![]()

CryptoFresh is a decentralized cryptocurrency exchange. Being a decentralized exchange, CryptoFresh does not require KYC (Know Your Customer) identity verification protocols to be completed for use of the exchange. US users can use the exchange for full access without restrictions.

History of CryptoFresh

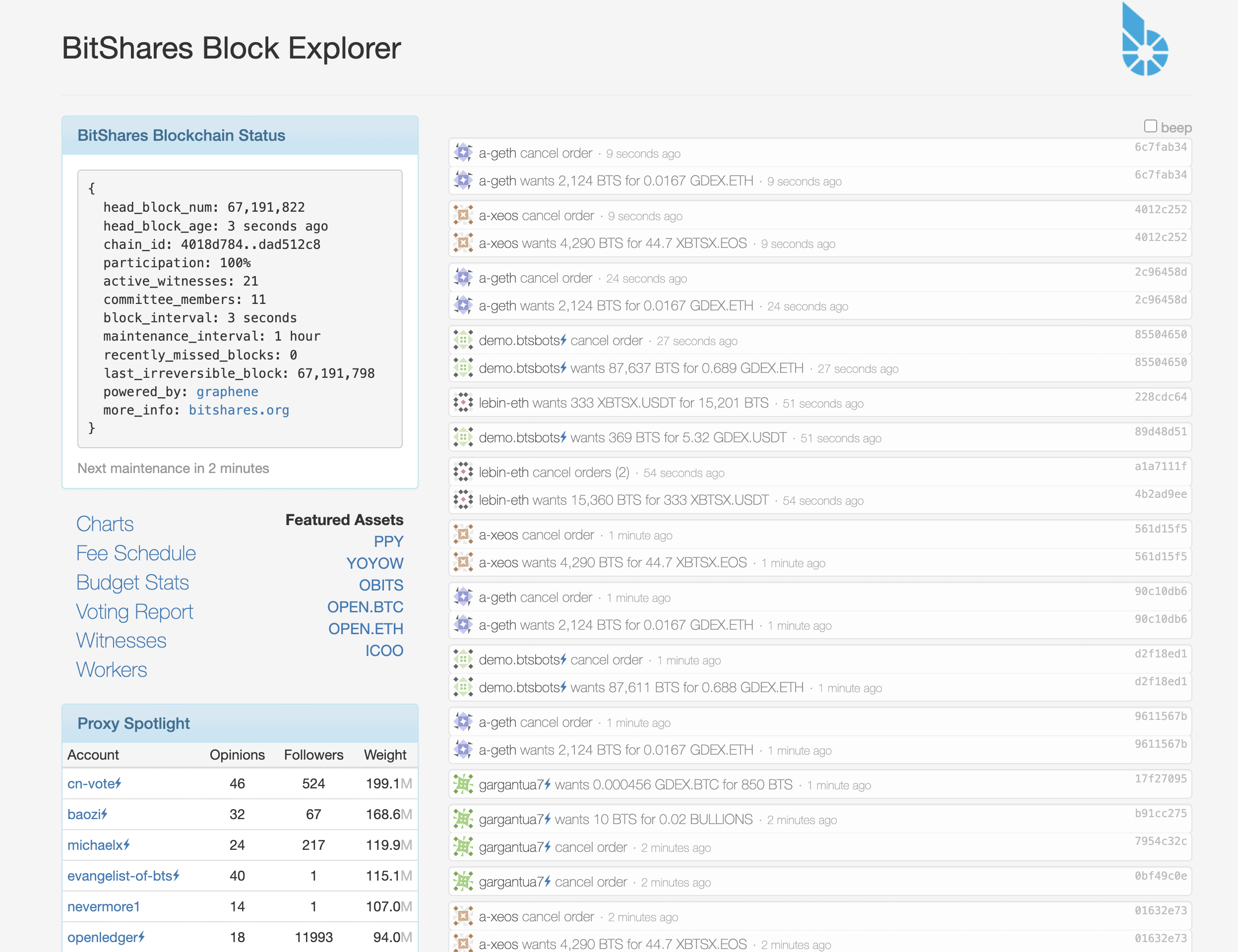

CryptoFresh was launched in 2013 as BitShares Asset Exchange. By definition, servers of a decentralized exchange or service are normally spread out over the world, or distributed. As such, CryptoFresh is not regulated but is more immune to downtime.

The creator of BitShares was Dan Larimer. Today, it is organized as a DAO (decentralized autonomous organization) and offers the same features that are found on other top DEX’s such as Uniswap or centralized exchanges such as Binance with their fiat trading pairs. Initially, Larimer presented his ideas to launch BitShares as a DEX to Charles Hoskinson, the creator of Cardano and co-founder of Ethereum.

Initially, Larimer intended to launch BitShares as a clone of bitcoin called ProtoShares, whose tokens were intended to be upgraded later to BitShares, and ran on proof-of-work consensus. However, he later changes this consensus model to a delegated proof-of-stake consensus algorithm due to the possibility of mining to allow for centralization.

Today, BitShares can process 100K transactions per second. BitShares involves the use of the native BTS coin, which is used for network activity fees or collateral.

Cryptofresh is best for:

- Advanced cryptocurrency investors and traders desiring to trade on a decentralized exchange, or DEX, without any KYC being required, while keeping custody of their funds and private keys

PROS

- No account creation

- No KYC

- Permissionless decentralized exchange

- Custom token creation

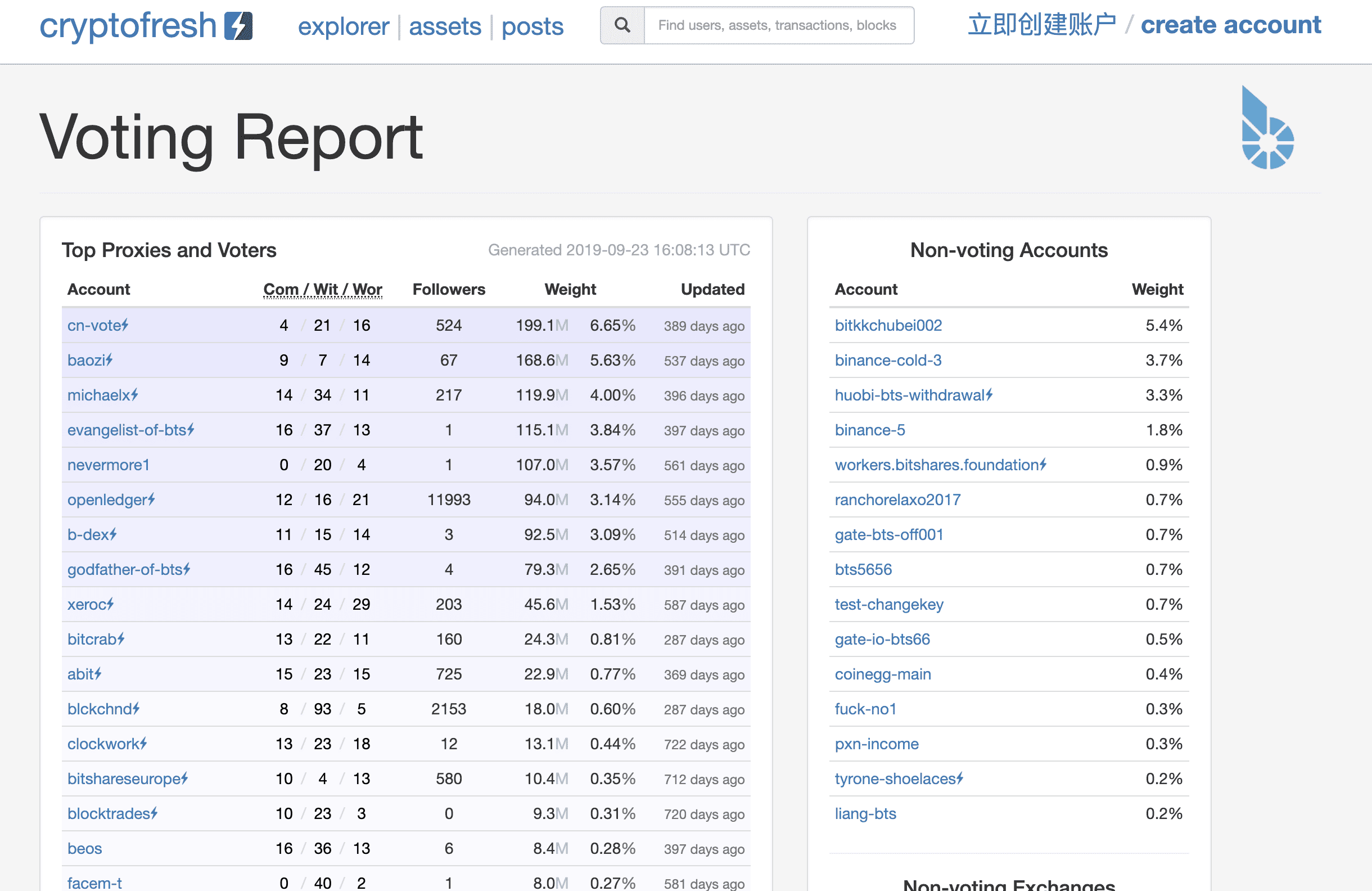

- Voting governance model

- Reserve pool

- Unlimited number of assets

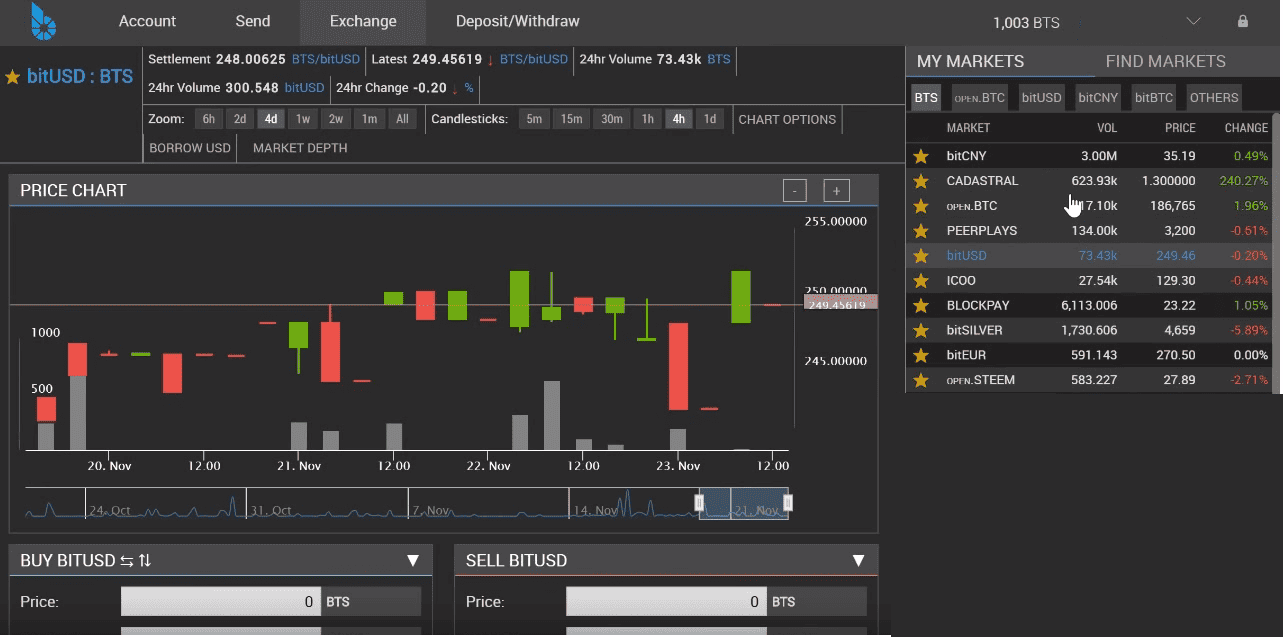

- Integrated charting with TradingView

- Advanced order types

CONS

- No official support

- Spot trading only

- Too complex for a beginner

- Not really set up for top cryptos

- UI is not very user-friendly

- Difficult fee model

- No tiered volume incentives

- Only limit orders

Pros & Unique Features

The unique features of CryptoFresh are based around it being a DEX. Firstly, the exchange requires no account creation nor KYC since users custody their own funds to use the services. Since CryptoFresh is a permissionless DEX and not a centralized exchange, users retain custody of their assets at all times, using non-custodial wallets such as Metamask.

Users of the DEX can also create their own custom tokens to crowdfund their own business or startup, for example. The DEX also supports decentralized assets or “smartcoins,” which are tokens whose price is denominated in BTS token. Anyone can borrow these and provide collateral in the form of BTS.

The exchange also functions on a decentralized governance model with voting. There is a reserve pool that stores the proceeds from transactions on the blockchain. BTS holders can make proposals to finance the project from this pool.

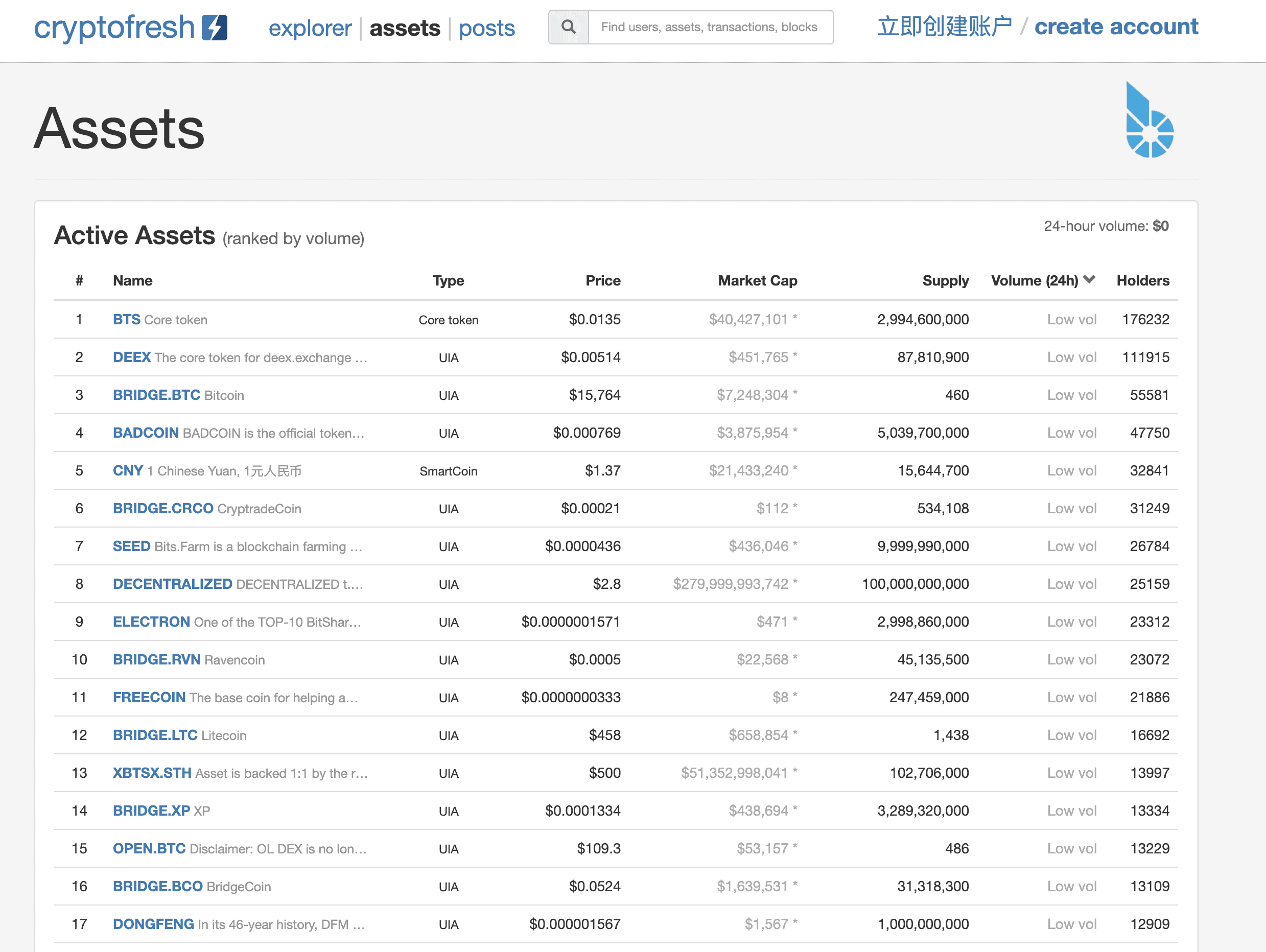

CryptoFresh offers essentially an unlimited number of assets, since anyone can make a token. Only spot trading functionality is offered, with no features for margin or futures.

Though it is a DEX, CryptoFresh still offers access to integrated charting with TradingView on its interface. There are also features for advanced order types and access to the order book on the DEX, so it functions similar to a centralized exchange, except for the custody of user assets. Due to its permissionless nature, there are no restrictions on user jurisdiction or account or trading limits.

The main benefit of using CryptoFresh will be the possibility of users to trade in a permissionless manner without registering for an account or ever losing custody of their assets. Being a DEX, users can interact with CryptoFresh directly from the browser environment, using a web3 wallet.

There is no official support since this is a DEX, but there is a forum for users to discuss happenings on the exchange.

Cons & Disadvantages

The main disadvantage of CryptoFresh is that it is far too confusing to use for a beginner or average crypto user. This is also because top cryptocurrencies are not available for trading or investing at this exchange, but rather this exchange is meant more for buying and selling various user-listed tokens that otherwise cannot be openly listen anywhere.

Secondly, since this is a decentralized exchange, or DEX, there are no extensive crypto financial services or products offered besides the actual exchange itself. The UI is not very user-friendly and charting or advanced order books functionality is nowhere near as developed as that of top exchanges like FTX, and there are no margin or futures offerings.

Active traders or derivatives traders of any kind would rather seek any centralized or possibly decentralized derivatives exchange, such as Mango Markets, or DYDX.

One other disadvantage of CryptoFresh is in its extremely difficult to understand fee model, which is denominated in its native BTS token for each and every single transaction performed, from orders to fills, instead of denominated in a maker-taker schedule.

Unlike many other top exchanges, there are no tiered volume incentives or market maker rebates or reduced fees for makers. Hence, there are no incentives for liquidity providers or for high volume traders to participate more in this exchange, while other competitors such as Binance and FTX do offer both features.

As such, there is a significant user learning curve to use this exchange. CryptoFresh only supports limit orders, so users must be able to match the orders on the order book in order to get filled. Lastly, users cannot deposit or withdraw assets in CryptoFresh, since it is a DEX and all transactions are done in a non-custodial manner using a Web3 wallet, so users will have to obtain crypto assets on a centralized exchange or via another fiat on-ramp first before using CryptoFresh.

CryptoFresh Fees

CryptoFresh charges a flat fee schedule on actions for each and every transaction on the exchange. The full fee schedule and actions that are charged can be noted here.

Additionally, unlike other exchanges, CryptoFresh does not offer any additional rebates for market makers, so it is not the ideal exchange for very high volume traders who could otherwise receive net rebates or pay 0 fees at other top exchanges.

Trading fees are incurred when an order is filled. If an order does not execute, there is no fee charged until it does execute at a later point, or it can be canceled.

Fees are denoted in the native BTS token for basic transactions, or users can pay a lifetime fee. Fees can also be toggled to USD or CNY fiat currencies. All fees and associated parameters on the BitShares blockchain are set by the committee in charge of the exchange’s governance.

BTS fees are periodically adjusted to keep them competitive in the face of fluctuation of the core token’s value. Fees paid in SmartCoins may vary. 20% of all fees are paid to the network. The rest typically goes to the service provider. Lifetime members get to collect their entire 80% remainder through the cashback program.

Other Fees

Since CryptoFresh is a DEX, it charges the following deposit, withdrawal, and other fees:

- No account creation or maintenance fee (non-custodial DEX; users do not need an account to use the DEX)

- Deposits are not needed, since this is a non-custodial exchange, users interact with the exchange using their Web3 wallets

- No withdrawals, since this is a non-custodial exchange, users interact with the exchange using their Web3 wallets

- Fees charged by the blockchain for transactions are noted in BTS, USD, or CNY

- There are many other fees for various transactions as can be noted on the full fee schedule

- Reserve percent of fee: 20%

- Network percent of fee: 20%

- Lifetime referrer percent of fee: 30%

- Cashback vesting period: 90 days

- Cashback vesting threshold: 100 BTS

- Fee liquidation threshold: 100 BTS

Account Tiers & Limits

Since CryptoFresh is a permissionless and non-custodial decentralized exchange, there are no accounts in the traditional sense as there are with centralized custodial cryptocurrency exchanges, and there are no limits on user activity or trading.

The only inherent limits are in the transaction capacity of the underlying blockchain network itself, on which transactions are carried out.

Crypto Security

CryptoFresh does not have any security issues since it is a non-custodial decentralized exchange, meaning it is not possible for CryptoFresh to lose access to user funds.

Users are always in full custody of their funds at all times while using the exchange, hence care should be taken to set up the wallet correctly, such as by ensuring the wallet private keys are never stored digitally or given to anyone in a social engineering or phishing attempt.

CryptoFresh itself cannot be hacked, and downtime is very rare, since the servers are distributed due to the exchange’s decentralized nature. There are also no reported security issues.

Transactions are subject to the risks inherent to blockchain technology, including but not limited to: smart contracts not being handled in a timely manner or transactions failing.

CryptoFresh Review Conclusion

CryptoFresh is an okay choice of exchange, but it is only for those traders seriously invested in trading in a permissionless and decentralized manner and able to get over the learning curve of using this DEX.

Since it is a non-custodial and permissionless DEX, it offers some advantages over centralized exchanges, namely in not needing an account and being permissionless, which means no KYC, and no jurisdiction restrictions. However, the learning curve to using the exchange is higher and there is no functionality for market orders, plus the fee schedule includes provisions for every single transaction done to interact with the exchange, and is extremely confusing to use and understand.

The other benefit is that the exchange is governed by its users and anyone can list an asset on the exchange to raise funds for a project or a business.

Any user looking for lending, borrowing, and staking options, from a more centralized exchange, or institutional clients looking for other features may find other competitors more valuable, especially if seeking to trade margin or futures products.

- CryptoFresh offers access to an unlimited list of (unverified) cryptos, in a permissionless, KYC-free, manner, since it is a DEX (decentralized exchange)

- Traders and investors of all types seeking all other crypto assets, margin, or access to futures and other exchange services should seek a different exchange, whether DEXes such as Mango Markets or DYDX for decentralized futures trading, or a centralized exchange for financial services and regulated trading

Other Alternatives

For customers who desire access to a more comprehensive crypto exchange that also offers a host of financial services such as staking and cashback cards, major centralized options such as Crypto.com, Gemini, Coinbase, and Binance make great alternatives, and all of these also offer verified cryptocurrencies to trade along and better reputation and security. In contrast, anyone can list a crypto on CryptoFresh but it may not be the actual asset that it is labeled.

Beginners, buy-and-hold investors, and low volume traders may prefer the easy to use features and functionality of Voyager and Coinbase with their brand presence, US regulatory approval, and security.

CryptoFresh offers only spot trading for unlimited assets that are listed on its exchange (users can sort by volume to find the likely most legitimate assets), but all of these mentioned choices may offer expanded margin trading, as well as a variety of coins.

Active traders who need access to order books and advanced charting functionality may prefer using Coinbase Pro, FTX, Binance, or KuCoin though their fee structures and product offerings differ and most exchanges on the market use maker-taker fee schedules that give volume incentives, unlike CryptoFresh.

Other decentralized exchanges that users may use with more choice of crypto assets to trade include Uniswap or PancakeSwap on Binance Smart Chain.

For customers who desire to trade and invest in stocks in addition to top cryptocurrencies and do not mind having a smaller selection from which to choose or only desire access to the top 20 cryptos on the market, Webull and Robinhood are brokers that offers US equities and a small selection of cryptocurrencies.

Other competitors to CryptoFresh include DYDX, Uniswap, and Sushiswap, amongst other DEXs.

CryptoFresh vs Coinbase

The two are fundamentally different types of exchanges: CryptoFresh is a DEX that allows anyone to create a coin or token, while Coinbase is better for many core aspects of crypto trading and products and much more palatable for the average crypto user and investor.

Both only offer spot trading, but CryptoFresh has a far more confusing (but cheaper) fee schedule, albeit a flat one without provisions for market makers or higher volume traders. An advantage for high volume traders will be the volume-tiered fees at Coinbase.

A major difference is that Coinbase is custodial (meaning users must deposit assets into an exchange account as is standard for exchanges), while CryptoFresh is non-custodial, and CryptoFresh requires no KYC, while Coinbase does.

Coinbase also offers advanced charting, accessible order books, and advanced order types, which CryptoFresh does not offer to quite the same level.

CryptoFresh vs FTX

FTX will win against CryptoFresh in every category of investing and trading, most notably for offering a wide selection of futures and derivatives trading products, as well as over 300 coins overall for trading.

Derivatives traders who want to trade margin, extensive crypto futures pairs, or leveraged tokens and options will prefer FTX since CryptoFresh offers only spot trading access.

As with the other comparison, there is a difference in asset custody as well as in KYC requirements. FTX is known for its extensive futures pairs and top-class matching and liquidation engine for advanced derivatives traders, while CryptoFresh only supports limit orders and does not have an advanced matching or liquidation engine, plus it UI is not as appealing even if compared to other DEXs like TronTrade or Uniswap.

International users who can use FTX International will prefer FTX and US users who can only access FTX US (or CryptoFresh which is permissionless) may still prefer FTX US depending on what they are seeking. Fees may be slightly more competitive at FTX as a trader’s volume is higher, since FTX offers both fee incentives for volume and for holders of its FTT token.

CryptoFresh vs Gemini

Gemini offers holistic crypto financial services and a strong spot offering, while CryptoFresh lacks in both.

The fees may be about equal for both choices, but Gemini’s fees start higher for takers at 0.35% technically. CryptoFresh fees are likely much cheaper for all users, but there is a much higher learning curve to use it, and fees are not easily understood, being denominated in BTS tokens.

Gemini offers volume incentives while CryptoFresh does not, both as far as fees go, neither platform is competitive as compared to the global crypto market offerings, but at least the Gemini brand name is regulated and compliant.

US investors and traders are allowed to use Gemini with KYC verification only, since Gemini is regulated and based in the USA, however as a result, Gemini offers no margin or futures products. CryptoFresh does not require any KYC and has no jurisdiction limits, but also does not offer any margin.

Gemini offers 62 coins compared to unlimited at CryptoFresh (but unverified coins), and Gemini offers services such as staking and a crypto credit card, while CryptoFresh is only an exchange.

CryptoFresh vs Kraken

Kraken offers margin trading at up to 5X leverage even for US investors and several other margin offerings, while CryptoFresh does not.

US users may prefer Kraken for its regulatory compliance and strong track record if they are traders especially, or they can opt to use CryptoFresh in a permissionless and non-custodial manner if they are advanced users.

Kraken uses a maker-taker fee schedule, starting at 0.16% maker fees and 0.26% taker fees at the entry level which is already more competitive than CryptoFresh’s confusing and itemized fee schedule. Market makers enjoy reduced fees however at Kraken and fees also reduce with volume, which is an advantage.

Kraken offers a greater variety of verified legitimate cryptocurrencies and pairs (over 90 coins, over 400 pairs), so users who value a large selection and advanced traders who seek margin will prefer Kraken over CryptoFresh.

If an active trader wishes to trade similar or more futures instruments and prefers not to KYC, he or she may prefer other centralized exchanges such as OKX, but if he or she prefers a much larger selection of crypto only instruments and does not mind KYC, Kraken wins. As an alternative to both, for another DEX offering futures or margin, DYDX or Mango Markets can suffice.

Kraken is accessible in 48 US states with KYC and is regulated and licensed by FinCEN in the USA, while worldwide users can access CryptoFresh without limits.

CryptoFresh vs Binance

The two options are not comparable in their scope, as Binance is the leading global crypto established exchange by trading volume, offering a much larger selection of verified and legitimate cryptocurrencies than CryptoFresh—over 351 coins and over 1300 pairs.

CryptoFresh is a DEX offering anyone to list assets for spot trading only, while Binance is a global leader and fast innovator in every crypto product.

Traders looking solely for the most advanced trading options such as high leverage margin and futures products specific to crypto only will prefer Binance, as it offers many USDT futures pairs not found anywhere else besides potentially OKX or FTX. Plus, it offers leverage and margin for KYC’d users, which CryptoFresh does not, though the one advantage CryptoFresh has over Binance is its lack of KYC or jurisdiction limits, while Binance requires KYC now even for spot trading.

Binance’s maker-taker fee schedule is unique in its competitiveness compared to that of other exchanges, starting at 0.1%, plus Binance also offers further 25% reduction in fees if paid in BNB, alongside offering reduced fee tiers for higher volume and even maker rebates. Hence, Binance easily wins in the fee and liquidity department.

Binance also offers a more extensive web and ecosystem of products, support, and liquidity, especially given its larger daily volume as compared to CryptoFresh by far. Binance is the most popular and well-known futures market in the global cryptocurrency industry and well-known for its extensive futures pairs.

The Binance exchange is not at all accessible to US persons and US customers will have to use Binance US which is a much more limited version of its global parent site, with only 64 coins and 130 pairs, which is still a better choice than CryptoFresh for almost every user, beginner or advanced, if they want a proper exchange experience.

Advanced traders and intermediate users alike who value a large selection of cryptocurrencies, products like staking, lending, and more, competitive fee structures, and futures and margin products will probably prefer Binance.

FAQ – Frequently Asked Questions

Is CryptoFresh Safe?

Yes, CryptoFresh does not have any security issues since it is a non-custodial decentralized exchange, meaning it is not possible for CryptoFresh to lose access to user funds.

Users are always in full custody of their funds at all times while using the exchange, hence care should be taken to set up the wallet correctly, such as by ensuring the wallet private keys are never stored digitally or given to anyone in a social engineering or phishing attempt.

CryptoFresh itself cannot be hacked and has reported no security issues. Thus, as long as the user knows how to safely use decentralized wallets online, CryptoFresh is perfectly safe to use.

Transactions on CryptoFresh are powered by the blockchain, and are subject to the risks inherent to the technology. Users should also be wary that anyone can list any asset on CryptoFresh, even if it is not legitimate. As such, users will need to verify the contract address and liquidity on the blockchain to ensure the asset they are buying is what it claims to be.

How long does CryptoFresh Withdrawal take?

Using CryptoFresh does not require undergoing withdrawals, since CryptoFresh is a non-custodial exchange, meaning users interact with the exchange using their Web3 wallets. As far as how long transactions can take for trades depends entirely on the blockchain, but confirmations usually take less than 10 minutes, depending on the blockchain network being used.

Is CryptoFresh a good exchange?

CryptoFresh is an okay choice of exchange, but it is only for those traders seriously invested in trading in a permissionless and decentralized manner and able to get over the learning curve of using this DEX.

Since it is a non-custodial and permissionless DEX, it offers some advantages over centralized exchanges, namely in not needing an account and being permissionless, which means no KYC, and no jurisdiction restrictions. However, the learning curve to using the exchange is higher and there is no functionality for market orders, plus the fee schedule includes provisions for every single transaction done to interact with the exchange, and is extremely confusing to use and understand.

The other benefit is that the exchange is governed by its users and anyone can list an asset on the exchange to raise funds for a project or a business.

Any user looking for lending, borrowing, and staking options, from a more centralized exchange, or institutional clients looking for other features may find other competitors more valuable, especially if seeking to trade margin or futures products.

Where is CryptoFresh located?

Since CryptoFresh is a decentralized exchange, it has no headquarters or location.

Does CryptoFresh require KYC?

No, since CryptoFresh is a decentralized exchange, it requires no KYC, since users do not need to create an account to use the exchange.

What are the Deposit and Withdrawal Methods and Fees for CryptoFresh?

CryptoFresh offers the following deposit and withdrawal methods, with the corresponding fees:

- No account creation or maintenance fee (non-custodial DEX, users do not need an account to use the DEX)

- Deposits are not needed and no deposit methods are offered, since this is a non-custodial exchange, users interact with the exchange using their Web3 wallets

- No withdrawals are needed and no withdrawal methods are offered, since this is a non-custodial exchange, users interact with the exchange using their Web3 wallets

What is the Minimum Withdraw Amount for CryptoFresh?

There is no minimum withdrawal amount since no withdrawals are conducted, being that CryptoFresh is a non-custodial exchange. Users conduct trades using their self-custody web3 wallet itself and can use that for withdrawals, without limits.

How do you withdraw from CryptoFresh?

Users do not withdraw any assets from CryptoFresh, since CryptoFresh is a non-custodial exchange. Users conduct trades using their self-custody web3 wallet itself .

Is CryptoFresh a wallet?

No, CryptoFresh is a decentralized exchange that users interact with using their non-custodial MetaMask browser extensions which custody their assets. Users retain control of their private keys and CryptoFresh offers no custody services.

How to use CryptoFresh?

Any user from any country can use CryptoFresh since it is a permissionless DEX.

Using CryptoFresh can be done by going to https://cryptofresh.com/, clicking the “Create Account” link on the top, connecting your Web3 wallet, confirming on the popup for the respective wallet, then going to Exchange and placing a trade.

Custody of assets remain with the user and all trade confirmations must happen from within the wallet the user is using.

User Reviews

- Users on Quora discuss the speed of transactions on BitShares (CryptoFresh). “In simple terms it is a decentralized exchange. You can buy many coins here and in dex transactions are super fast. If you want to sell btc, it just take secs compared to other exchanges.”

- When asked how coins or tokens get listed on BitShares (CryptoFresh), a user responds: “It depends where the Project ico want to be listed there token/coins they have a roadmap on it try to check there whitepaper and roadmap to know when the ico will be listed on exchange. I recommend you Bitxoxo is the fastest growing Bitcoin exchange in India, the main sale is live now you can check in there website.”

- Users offer their opinion on the BitShares for investing. Someone claims it as, “an abandoned project,” but they probably don’t realize it was rebranded.

- A user on Reddit asks if BitShares is still a thing. “I had Bitshares coins on openledger a few years ago. Now I cannot find my coins, Does Bitshares have a new wallet where I can access my coins?” u/ahdigital replies, “Openledger shut down all activities … Bitshares is not dead, and not to blame for OLs questionable actions.”