Let’s say you want to start investing in a cryptocurrency like the big bad Bitcoin or the magical Ethereum or if we’re scrubbing the bottom of the barrel even dogecoin. So you check the price of whatever coin you are looking at and see that it’s at an all time high, you expand to see the 1 year trading and see that if you would have invested $1200 at 0.002 you would have made 20 grand in profit but like usual you still didn’t invest and figured you would wait for another low.

And now that you’ve gotten the dopamine high of thinking how rich you could have been you then check it a few weeks later and go “Dang, the price is super low right now, maybe the project isn’t going anywhere”. A few more weeks of this pass, and the decision fatigue kicks in and you don’t purchase any at all.

When it comes to the mathematically smartest way to invest in a project you believe in long term, the solution is simple. You should average out your investment and dollar-cost. This simply means instead of waiting for the perfect moment to buy a lump sum of crypto, you would put a certain amount at regular intervals.

What is Dollar Cost Averaging?

Dollar Cost Averaging is when an investor decides to invest a set amount into an asset at a regular time interval. For example, they might invest $200 a week, instead of trying to buy a dip. It is a form of investing that has worked well for ages. In fact, we can apply it to past data from things like the stock market and see that it mathematically works really well also.

Instead of stacking up your United States Dollar bills in your mattress, and trying to time the market for Ethereum to hit a low, to which you can hopefully time it so you can sell at a peak… you invest a little bit over a long time period. This way, you are buying in at both the highs, but also the lows.

Just like showing your appreciation for this channel, don’t wait for the perfect time. Just give us a like right now and ride that dopamine high the rest of the video.

The time period can be days, weeks, or even months. For example, let’s say you wanted to get into Bitcoin. Instead of looking at the price and letting your emotion decide your decision, you instead agree to yourself that you’ll put in $100 each month. Now of course, some months would be higher, and some would be lower, but beating your emotions is exactly what this DCA method is trying to achieve.

You’re averaging out your investments so that over time, you are buying into the stock, but aren’t affected by super high points or super low points as much.

My Experience from DCA

About this time last year myself, my aunt, and my cousin began putting in $20 a month each into a few different cryptocurrencies, it didn’t matter if the project was going well or it was going bad I still put in my $20 and so did the other members of my party.

Jump forward and our portfolios have grown larger, not because we were some great investor predicting the next big boom, but because we stuck to our plan of investing in believing in certain projects and over time they did well. Looking back, we bought quite a bit of Ethereum at $200, which has 10x, so that $20 I invested is $200 now.

Another time that I have ‘dollar cost averaged’ was a few years ago. I began putting $500 into my Roth IRA as a retirement. Being self-employed, I knew I had to start early, since it’s really easy to go every month without committing. $500 a month works perfectly now, as the yearly limit is $6000, and my portfolio has grown to more than $30,000 just by investing in a simple index fund. Looking back, it would have taken a lot of willpower to simply save that much, and quite a bit of that is profit from price appreciation and dividend returns.

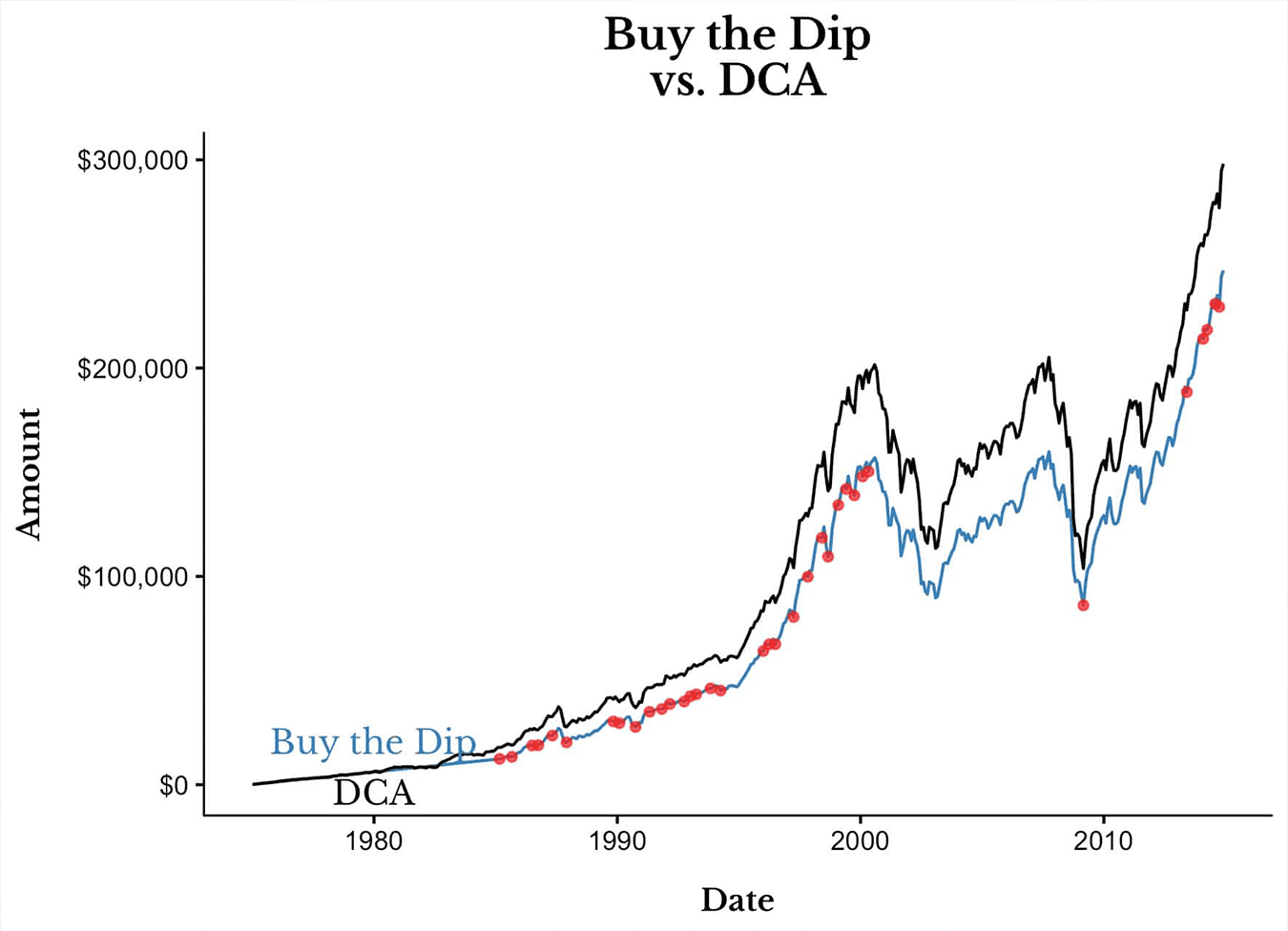

According to an article on Forbes, investing lump sums during any dip has been proven to maximize your investment if the investment is up. However, dollar cost averaging has been proven to avoid major losses. Another big benefit of Dollar Cost Averaging is you can set it up to happen automatically each month, so the psychological barrier to investing is non-existent each month. In fact, if we compare two graphs that used the two strategies of buying the dip and dollar cost averaging, buying the dip doesn’t win by much. For us, we don’t think this improvement is worth watching the price daily to see if there is a dip… in fact you could probably spend that time watching the price and reading price predictions to work on a hobby or extra hours at your job which give you more money to invest.

Either way, the smartest way to invest is to have a plan. Many investors rely on their emotions at the time to either buy or sell. In reality, the best investors have plans such as “buy any dip more than 20% with the $10,000 I have” or “Spend $20 a month, no matter the price”.

How to get started DCA’ng

Alright drumroll please… Now it’s time for the million dollar question. How do you get started? Well it’s as simple as figuring out what you can allow yourself to invest in whatever time frame you decided. For us $20 was easy each month because it was just extra cash. What I would recommend is to also start a spreadsheet to track what you have invested.

We’ll leave a download link in the pinned comments of a template we have made so that you can get started easily. It won’t be anything too complex but it should get you started on the right track!

Once you start investing it’s time to just commit, if you haven’t watched our video on diamonds vs paper hands this would be a good time to because you’ll be tempted with a lot once you start gaining money in your accounts.

Many large central exchanges actually have programs that allow you to dollar cost average. Coinbase and Binance both have options to “invest weekly” so that they will spend a certain amount at each time period buying a coin.

Something to think about is the fees paid using these options. For example, Coinbase’s fee drops off after you spend $200, so paying monthly versus weekly may save you some money. As an alternative, Coinbase Pro has even lower fees.

Conclusion

Okay, now that we’ve told you about DCA we need you to take a little bit of action and not be like we were in the past. Whether it be $5 a day, week, or a month, put something in and let it sit. We don’t think you’ll be disappointed at the return in a year or two but as always remember only invest what you’re financially able to.