Neiko and I had an idea for a token a few months back that would let you guys, the viewers of this channel, vote on which topics you would want to see first.

Not only that, but token holders could propose new videos ideas and maybe we’d even pay them if the video did well. We didn’t know what launching a token involved, other than in the past launching a token could be seen as scammy, and that we would probably have to crowdfund it in some manner.

We figured that since we had been doing TONS of research into creating this token and launching it that it would be a good teaching moment on this channel. We didn’t end up creating a token, but we still made this video.

An ICO, or Initial Coin Offering, is like a fundraising event in the crypto world. It’s when a new cryptocurrency project sells part of its cryptocurrency tokens to early adopters and enthusiasts in exchange for money or other cryptocurrencies, usually to kickstart the project and get it off the ground.

Let’s dig in.

What is an ICO?

In the briefest terms, an ICO is an Initial Coin Offering, which is a way to launch a new coin by selling it to investors during a launch period.

That may have been too complicated, so let’s take a look at traditional finance for a quick moment.

Coinbase, which is a crypto/fiat based company launched their IPO—which stands for Initial Public Offering—in 2021. In short, this means that they are giving out shares of their company in return for money, and that hopefully that money can be used to help fund some of their projects and whatever else they might need capital for.

Just like Coinbase, a coin or token can do what is called in the crypto world an ICO—an Initial Coin Offering—though the name might be the only similar thing to the traditional meaning.

Basically, a token creator can sell you a bunch of tokens for a set price in order to get the token out into the market and raise capital for the creator or project.

IPO vs ICO

When you go to buy a stock that’s participating in an IPO you gain a certain amount of power within that company; you are actually owning fractions of a portion of that company. This means you can even vote if you hold enough shares.

In the case of investing in an IPO, you are hoping that the project you’re investing in does well. This means you have to do a ton of research if you’re putting a decent amount of money in.

In some cases, an ICO doesn’t even have a finished product, which means increased risk, but other projects have working and testable products, so that’s something to think about when researching.

A big difference between IPO’s and ICO’s is that ICO’s aren’t regulated by the government. There is nothing that is stopping you from getting your money taken and run off with, this is a big problem in many rug pulls.

If you don’t know what a “rug pull” is, it’s when a developer takes all the money from a project and runs away with it. In fact, many ICOs in the past were rug pulls, meaning the developer would raise a bunch of money and then never develop the product… simply because there was no official regulation.

IPOs are officiated by the government and many 3-letter agencies that surround them, such as the SEC (Securities and Exchange Commission). They regulate all the decisions and make sure that as an investor, you aren’t completely ripped off, which lowers the risk for investors.

ICOs however, are not regulated. In fact, anyone can create an ICO. For now—there are many ongoing court cases trying to decide how they should be regulated internationally.

Can Anyone Launch an ICO?

Yes! Back to the intro when we were talking about creating our own WBC token, we figured that it would take a lot to be able to create an ICO and launch a token, but that’s not the case, it’s actually really easy.

Let’s go over the steps we would need to take.

1) Create a Whitepaper

A whitepaper is basically a statistical explanation for what issue your coin or token will be solving and specifically how it is going to be different from other coins or tokens. Some of the other issues you’ll want to cover in your whitepaper are:

- Marketing plan

- What problem the coin solves

- How the coin is different

- Code mechanics of the coin

- Developer fees, wallets, and future spending plans

- Long term goals

2) Market Your Coin

This is where it can get difficult, especially since there have been so many influencer scams and rug pulls in the past. In fact, ICOs have a ton of negative emotions around them due to a ton of ICO scams around 2018.

To launch a successful ICO, you need to get people to see your new coin, the problem it solves, and get them to help fund you. You can do this in a variety of ways.

Some of the most popular advertisement methods are to advertise on different platforms (specifically crypto platforms), join groups (please NEVER use a Discord bot), and heck you could even pay us $100,000 to advertise your new coin on this channel. Just kidding, we don’t do sponsorships!

3) Sell Your Coin on a Platform

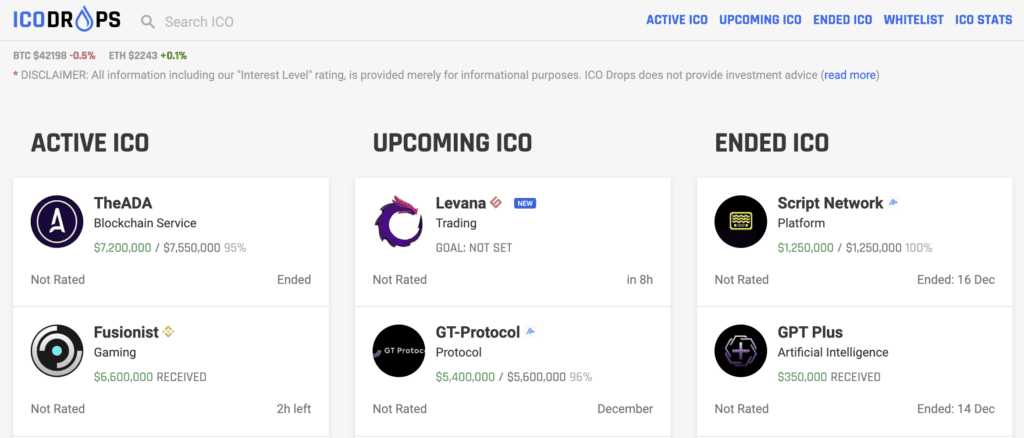

Lastly, you’ll need a way to actually sell your coin. There are platforms out there that will allow you to collect money for pre-sales and then distribute your coin to everyone who bought them. This way the investors don’t have to trust just you—they can trust the 3rd party platform.

Why Buy an ICO?

One of the questions we haven’t asked and answered yet is “why buy an ICO” instead of waiting for it to launch? The answer is twofold.

First, when you invest in an ICO, the coin developer usually has a plan for the funds they are raising that will help the coin succeed. Without your funds, the developer may not be able to implement specific features or advertise the coin, which could hinder it’s success.

Secondly, the idea of buying an ICO is to allow investors early access to a cheaper price. Then, hopefully, once the coin launches, the price will increase, which means the investor could sell for a profit.

We have to say that many, many ICOs did not follow this route. In fact many ICOs actually raised a bunch of money but never developed their project further, or the price fell after the ICO. This is something to think about when investing in a new coin.

Conclusion

ICO’s can be a tricky place, especially if you don’t have an eye for scams, but on the other end it can also be a really promising space for new and upcoming blockchains trying to improve the cryptocurrency space.

In fact, do you have any better ideas for launching a new coin? Maybe give a ton of free coins to people who use a similar coin to get them to try it out? Leave a comment below if you have any other ideas.

Thanks for reading, we hope you enjoyed it, and we really hope you learned something.