What if every time you checked your wallet, the amount of cash changed? Yesterday you checked and you had $43. Today you checked it and you have $38. Tomorrow you check it and you have $50 even.

How would you deal with this? Would you wonder who’s playing a prank on you, or would you want to talk to whoever is in charge of your disappearing dollars?

In this article, we are going to explain some common algorithms that stablecoins use to stay pegged to $1, or at least try to stay pegged: Rebase Algorithm, Seigniorage Supply, and Fractionally Algorithmic Stablecoin.

Yes, we are also going to talk about their issues as well.

Background

First off, this video is going to be a bit more technical, so if you don’t know what stablecoins are, go watch our generic hand-me-down video about them. Trust me, you’ll learn a lot.

Anyways, we are going to assume you know that stablecoins are cryptocurrency tokens that are supposed to roughly stay equal to $1 so that you don’t have to worry about bitcoin going down 50% or ether doubling in a month.

You want to participate in decentralized finance without the volatility, we get it. However, we don’t know what to offer you. The best we can do is explain these three stablecoin algorithms and let you decide if they are worth holding.

Rebase Algorithm

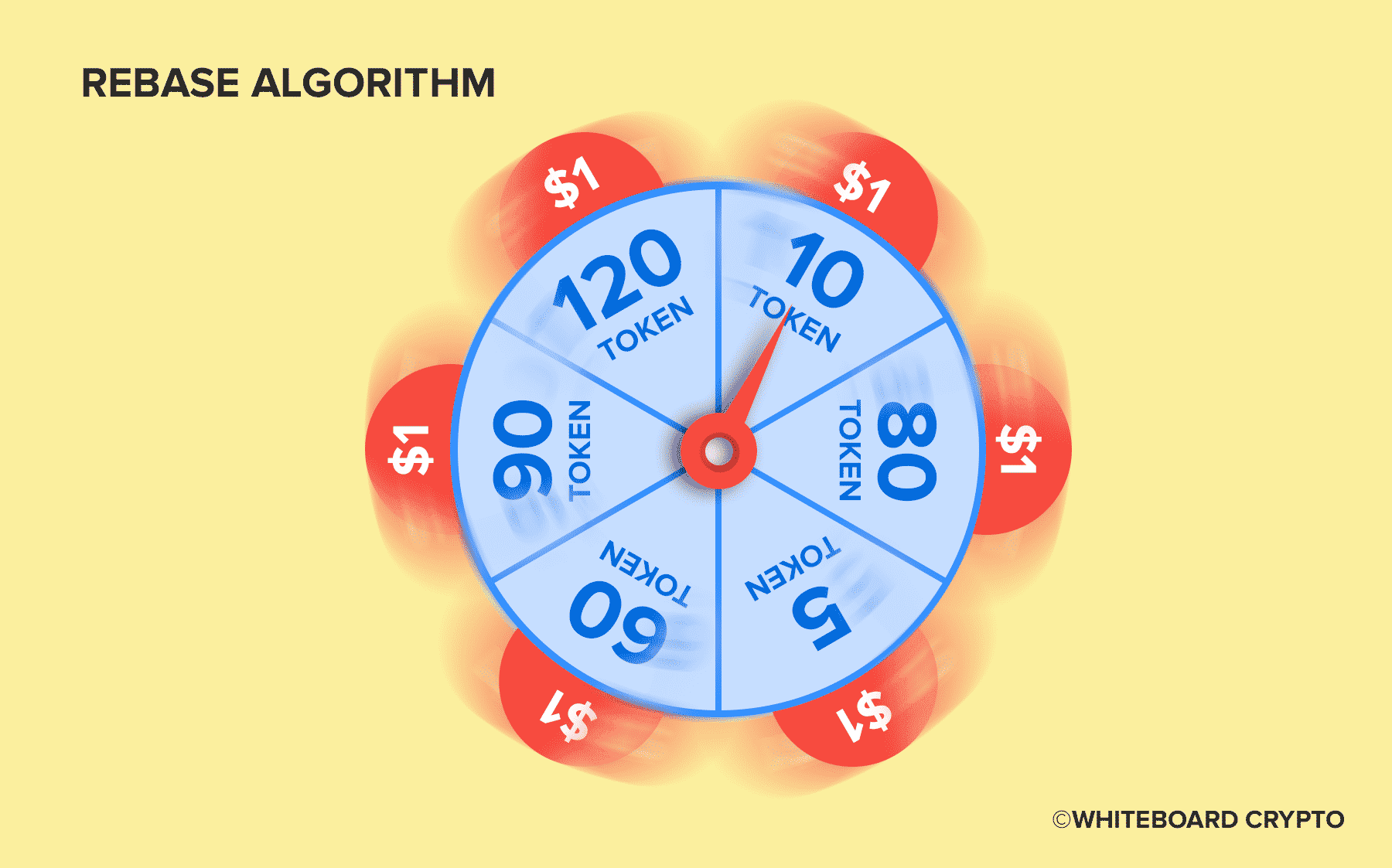

Rebase is the first kind of algorithm for stablecoins. Basically, rebasing is this term where the coins are self aware of their price and will do something to make sure they go back to $1 if they aren’t.

In short, here is what they will do. If they are more than a dollar, money printer go brrrr, and they give everyone more free tokens so that each token is worth $1. So if you hold .0001% of all tokens… when they rebase to get the peg back to the dollar, you will get .0001% of how many free tokens they printed.

This way you don’t change the actual value of how much money you have, you just change how much the tokens are worth individually, so everyone has the same amount of money, just a different number of tokens so the price equals $1.

Debasing is the term for the opposite. If the value is under $1, they will actually take away equally the number of tokens from everyone’s wallet.

In the case of rebasing and debasing, it doesn’t matter if the tokens are in your cold wallet or on an exchange, wherever they are, the amount in that wallet will effectively change over time so that the price of the coin stays $1.

Basically, instead of having price volatility, you are instead having supply volatility. This means instead of the stablecoin going up to $1.20 or down to .75, it stays $1 more steadily, but the amount that are out there changes a lot.

There’s one big problem though, the IRS is going to have one big corporate aneurysm when they try to calculate cost basis of your shrinking and growing wallet.

The next two algorithms use human behavior to stay pegged to $1.

How do you even change the value of something? You have to change what everyone believes it is. Well, humans are a lot like rats in the way that you can train them to do specific things if you give them the right incentives and punishments.

Seigniorage Supply

All Seignorage coins fail. We don’t exactly know why, but our best guess is human greed. By the way, basis coin and ESD coin both are seignorage coins, just work a little differently.

Seignorage is the term to describe the profit that banks make between printing money and what the money is actually worth. So a dollar might cost $0.03 to print, but be worth $1… which means the seignorage is $0.97.

Let’s go over 2 famous seigniorage supply stablecoins.

Basis Cash

Basis Cash keeps its peg because are there three total coins for this process to work.

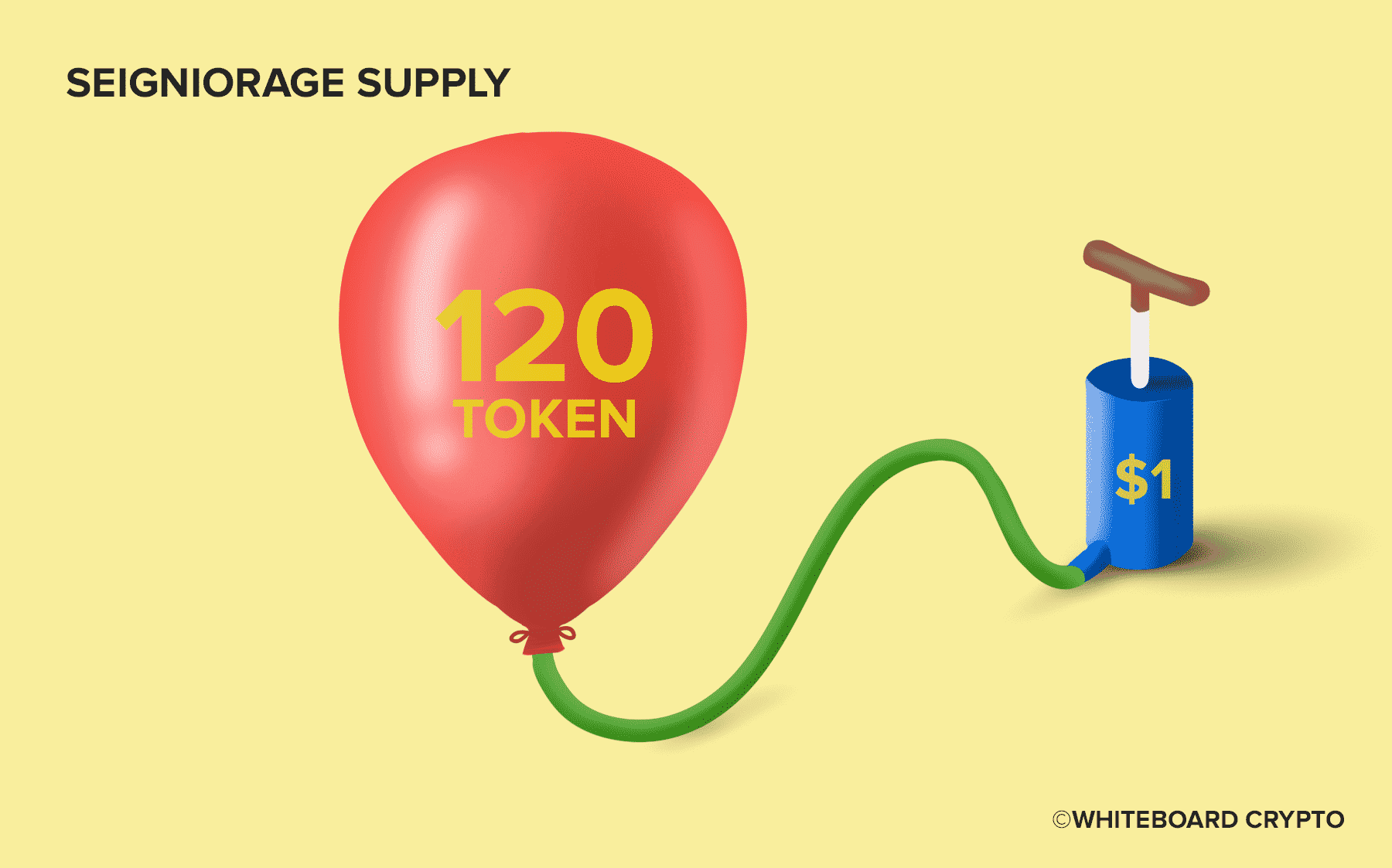

First, when the price of Basis Cash is over $1, they do the simplest thing possible to push the price back down to $1: print more. But where do they give that extra money?

Well, if you own some Basis Shares, which is the second coin in this stablecoin-trio, you get a portion of all those free Basic Cash tokens newly minted from the money printer.

What about when the price falls below $1? People can buy bonds, more specifically Basis Bonds, when the price is below $1. Traders spend their Basis Cash to buy Basis Bonds, so that the price of Basis Cash goes back up, since there are less tokens in the market.

Well, why the heck would you be incentivized to do this? The next time the price goes above a dollar, the Basis Bond holders get paid first, then the Basis Share holders do.

Theoretically, this gives humans a fair incentive to keep the price at $1. If it goes above, they can do something to make money, and if it goes below, they can do something to make money. In reality though, that’s not what happens. Where would all that free money come from, anyways?

These coins usually work in two cycles: expansion and contraction. As more people are investing in the stablecoin system, the whole system is expanding and the stablecoin usually keeps it’s price pegged to $1.

However, when investors start to trade their stablecoin for other coins, and the price starts falling, the inverse happens. The price plunges and something called a “death spirals” happens, which means a ton of free coins are printed and the prices of all three go crazy.

Specifically the stablecoin usually falls close to 0. Just check the price of Basis Cash right now on CoinMarketCap; it’s probably not $1.

Empty Set Dollar

Empty Set Dollar (ESD) is a very similar coin, however instead of having a coin-trio… there are only two coins. The share and the stablecoin are one, so you only have the stablecoin and the bond coin.

So you can stake your stablecoin to earn the income when the dollar’s price is over $1… instead of the method we just described where you had to buy a whole different coin.

If ESD price goes under $1, holders can purchase coupons, which are sold at a discount and their purpose is to get rid of ESD in the system… effectively burning them and raising the price again.

Coupons are only redeemable if the price goes above $1, and only for a short period of time, so there is a little bit of a difference compared to the Basis Cash.

However, the tokenomics are pretty much the same. The price of the stablecoin usually goes down when people pull their money out.

It doesn’t matter if they are investing in other tokens or if they are leaving because they are scared, it causes the price to fall, which then scares people who pull their money out, and before you know it, the death spiral isn’t even a spiral, it’s a straight line down.

Fractionally Algorithmic Stablecoin

So by now, you’ve probably realized fiat-collateralized stablecoins have a ton of benefits.

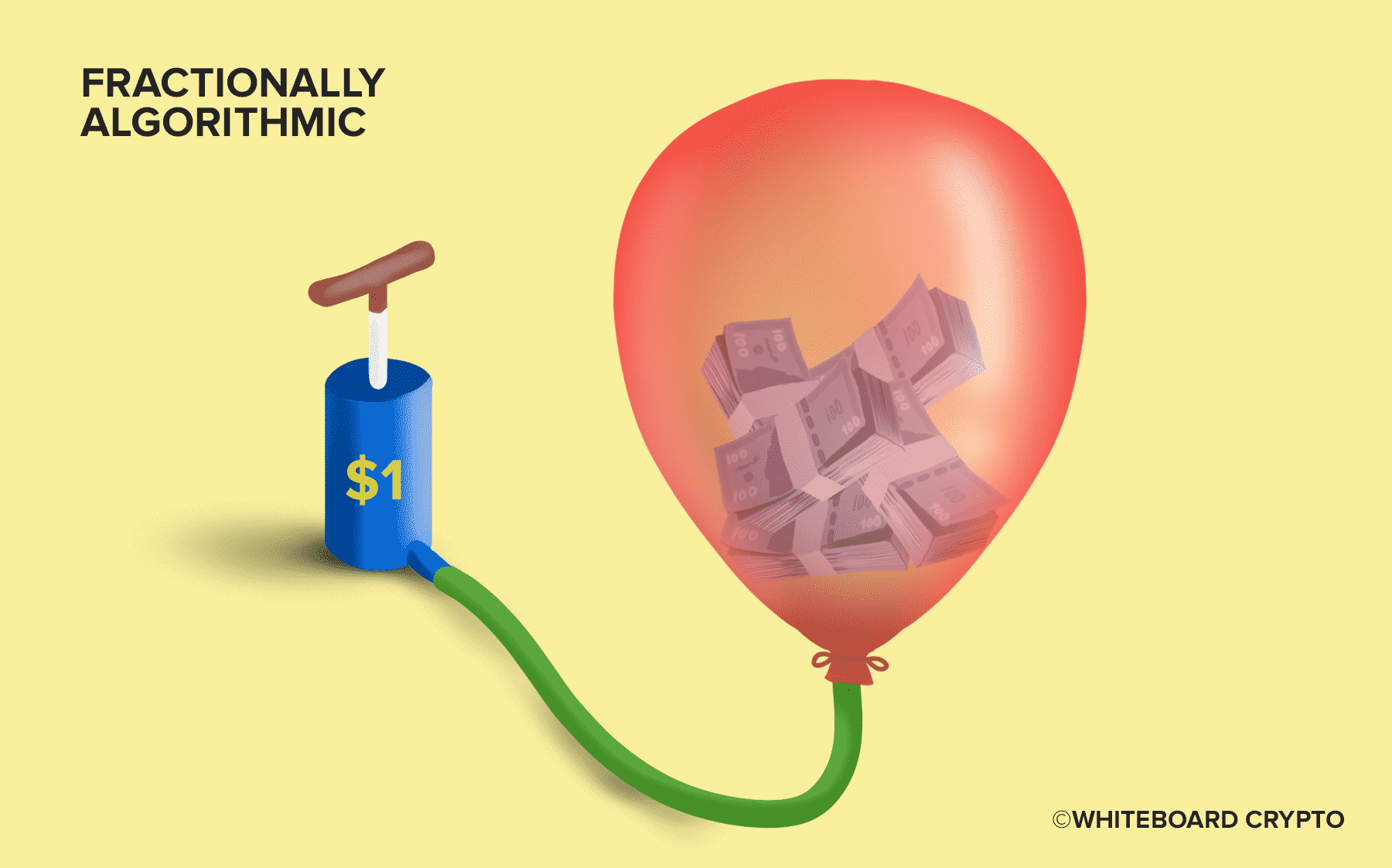

What about if you could combine the two, so you have the benefit of actually staying pegged to a dollar, but also use some algorithms so you don’t have to store $60 billion in a bank account, like Tether (or at least you don’t have to tell people you do).

Titan & Iron Finance

We might as well talk about Iron Finance and their farm token Titan, as they were a huge stablecoin failure. In fact, Mark Cuban even talked about and invested in it.

The stablecoin Iron is 75% collateralized with USDC, which is basically United States dollar, and the rest of their token was 25% collateralized with Titan.

If Iron went above $1, Someone could come along and “mint” a new token for 75 cents of USDC and 25 cents of Titan – and so they gave $1 of value but now they have a coin that is over $1, effectively making a profit, although now there is a new token.

Do this over and over again, and you have buy pressure for Titan, some USDC for collateralization, and even a way to push the price down. This is essentially a way of printing more. As we have discussed earlier, the best way to push the price down is to print more.

If Iron went below $1, someone could redeem their Iron for 75 cents of USDC and 25 cents of Titan, no matter how many Titan it took to print to make sure they had 25 cents. This way there are less and less Iron tokens, raising the value.

So if the price wasn’t $1, there is a way for someone to come along, do something to push it back to $1 and make money.

Long story short, Titan and Iron experienced the death spiral and crashed. We can make a full video on the story of Iron Finance, but Finematics actually did a great job explaining it, so you should check out his similar channel if you’re interested.

There is a little more involved than what we said here, because Iron Finance also had a yield farm with a liquidity mining program, but those are complicated and outside the scope of this stablecoin algorithm video.

Conclusion

In short, almost all algorithmic stablecoins have not held onto their peg to $1. If you find one, definitely leave a comment below, as we would love to research it and cover it.

Thanks for reading, we hope you enjoyed it, and we really hope you learned something.