![]()

BitMEX is a trading platform based in Seychelles and founded in 2014 that offers investors access to the global financial markets using only Bitcoin. BitMEX is known for derivatives trading and for the creation of the popular “perpetual contract” used today in the crypto markets.

Note that BitMEX is a global exchange and US residents are not allowed to use it. The exchange services require KYC (Know Your Customer) identity verification protocols to be completed for all accounts.

History of BitMEX

BitMEX was founded in 2014 by Arthur Hayes and others and introduced perpetual futures contracts in 2016, which soon became its most popular derivative product. In 2018, one of the co-founders of BitMEX, Ben Deli, became the UK’s first billionaire from bitcoin, and one of the UK’s youngest self-made billionaires at that.

In Oct 2020, the BitMEX founders were indicted on charges of violating the US Bank Secrecy Act and conspiracy to violate that law, arising from allegations that they failed to implement anti-money laundering measures. Their court case takes place in 2022. For the moment, BitMEX implements full KYC procedures for all activities and US users can no longer use the exchange

The creators of BitMEX are finance professionals with over 40 years of combined experience. The exchange is owned by HDR Global Trading Limited. Building on the success of BitMEX, the founding team established 100x, a holding company to pursue a broader vision to reshape the modern digital financial system into one which is inclusive and empowering.

BitMEX is best for:

- Intermediate to advanced cryptocurrency derivatives only traders (no spot offerings, and crypto only) who desire access to a fair amount of popular futures pairs by a leading exchange

- Active futures traders who desire a high latency platform with advanced trading tools, competitive trading fees with a clearly defined & tiered, trading volume based pricing structure for makers and takers, and up to 100X leverage available

PROS

- Caters to advanced futures traders

- Professional derivatives trading

- Low trading fees

- Multiple types of futures contracts

- HODL and Earn program

- Advanced order functionality

- Maker rebates and low trading fees

CONS

- Limited ecosystem

- Few coin offerings

- Only advanced futures derivatives trader-friendly

Pros & Unique Features

The biggest perks of BitMEX are its straightforward trading platform that caters to advanced futures traders. BitMEX has carved a niche as a professional derivatives trading platform that offers deep liquidity for Bitcoin perpetual futures and with low trading fees. The exchange is well-known and respected in the industry for having played a large role in the formation of the crypto derivatives industry as a whole.

BitMEX offers an institutional-grade crypto derivatives trading experience built by experienced traders. Its contracts list can be found here, with over 20 coins’ contracts offered for derivatives trading, at a max of 100X leverage. There are both perpetual contracts offered that do not have a settlement date, as well as traditional and quanto futures contracts that do have a settlement date.

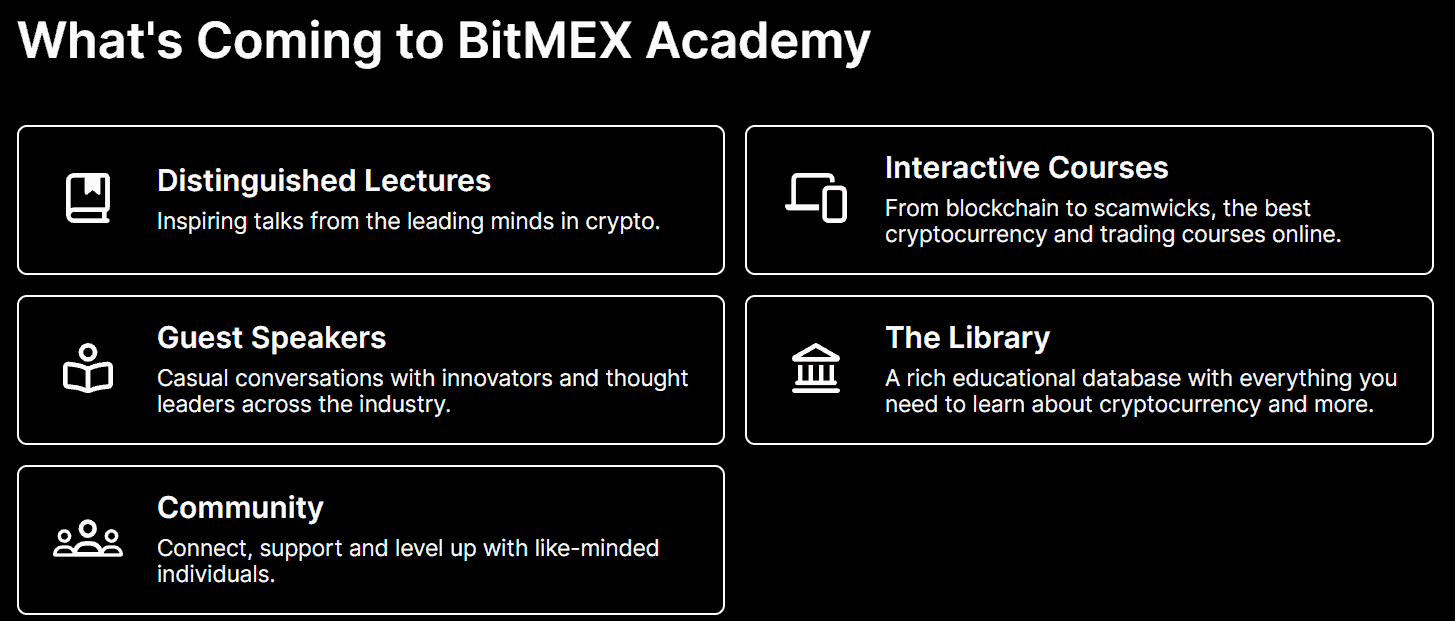

Besides functioning as a derivatives trading platform, users can also buy crypto through third-party payment providers, convert crypto with zero fees, and earn interest via a new product offering called BitMEX Earn which allows users to earn on HODL-ing tokens by placing them into high return products for USDT and BTC.

The trading platform offers advanced charting features integrated as well as order book and advanced order functionality. Note the exchange is a derivatives-only exchange and does not offer spot products.

BitMEX maintains an extensive FAQ and guide to using its margin trading services, and the exchange also provides an API.

As for customer support, BitMEX offers support via a website entry form in English, Chinese, and Russian. Users can access support via the online interface.

Cons & Disadvantages

The main disadvantage of BitMEX is that it is fairly limited in its ecosystem and coin offerings. This is not a good choice of exchange unless the user is an advanced and seasoned derivatives trader looking for the most professional exchange on which to trade. For these users however, BitMEX is a good choice and offers maker rebates along with low trading fees, but it requires KYC as well.

Despite now offering a product to earn interest on holdings, its ecosystem of products and crypto financial services is much more limited than its competitors such as Binance and FTX, which also offer extensive futures trading products.

The futures pairs offerings are slightly more limited with only around 30 pairs, leaving a lot of selection to be desired if compared to Binance Futures’ selections, which is known for being the first to list new coins.

Additionally, there are no other derivatives products offered such as options or leveraged tokens such as Binance offers in its selections, so advanced derivatives traders who wish to trade such instruments may prefer to do so on Binance or FTX.

US users who wish to transact with more functionality without KYC may opt to use competitors like KuCoin, thereby gaining access to a much wider selection of trading instruments such as margin and futures. All exchange users of BitMEX are required to complete KYC procedures, and the exchange is not US-compliant at this time, nor does it allow US users.

BitMEX Fees

BitMEX uses a maker-taker fee schedule with tiers for the user’s trailing 30-day USD trading volume. The platform operates a standard trading fee structure across all products for simplicity. The maker rebate is 0.01% and the taker fee starts at 0.05% for the lowest volume tier.

Trading fees are incurred when an order is filled by the exchange’s matching engine. If an order does not execute, there is no fee charged until it does execute at a later point, or it can be canceled.

In general, for a maker-taker fee schedule, taker fees are charged on market orders that are filled immediately (takers of liquidity from the market), and maker fees are charged on orders that are not filled immediately but rather are placed in the orderbook as limit orders (adding to the market liquidity).

Market orders are always charged taker fees since they take volume from the orderbook, while limit orders are always charged maker fees since they add liquidity and volume to the orderbook.

The table below shows the tiered fee structure for BitMEX’s futures markets and can be found here. For high volume traders, BitMEX offers discounted taker fees as per the table below. These fees apply to all products automatically based on the user’s rolling 30-day average daily volume (ADV), measured daily at 00:00 UTC.

BitMEX Futures Taker Fee Schedule Based on 30-Day Trading Volume (USD)

| Tier | 30-Day Volume (USD) | Taker Fee % |

|---|---|---|

| 0 | < $5M | 0.05% |

| B | ≥ $5M | 0.04% |

| M | ≥ $10M | 0.035% |

| E | ≥ $25M | 0.03% |

| X | ≥ $50M | 0.025% |

Maker Fees

The exchange’s maker fees are set at -0.0100% regardless of trading volume, meaning makers receive a rebate. Funding rates for various contracts can be found here; note that funding rates change based on market lending rates and therefore market conditions. The exchange’s funding interval is every 8 hours.

For dated futures contracts instead of perpetuals, at the time of settlement, any open position in contracts will attract the settlement fee.

Other Fees

BitMEX charges the following deposit, withdrawal, and other fees:

- Funding is exchanged between longs and shorts depending on the market conditions noted. BitMEX does not charge any fees on funding paid or received

- Fees are not charged on deposits or withdrawals on BTC. The fee is dynamically based on the blockchain network load

- Fees are charged only on withdrawing USDT (Tether), but not on deposits. Fees for withdrawing Tether are found on the withdrawal page

- Hidden/iceberg orders always pay the taker fee until completely executed. Then, it becomes a normal order and receives the maker fee for the non-hidden quantity.

There are no fees for signing up or for having an inactive exchange account, nor any fees for holding funds in an exchange account, and users may hold assets as long as desired.

Account Tiers & Limits

BitMEX requires full KYC (all identifying info including email, photo ID, name, DOB, proof of address), called the User Verification Programme, which requires all users to go through a four step process.

Users can no longer use BitMEX without KYC.

There are no further account tiers at BitMEX, as KYC’d users have full access to exchange services.

The minimum amount to trade on BitMEX varies from product to product depending on the Initial Margin. For XBTUSD (for example) it is $1 USD * 1% (Initial Margin) = $0.01. At a XBT/USD price of $600 this equals 0.00001667 XBT.

Crypto Security

BitMEX uses a secure multi-party computation (MPC) system and a first-of-its kind multisignature deposit and withdrawal scheme. MPC is a cryptographic tool which works by allowing two or more independent parties to collectively compute a function on encrypted data without any information—except the desired output—ever leaving the encrypted domain.

Each BTC withdrawal on the exchange is audited by hand by at least two employees before being sent. All BitMEX Bitcoin addresses are multisignature and all storage is kept offline. The hot wallet private key is not held by any one party at any point in time and deep cold storage is used for the bulk of the funds.

As for the trading engine, full risk checks are done after every order placement, trade, settlement, deposit, and withdrawal. All accounts in the system must sum to zero at any time, else trading is halted for everyone.

More information about the security procedures BitMEX follows can be found here.

BitMEX Review Conclusion

BitMEX is a great choice of cryptocurrency exchange for advanced derivatives traders who value trading on the futures exchange with the most history, advanced trading engine and tools, deep liquidity, and with a good selection of futures contracts from which to choose.

The exchange’s fee structure is low and competitive, margin offered is more competitive than at Binance and FTX, at 100X max, and the trading engine is top of the line.

The only drawback is that US users cannot use BitMEX as it is not compliant and its founders are still awaiting trial in the US, however international users who are ok with doing KYC will enjoy using BitMEX given the respect and reputation it has gathered over the years by the crypto community.

- Bitmex offers at least 30 cryptocurrency futures pairs, and while this selection is not as competitive as that of Binance or FTX, it is a strong selection of top coins to trade

- Derivatives only traders who prefer an advanced user experience, built-in charting functionality, and are ok with KYC will enjoy BitMEX

- Advanced traders who are ok with using slightly less leverage, at 20X leverage trading with a larger selection of futures pairs and users who wish to participate in margin lending or borrowing will prefer FTX or Binance

Other Alternatives

For customers who desire access to an equally simple user interface with even more trading pairs, or those who do not desire to participate in cryptocurrency futures trading, either Bittrex, Coinbase, and Voyager can make great alternatives with a more competitive amount of cryptocurrencies offered to trade and similarly competitive trading fees and functionality.

Beginners, buy-and-hold investors, and low volume traders may prefer the easy to use features and functionality of Coinbase with its brand presence, US regulatory approval, and cryptocurrency education that even provides the chance to earn free cryptocurrency for learning. Coinbase offers no futures trading, while BitMEX is only a futures exchange.

Coinbase is best designed for buy-and-hold investors or casual to intermediate cryptocurrency users though has a much larger selection of cryptocurrencies offered compared to BitMEX—402 spot pairs—while active traders who need access to order books and advanced charting functionality will prefer using Coinbase Pro, FTX, Binance, or KuCoin though their fee structures and product offerings differ.

For customers who desire to trade and invest in stocks in addition to top cryptocurrencies and do not mind having a smaller selection from which to choose or only desire access to the top 20 cryptos on the market, Webull and Robinhood are brokers that offers US equities and a small selection of cryptocurrencies.

Other competitors to BitMEX include OKX, Bybit, and Phemex.

BitMEX vs Coinbase

The only advantage BitMEX offers over Coinbase is its extensive offering of futures trading instruments, whereas Coinbase is a spot-only exchange.

Both exchanges offer the option of advanced charting and trading platforms. However, BitMEX only offers around 30 trading pairs, while Coinbase offers 139 coins and 402 pairs, so Coinbase’s selection is much more extensive and better for the average investor or spot trader.

Coinbase is a public US company and offers transparency into its industry-leading security along with its brand reputation, while BitMEX is not US compliant and only for international users.

Ultimately, advanced users who desire both competitive fees and a greater selection of both spot and derivatives trading products than what either FTX or Coinbase offer may find the choices below equally valuable.

BitMEX vs FTX

FTX International really shines against BitMEX for some intermediate traders, offering 323 coins and 492 trading pairs which include both an extensive spot selection as well as derivatives instruments such as leverage tokens and futures pairs.

Derivatives traders who want to trade margin, futures pairs, or leveraged tokens and options would enjoy both FTX or BitMEX and advanced traders may have a hard time choosing between them as both exchanges focus on their derivatives offerings really well, however FTX has built an entire ecosystem of other products and offerings as well, whereas BitMEX only focuses on futures trading as a niche.

FTX cannot be used by US persons, and instead offers a US version of its exchange whose trade offerings are far more limited than its parent global exchange and do not at all compare to FTX International’s selection, and FTX International’s fees are more competitive than FTX US’s low fees.

US users cannot use neither FTX International nor BitMEX and will instead need to use FTX US which has a much more limited functionality and no futures trading, but does offer margin access to select investors. All exchanges require KYC in some form.

BitMEX vs Gemini

BitMEX and Gemini are not at all similar in terms of their offerings and serve fundamentally different market segments.

Gemini’s product consists of spot trading and investing with 62 coins and 86 trading pairs, while BitMEX’s product focuses on a targeted list of futures trading pairs. Gemini’s fees are typically much higher than those of other exchanges, and BitMEX’s fees are geared more towards active traders and quite low.

US investors and traders are allowed to use Gemini with KYC compliance since Gemini is regulated and based in the USA, however as a result, Gemini offers no margin or futures products, but BitMEX does not offer usage or margin to US users either and is KYC-compliant as well for all users of the exchange.

Both exchanges offer an Earn feature for users to earn interest on their longer term holdings, however that of Gemini’s is more extensive.

BitMEX vs Kraken

Kraken offers margin trading at up to 5X leverage even for US investors and several other margin offerings, while BitMEX offers no usage or margin trading at all for US users, but only for international users.

Kraken uses a maker-taker fee schedule, starting at 0.16% maker fees and 0.26% taker fees at the entry level which is higher than BitMEX’s 0.05% taker entry fee and maker rebates regardless of volume, so BitMEX wins in the fee department .

Kraken also offers a much larger variety of cryptocurrencies and pairs (93 coins, over 400 pairs), so users who value a large selection and advanced traders who seek margin will prefer using Kraken if they mostly want a selection of spot products, but derivatives only traders will prefer BitMEX.

Kraken is accessible in 48 US states with KYC and is regulated and licensed by FinCEN in the USA, while BitMEX cannot be used by US users at all.

BitMEX vs Binance

Binance is the leading global crypto established exchange by trading volume, offering a much larger selection of cryptocurrencies than BitMEX—over 351 coins and over 1300 pairs.

Traders looking solely for the most advanced trading options such as high leverage margin and futures products will prefer Binance, as it offers many USDT futures pairs that are not offered even on BitMEX or FTX, the other derivatives leaders. Binance is known for being often the first to list new coins’ futures pairs while BitMEX keeps its futures offerings more focused.

Binance’s base maker-taker fee is fairly competitive for the industry, starting at 0.1%, and offering further 25% reduction in fees if paid in BNB. BitMEX however beats Binance in this category, with base taker fees at 0.05% and maker rebates for all volume levels.

The BitMEX brand overall has existed since 2014 while the Binance brand is much newer since 2017, albeit with a much more extensive network of crypto financial services and product offerings. Binance offers a more extensive web and ecosystem of products, support, and liquidity, especially given its larger daily volume as compared to BitMEX, but BitMEX has a more extensive history in terms of futures trading, having invented the perpetual swaps product that Binance offers today as well.

The Binance exchange is not at all accessible to US persons and US customers will have to use Binance US which is a much more limited version of its global parent site, with only 64 coins and 130 pairs, which is still a better spot selection than offered at BitMEX, however note that Binance US offers no futures trading at all, and BitMEX is not meant to be anything besides a futures trading exchange.

Binance requires full KYC now to trade even spot products, and BitMEX also requires full KYC to use its exchange services.

In summary, advanced traders and intermediate users alike who value a large selection of cryptocurrencies, products like staking, lending, and more, competitive fee structures, and futures and margin products may prefer Binance.

However, derivatives only traders who prefer lower fees and maker rebates, as well as trading with the leader of crypto derivatives in a well-regarded exchange may prefer BitMEX.

FAQ – Frequently Asked Questions

Is BitMEX Safe?

Yes, BitMEX is a well-respected exchange and it uses a secure multi-party computation (MPC) system and a first-of-its kind multisignature deposit and withdrawal scheme. MPC is a cryptographic tool which works by allowing two or more independent parties to collectively compute a function on encrypted data without any information—except the desired output—ever leaving the encrypted domain.

Each BTC withdrawal on the exchange is audited by hand by at least two employees before being sent. All BitMEX Bitcoin addresses are multisignature and all storage is kept offline. The hot wallet private key is not held by any one party at any point in time and deep cold storage is used for the bulk of the funds.

As for the trading engine, full risk checks are done after every order placement, trade, settlement, deposit, and withdrawal. All accounts in the system must sum to zero at any time, else trading is halted for everyone.

More information about the security procedures BitMEX follows can be found here. As far as its security record, BitMEX has never been hacked or lost customer funds and users should always use 2FA with all exchanges.

How long does BitMEX withdrawal take?

The cutoff time for Bitcoin withdrawals is 13:00 UTC. Withdrawals are processed shortly after this time.

The usual timeframe for ACH withdrawals to reach the user’s bank is 2-4 business days, excluding weekends and holidays. The transfer is executed after two separate employee audits on BitMEX’s end, however the banking system might need a few additional days to credit the funds to the user’s bank account.

Tether withdrawals are processed real time. This may involve a manual review of your withdrawal attempt to ensure that withdrawals are legitimate.

Is BitMEX a good exchange?

BitMEX is a great choice of cryptocurrency exchange for advanced derivatives traders who value trading on the futures exchange with the most history, advanced trading engine and tools, deep liquidity, and with a good selection of futures contracts from which to choose.

The exchange’s fee structure is low and competitive, margin offered is more competitive than at Binance and FTX, at 100X max, and the trading engine is top of the line.

The only drawback is that US users cannot use BitMEX as it is not compliant and its founders are still awaiting trial in the US, however international users who are ok with doing KYC will enjoy using BitMEX given the respect and reputation it has gathered over the years by the crypto community.

Where is BitMEX located?

BitMEX is located in Seychelles.

Does BitMEX require KYC?

Yes, for all exchange functions including trading, using the BitMEX exchange in any capacity requires full KYC, meaning government identification, a selfie, proof of address, source of funds identification, and more. US users may not use the exchange.

What are the Deposit and Withdrawal Methods and Fees for BitMEX?

BitMex offers the following deposit and withdrawal methods, with the corresponding fees:

- No withdrawal fees on BTC besides the blockchain network fee

- Withdrawal fees on USDT withdrawals can be found here

- No deposit fees on either BTC or USDT (these are the only collateral types users can deposit)

- Deposit methods include: only crypto deposits (only BTC and ERC20 USDT) allowed, users can also buy crypto using third-party debit/credit payment processor

What is the Minimum Withdraw Amount for BitMEX?

There is no minimum withdrawal amount noted by Bitmex support for either BTC or USDT, however it is likely 10 USDT worth of collateral.

How do you withdraw from BitMEX?

Instructions for withdrawing from users accounts can be found here from official support sources.

Users can withdraw from the wallet trading account by navigating to the left hand side “Wallet” heading and then clicking “withdraw.”

From there, the user should select the currency (either BTC or USDT) and amount and choose the wallet address to withdraw the crypto assets to, or add a new account if necessary.

The withdrawal options including the blockchain network and any associated fees will then populate on the screen. Finally, the user enters in the exact amount he or she wishes to withdraw, the destination wallet address, and clicks the “Submit” button.Withdrawals require manual auditing by BitMEX staff. Tether withdrawals are processed real time and BTC withdrawals are processed after 13:00 UTC daily.

Is BitMEX a wallet?

No, BitMEX is a derivatives-only cryptocurrency exchange which also provides a BTC and USDT wallet inside of the user’s trading/exchange account for custody with the exchange.

How to use BitMEX?

Using BitMEX can be done by going to bitmex.com, creating an account on the platform, undergoing the required KYC procedures to use the account, deposit any trading funds (only BTC or USDT allowed to deposit) into the account, and then get access to the derivatives offerings and begin trading.

User Reviews

- u/DonaldObama911 asks “Is there any one who has had consistent success on Bitmex?” Specifically, they are referencing liquidations but are interested in if people found strategies they use successfully to avoid them. A now-deleted user responds: “Yes I’ve done hundreds of trades on there and am consistently profitable year to year and in both down and up markets. I actually do better when the price is dropping though.”

- Users on Reddit discuss the actions BitMEX took during the market crash in March 2020. The OP said the following, and all the respondents agreed: “Bitmex will act to preserve itself when market stress arises. The insurance fund will switch from a theoretical backstop to a speculative trading instrument controlled by Bitmex trading in its own interest. I have always considered Bitmex one of the most trustworthy sites, I have never come across a credible report of them stealing or having weak security. This event however demonstrates that their advertised systems are at the whim of what they feel is needed for the site and their insurance fund will exploit traders as needed in extreme situations.”

- Users on the official BitMEX subreddit discuss how futures contracts work and how to utilize them on the site.

- u/btctraderjr examines the fee structure for BitMEX and concludes: “If I’m right, how can traders be negligent enough to trade there? How do these guys get away with such outrageous fees?” u/STRML refutes: “This works the same way at every single exchange with leverage.”