Robert Mugabe. Fiat money can also be bought and sold on currency exchanges; speculation on such exchanges can cause sudden fluctuations in the value of a fiat currency, as seen when George Soros collapsed the British pound. In short, fiat money can be considerably less stable than money backed by a commodity.

Finally, since this currency is supported only by faith in the government backing it, if the public loses faith in this government the currency can become worthless.

Conclusion

As you can see, fiat money didn’t arise overnight. It came into being after a long, well-established history of national currencies backed by gold, and is accepted due the faith in the stability of the governments issuing them.

Despite not being backed by anything of value, fiat currencies have some very tangible benefits, and for this reason, are favored by virtually all modern economies.