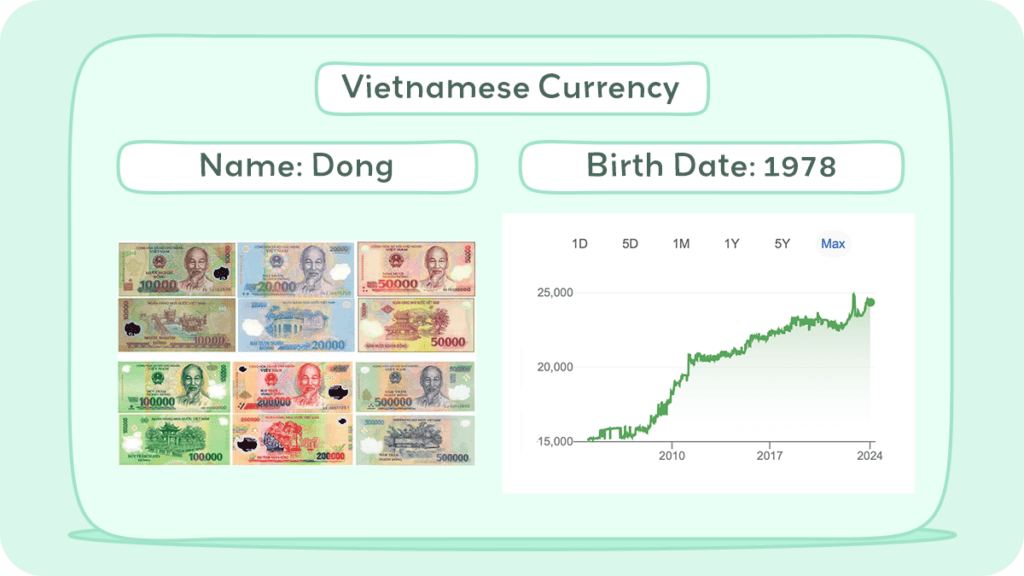

The dong has been the official currency of Vietnam since 1978, replacing the previously used South Vietnamese piastre. The currency is abbreviated as VND and is issued by the State Bank of Vietnam.

The dong is a non-convertible currency, which means it cannot be freely traded on the international market. This makes it difficult to obtain outside of Vietnam, so it’s recommended that you exchange your currency upon arrival.

This article explores the history and current state of the Vietnamese dong, Vietnam’s official currency. It covers the dong’s origins and its significance in Vietnam’s dynamic economy, highlighting important facts and figures that characterize the currency.

Historical Journey of Vietnamese Currency

The Vietnamese Dong is represented by the ISO code VND. The word “dong” means money in Vietnamese, and adding the word after a country’s name refers to any currency.

Understanding the Vietnamese Dong is crucial when traveling to Vietnam. Knowing the currency symbol, current exchange rates, and conversion rates from your home currency will help you plan your trip and manage your finances better.

If you are interested in the history of Vietnamese currency, you will find that it has a fascinating journey. The currency used in Vietnam has undergone several changes throughout history. In this section, we will explore the historical journey of Vietnamese currency.

History of Coins

The Vietnamese dong has had a complex history with various coin issues. The first dong, introduced in 1978 with aluminum coins minted in East Germany, included denominations of 1, 2, 5 hao, and 1 dong.

However, due to severe inflation in the 1980s and 1990s, these coins quickly lost their value and were eventually phased out of circulation.

In 2003, the State Bank of Vietnam reintroduced coins, produced by the Mint of Finland, in denominations of 200, 500, 1,000, 2,000, and 5,000 dong, made from nickel-plated or brass-plated steel.

This reintroduction aimed to reduce the production of small denomination banknotes and facilitate vending machine transactions.

However, these coins did not gain widespread acceptance in Vietnam, with issues in banks accepting or exchanging them, leading to their partial discontinuation in April 2011.

Despite efforts, the Vietnamese people did not widely adopt these coins, reflecting ongoing challenges in the country’s currency system.

History of Bills

The Vietnamese dong has seen several banknote series since the first dong was introduced in 1978 by the State Bank of Vietnam.

Initially, notes were issued in denominations from 5 hao to 100 dong, featuring various cultural and industrial motifs. However, due to inflation and economic instability, these notes were discontinued in 1985.

The second dong series, launched in 1985, included higher denominations up to 500,000 dong, reflecting ongoing inflation. These notes underwent several design changes, with the earlier series criticized for lack of unified themes.

In 2003, Vietnam began replacing cotton banknotes with plastic polymer ones to reduce printing costs. This change was not without controversy, including allegations of corruption and printing errors.

As of 2019, the older cotton banknotes of lower denominations remained in circulation alongside the newer polymer notes. Commemorative banknotes, such as the polymer 50 dong issued in 2001 and the cotton-based 100 dong issued in 2016, were also released but are primarily intended for collectors.

Inflation and Buying Power of Vietnamese Dong

In December 2023, Vietnam’s annual inflation rate rose to 3.58%, up from 3.45% in November. This increase was driven by higher prices in transport, education, and culture, entertainment & tourism sectors.

Despite this, there were continued rises, albeit at a slower rate, in food & drink services, housing & construction materials, and clothing & footwear.

The core inflation rate, which excludes volatile items, dropped to a 16-month low of 2.98%, down from November’s 3.15%. Every month, the increase in consumer prices slowed to 0.12% in December from 0.25% in November.

Overall, the inflation rate for the year 2023 stood at 3.25%, reflecting the year-over-year price changes.

The Vietnamese dong is considered one of the cheapest currencies in the world. One reason why the Vietnamese dong is cheap is due to the country’s trade surplus. Vietnam has a large export sector, especially in electronics, textiles, and footwear. The trade surplus has led to an increase in foreign reserves, which has helped to stabilize the Vietnamese dong.

Vietnamese Dong

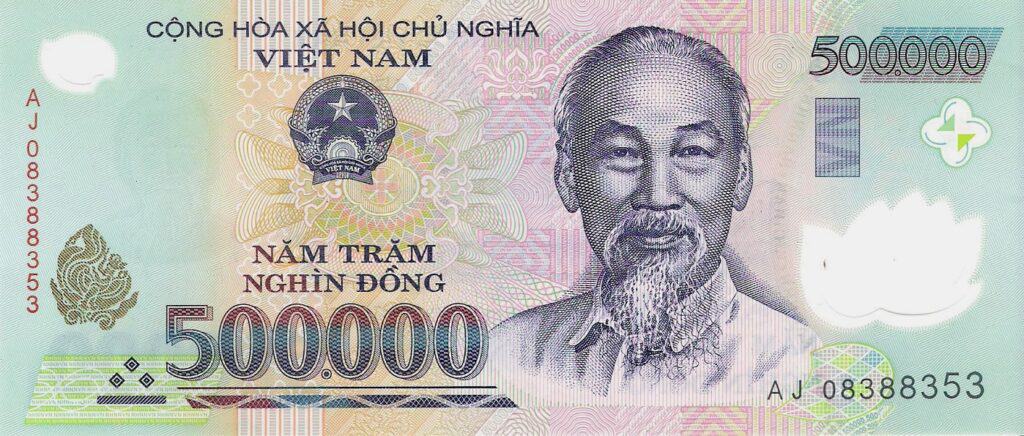

The 2003 Polymer Series of Vietnamese dong banknotes features various denominations, each note’s design reflects significant cultural and historical elements of Vietnam.

10,000 dong

The 10,000 dong note is yellow and depicts the Portrait of Ho Chi Minh on the obverse and the Offshore platform on the reverse.

20,000 dong

The 20,000 dong is blue and shows the Portrait of Ho Chi Minh on the obverse and the Covered bridge in Hội An on the reverse.

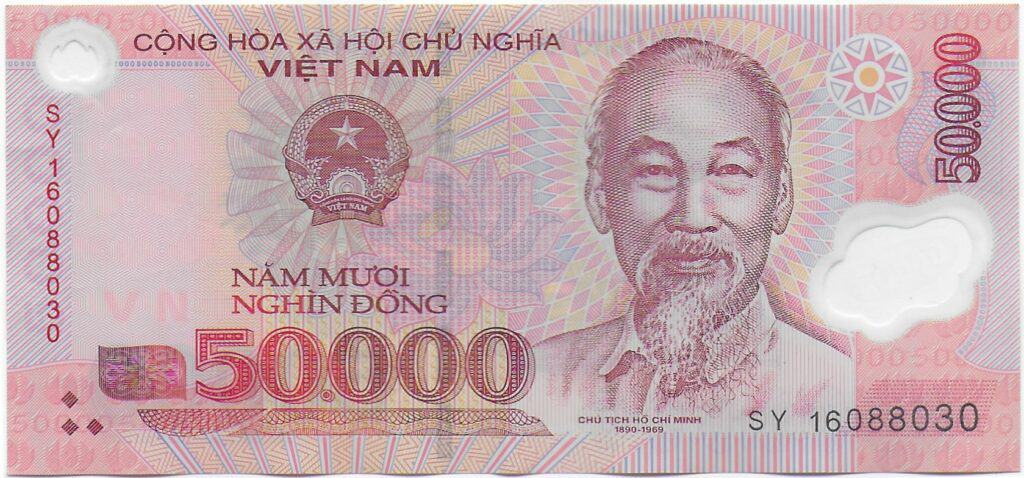

50,000 dong

The pink 50,000 dong note features the Portrait of Ho Chi Minh on the obverse and the Huế pavilion on the reverse.

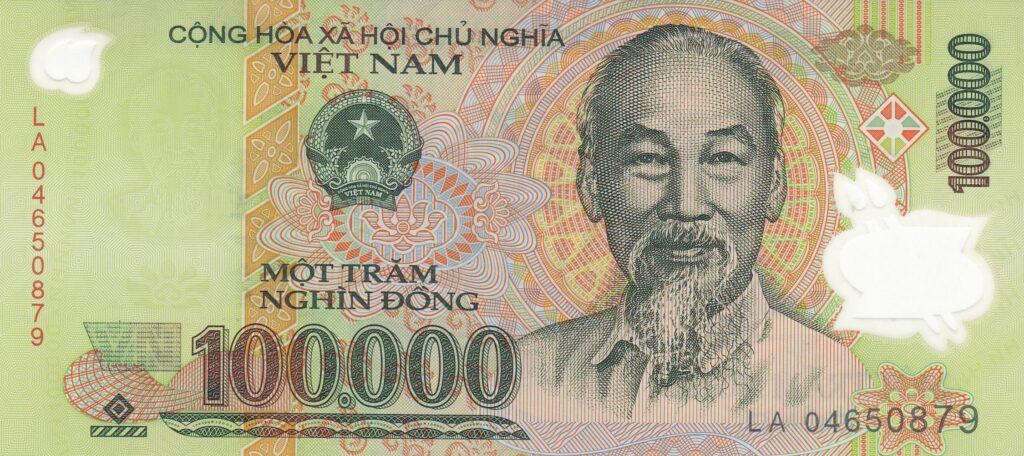

100,000 dong

The 100,000 dong note, green, displays the Portrait of Ho Chi Minh on the obverse and the Khuê Văn Các part of the Temple of Literature in Hanoi – Vietnam’s first national university on the reverse.

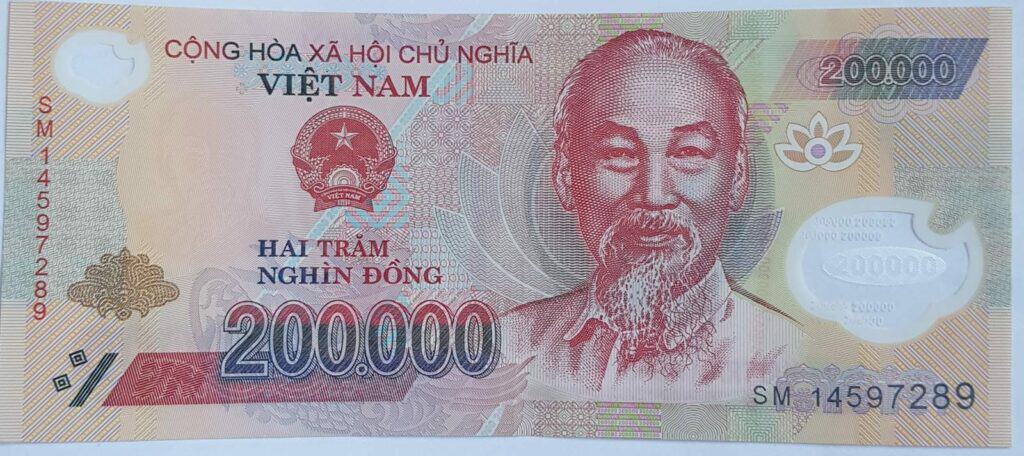

200,000 dong

The 200,000 dong, red, illustrates the Portrait of Ho Chi Minh on the obverse and Rock formations on the reverse.

500,000 dong

The cyan 500,000 dong note showcases the Portrait of Ho Chi Minh and the State emblem of Vietnam on the obverse and Ho Chi Minh’s birthplace in Sen Village, Kim Liên Commune, Nam Đàn District, Nghệ An Province on the reverse.

Currency Usage in Vietnam

In Vietnam, the economy features a mix of traditional and modern payment methods. The Vietnamese dong (₫ or VND), known for its colorful polymer bills and numerous zeros, is predominantly used for daily transactions.

Cash is especially prevalent in local markets, small restaurants, and transportation services like motorbike taxis. However, as the country moves towards digitalization, cashless transactions are becoming more common, particularly in major cities like Hanoi and Ho Chi Minh City.

ATMs and POS terminals that accept international credit and debit cards are widespread in these areas, and larger establishments like hotels and tourist attractions often accept card payments.

Additionally, mobile wallets such as MoMo and ZaloPay are gaining popularity among Vietnam’s tech-savvy population for peer-to-peer transfers, online payments, and bill settlements.

This trend is gradually reducing the reliance on cash. Tourists can also benefit from these mobile wallets for convenient transactions. Looking ahead, Vietnam’s push towards a cashless society and the growth of e-commerce and digital services indicate a future where digital payment methods may become as common as cash.

For travelers, it’s advisable to carry both cash and cards to be prepared for various payment scenarios. Downloading popular mobile wallets like MoMo or ZaloPay can be handy for cashless payments at select locations.

However, be aware of potential fees for ATM and card transactions and check with your bank or card issuer for details. When using cash, especially at markets, don’t hesitate to engage in polite bargaining, as it’s part of the local shopping experience in Vietnam.

Is USD accepted in Vietnam?

While the Vietnamese dong is the official currency, USD is also widely accepted in Vietnam. However, it’s important to note that vendors may not always give you the best exchange rate when using USD. In addition, some vendors may only accept cash payments in VND. Therefore, it’s recommended to carry some VND with you when traveling in Vietnam.

Hotels, travel agencies, and souvenir shops often accept USD alongside VND, and it’s also required for visa stamping fees at airports. However, in restaurants, particularly local ones, and with street vendors and small shops, USD is less commonly accepted, and paying in VND is advisable.

For public transportation and day-to-day expenses like groceries and street food, only VND is accepted. When using USD, it’s best to carry small bills as large ones may be hard to exchange. Shopping around for the best exchange rates is recommended, and be cautious of scams at money changers.

Using ATMs to withdraw VND can be a safe and convenient option. Ultimately, while USD can be useful in some scenarios, carrying VND is essential for most transactions in Vietnam.

The Vietnamese dong is the official currency of Vietnam and is widely accepted throughout the country. While USD is also accepted, it’s generally recommended to use Vietnamese currency when traveling in Vietnam.

Exchanging Currency in Vietnam

If you’re planning to visit Vietnam, you’ll need to know how to exchange your currency for the local currency, the Vietnamese dong (VND). Here are some tips to help you get the best rates and avoid scams.

When exchanging currency, it’s important to keep in mind that different exchange offices may offer different rates. It’s a good idea to shop around and compare rates to make sure you’re getting the best deal.

Additionally, some exchange offices may charge commission fees, so be sure to ask about any additional fees before exchanging your money.

It’s also worth noting that some businesses in Vietnam may accept US dollars or other foreign currencies in addition to Vietnamese Dong. However, you may receive a less favorable exchange rate, so it’s generally best to have some Dong on hand for smaller purchases.

Where can I exchange Vietnamese currency?

Exchanging Vietnamese Dong (VND) offers several options, each with its pros and cons. Banks are the most secure and reliable, providing competitive rates, though they may require identification and have long lines.

Licensed money changers, especially in tourist areas, offer quick service and competitive rates, but ensure they are licensed and compare rates first. Some post offices also exchange currency but may not offer the best rates.

Hotels can exchange currency too, but typically at less favorable rates. ATMs are a convenient way to withdraw VND using debit or credit cards, but be mindful of your bank’s international transaction fees.

Prepaid travel cards like Wise or Revolut are another cost-effective option. To find the best rates, compare them at different places using online resources, inquire about hidden fees, exchange larger bills for better rates, and avoid exchanging damaged bills.

It’s generally safest to use formal options like banks and licensed money changers and to exercise caution with informal options or vendors.

What to know before exchanging currency in Vietnam

It’s helpful to exchange some money upon arrival for immediate needs, carry a mix of VND for daily expenses and USD for emergencies, and consider mobile wallets like MoMo and ZaloPay for convenience.

Ensure you’re exchanging authorized currencies and keep receipts for any discrepancies. Trust your instincts and walk away if a situation seems dubious.

For larger amounts, banks usually offer better rates. Research and using formal exchange options are key for a secure and budget-friendly experience in Vietnam.

Choosing Between USD and Vietnamese dong in Vietnam

Choosing between using USD and Vietnamese Dong (VND) in Vietnam requires considering factors like exchange rates, convenience, and fees.

Exchange Rate

USD is generally stable and widely accepted in tourist areas, but it might incur extra charges for small transactions. VND, while more volatile, is essential for local shops, street vendors, and smaller expenses, and offers the most current rates at ATMs. Carrying a mix of both currencies is advisable, using VND for daily expenses and USD for emergencies.

Convenience

Using USD and VND in Vietnam depends on where you are spending. USD is often accepted in tourist areas, hotels, and larger businesses, while VND is necessary for local shops, street vendors, transportation, and smaller purchases.

It’s recommended to carry both USD and VND to be prepared for various transactions. For daily expenses, using VND is more convenient and eliminates the need for frequent currency exchanges.

Fees

Be mindful of potential withdrawal fees at ATMs and hidden costs at money changers. It’s helpful to exchange some VND upon arrival for immediate needs, and downloading mobile wallets like MoMo and ZaloPay can provide cashless convenience.

Tips

Keeping receipts for exchanges and withdrawals is important, and trusting your instincts when dealing with exchange providers is crucial. Additionally, a travel card like Wise or Revolut can be beneficial for competitive rates and easy currency management.

The key is to be flexible and well-informed, adapting your currency usage to fit your travel needs.

Cost of Living in Vietnam

Living in Vietnam is relatively inexpensive, with costs significantly lower than in the West and even cheaper than in many other Southeast Asian countries. Ho Chi Minh City and Hanoi are the most expensive cities, yet a comfortable middle-class lifestyle can be maintained for less than $1,300 per month.

A no-frills lifestyle can cost around $500 per month, while $4,000 per month affords luxury living. In smaller cities like Da Nang, Hoi An, Nha Trang, and Vung Tau, living expenses are even lower, with $800 to $1,100 per month providing a comfortable life, including housing, utilities, and dining out.

A budget of $3,500 to $4,500 per month in these towns allows for a lavish lifestyle with a modern villa and high-end dining. Expenses vary based on lifestyle; local groceries and dining are cheaper than Western options.

Household services, utilities, and healthcare are also affordable. For example, a two-person household in Hanoi or Ho Chi Minh City can have a comfortable lifestyle for $899 to $1,469 per month, while living in smaller cities would reduce this budget by 10% to 20%.

Additionally, expats should consider the cost of regular visa runs, which are required depending on the visa type, with trips like Ho Chi Minh City to Bangkok costing around $100.

Don’t Get Scammed Tips

Vietnam offers stunning landscapes and rich culture, but it’s important to stay alert to scams. Here are some tips to help you avoid them:

- Be cautious of inflated fares and tampered meters in transportation. Choose metered taxis from trusted companies like Vinasun or Mai Linh, agree on fares upfront, and avoid unmarked cabs. When renting motorbikes, use reputable shops, wear a helmet, and ensure you have the necessary license.

- For accommodation, book through established platforms like Booking.com or Agoda, verify addresses and reviews and be cautious of excessive deposit requests or payments outside the booking platform.

- For sightseeing, buy tickets from official counters, hire licensed guides through known agencies, and be aware of overpriced tours or fake attractions.

- When dealing with money, use authorized changers or banks for currency exchange, select secure ATMs, and inform your bank of your travel plans to prevent card blocking. Be vigilant against card skimming and currency scams.

- Learn basic Vietnamese phrases, dress modestly, especially at religious sites, and be mindful of pickpockets in crowded areas. Stay informed about common scams by reading blogs and forums.

By being cautious and informed, you can enjoy a scam-free and memorable experience in Vietnam, embracing its culture and hospitality.