Binance US is a US regulated exchange launched in September 2019 that is a separate entity from its related site, global Binance, which serves only non-US persons, but is represented under the same name.

Binance US is powered by the same matching engine and wallet technologies licensed from the global Binance brand but operated by BAM Trading Services based in San Francisco, CA.

Having been referred to as the US partner of Binance, it enjoys a similar brand presence to the largest global cryptocurrency exchange by trading volume, but is a much smaller operation.

Binance US offers exchange, OTC trading, staking, and custody services to both individuals and institutional accounts in the US.

As of Q4 2021, Binance US averages around $1B USD in daily trading volume, compared to the average $60B USD in daily trading volume of Binance’s global exchange. Note that Binance US is not available in these 7 US states.

History of Binance US

Binance US has always had a close relationship with parent company Binance and its CEO & Founder, Changpeng Zhao, known as C.Z., who today is a billionaire cryptocurrency exchange owner.

Binance US was launched in 2019 when the international Binance site was banned in the US on regulatory grounds. In response, Binance and its investors opened Binance US as a separate exchange registered with the US FINCEN and opted to comply with all US regulations.

C.Z. started his career as a developer creating high frequency futures trading software on Wall Street. He founded Binance in 2017 and grew it to become the largest cryptocurrency exchange in terms of daily trading volume in the world since. C.Z. has made public comments that 100% of his public net worth is in the form of cryptocurrency. C.Z. has made a goal of opening an IPO for Binance in the US within the next three years.

Earlier in 2021, a failed $100M funding round due to regulatory concerns led to the resignation of Binance US ex-CEO Brian Brooks after just three months in office, and investors had concerns about Binance CEO C.Z.’s 90% ownership stake in Binance US. In May 2021, Bloomberg reported that Binance was under investigation by the US DOJ and IRS for money laundering and tax evasion.

The Binance US CEO today is Brian Shroder, an experienced executive and Harvard MBA with prior experience as CEO for the Asian operations of Uber and the Chinese fintech giant Ant Group.

Note that all users of Binance US are required to comply with Know Your Customer regulations (KYC) and Anti-Money Laundering (AML) laws. This means all Binance US accounts— individual or corporate— must verify their identity in order to use any feature of the exchange.

Binance US is best for:

- Investors and traders of various skill levels who desire the choice between both a simple and high-performance advanced platform for both investing and active trading with competitive fees

- Beginners to cryptocurrency who want to use a simple buy/sell interface and have the ability to dollar-cost average into the crypto market with a mobile app

- Crypto-only traders and investors (no stocks offered)

Pros

CONS

- Not available in all us states

- Less crypto pairs than international Binance exchange

- Customer service is email only

- Lack of transparency re: security

- Possible regulatory issues

- No margin trading or derivatives trading

Pros & Unique Features

The biggest perks of Binance US are its low trading fees, which start at 0.1% for both makers and takers, even before taking into account any reduced-fee discount holding BNB. This trading fee structure is markedly lower than that of Coinbase or Coinbase Pro and becomes even lower with an additional 25% discount if the user holds spot BNB in his or her account.

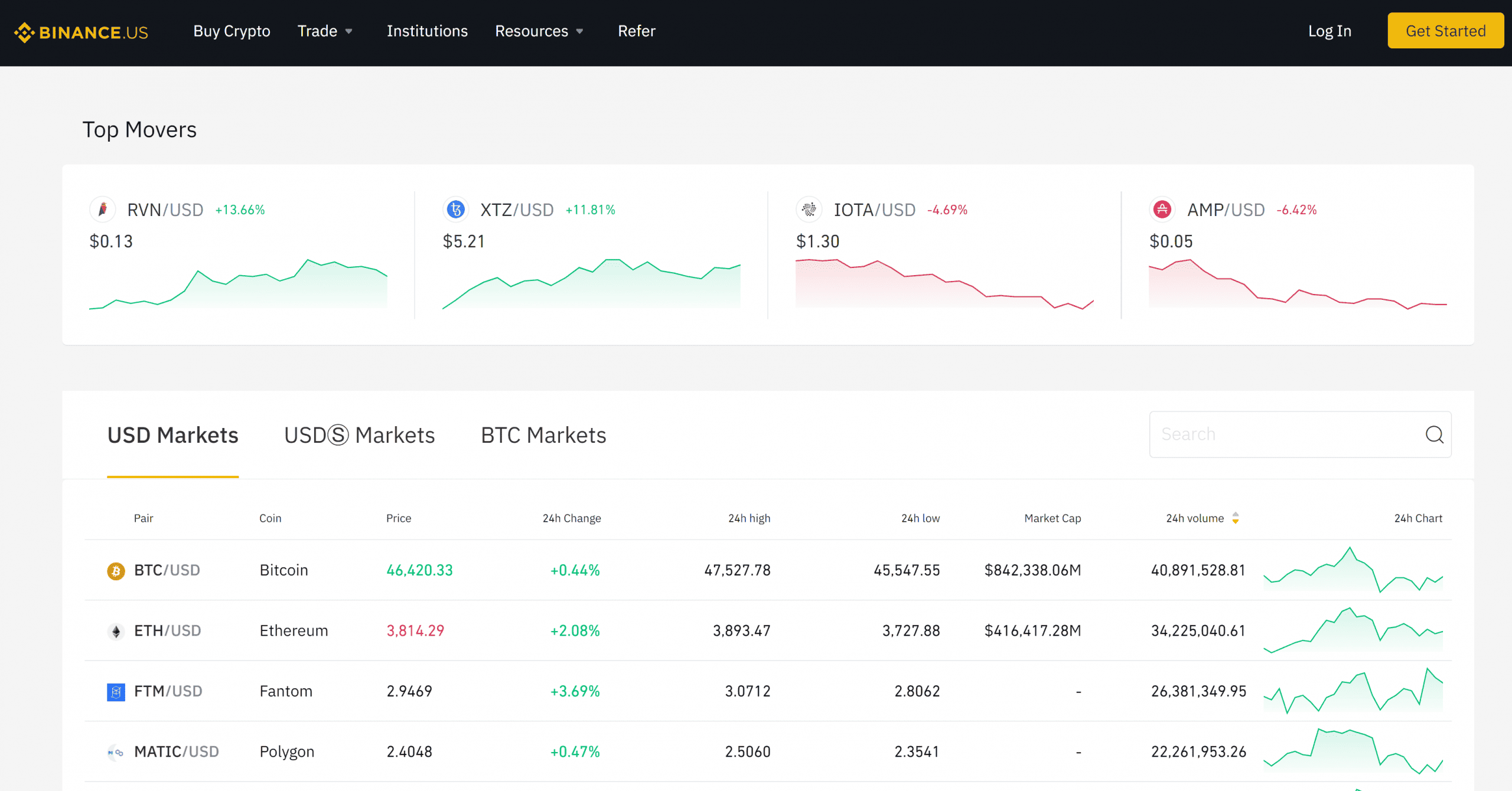

Binance US offers over 60 cryptocurrency market offerings and over 120 pairs, which is not as large of a selection as its parent international Binance exchange or competitor Coinbase, but Binance global is not an option for US persons to use, and exchanges require full KYC as of Q4 2021 due to the regulatory environment.

Binance US offers a slick, easy-to-use user interface with high-speed trade execution and liquid orderbooks, similar to parent company Binance, and a functional mobile app that offers full buy and sell features, plus the ability to place recurring buy and sell orders for investors to be able to practice dollar cost averaging.

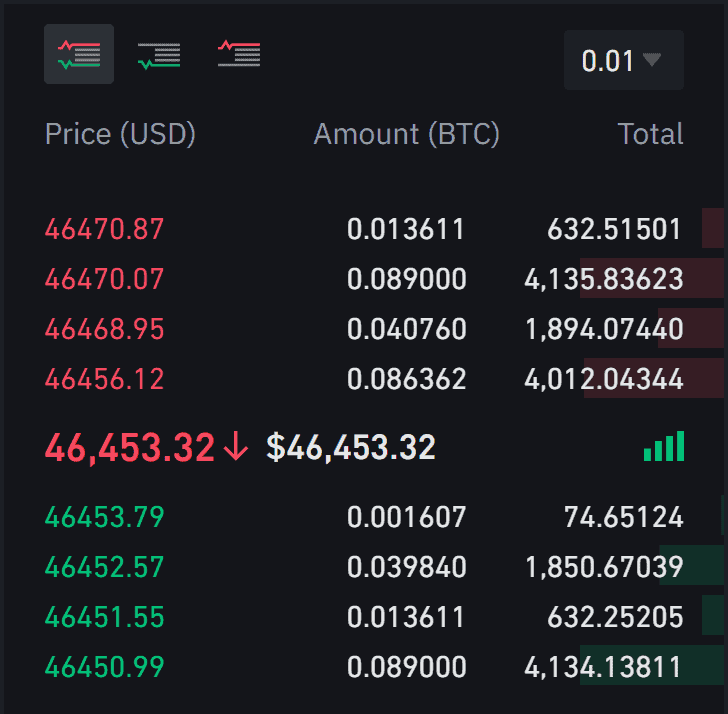

Binance US also offers an advanced trading portal with multiple order types and an order book. Both the basic and advanced trading platforms use the same technology as the parent global Binance site. The exchange also partners with Trust Wallet as a third-party hot wallet option for self custody of assets, to which users can withdraw their coins.

A fee-free OTC Trading Portal for larger traders is available, as are staking services, offering anywhere from 1-10% rewards as of 2021 depending on the blockchain and protocol being staked.

Binance US also offers a white-glove Institutional exchange solution for hedge funds, family officers, VCs, corporate treasuries, and other institutional participants.

Binance US also offers use of the BUSD stablecoin, a 1:1 pegged USD-stablecoin part of the Binance ecosystem. BUSD is a US-regulated stablecoin approved by the NYDFS and issued by Paxos, fully backed by US dollars, the value of which is always equivalent to 1 USD. BUSD can be used as a medium of exchange, store of value, method of payment, and as a base for cryptocurrency pairs to trade.

Cons & Disadvantages

One major disadvantage of Binance US is the fact that it is unavailable to use in these 7 US states, while major US competitor Coinbase is available in all US states except Hawaii.

Binance US also offers fewer crypto-to-crypto pairs than the international Binance exchange, so users will have to exchange their crypto assets into stablecoins first before transacting to other cryptocurrencies.

Binance US customer service is email only as of 2021. One other caution US users may have with Binance US is its lack of transparency as compared to some competitor exchanges in regards to security, storage, and customer service options.

Given that Binance US is a partner of Binance global, which has a history of regulatory scrutiny in the US, UK, and other countries, more conservative minded investors may not feel comfortable using Binance US until there is clear transparency between the regulatory environment regarding Binance global.

Note that Binance US does not offer any margin trading access or other derivatives trading products, while its affiliate Binance global is famous for its high leverage cryptocurrency futures instruments, leveraged token, and margin trading. US traders looking for margin trading capabilities will have to seek competitors such as Kraken or FTX US.

Binance US Fees

Binance US charges a minimum 0.1% spot trading fee and a 0.5% instant fee for buying and selling cryptocurrency for traders in a hurry. For higher volume tiers greater than the standard tier, Binance US also uses a maker-taker fee model like many other exchanges do to determine trading fees.

Taker fees are charged on market orders that are filled immediately (takers of liquidity from the market), and maker fees are charged on orders that are not filled immediately but rather are placed in the orderbook as limit orders (making the market liquidity).

Market orders are always charged taker fees since they take volume from the orderbook, while limit orders are always charged maker fees since they add liquidity and volume to the orderbook. For Binance US, if an order goes on the order book partially or fully (a maker order), any subsequent trades coming from that order will be as a “maker.”

Trading fees are determined based on a user’s trading volume over a 30-day period (in USD) and the user’s daily average BNB balance, including BNB held in the primary Binance US account as well as any sub-accounts within the account. The mechanism to track the user’s daily BNB balance can be found here. Using BNB inventory to pay for fees can be toggled on or off in the account settings, with only the toggle “on” setting qualifying the user for the BNB-fee discount. If there is not enough BNB present in the user’s account to cover the fees, then 100% trading fees are applied.

The unique fee schedule Binance US uses offers 25% off of the standard fee schedule if the fees are paid in BNB (Binance Coin).The table below shows the tiered fee structure for both the standard fee schedule and the fee schedule reduced by using BNB to pay fees.

Binance US Trading Fees Based on Trading Volume (30 Day Trailing Period)

| Level Name | Tier (30d Trade Volume in USD) | BNB Balance | Maker Fees | Taker Fees | Maker Fees (BNB Used) | Taker Fees (BNB Used) |

|---|---|---|---|---|---|---|

| VIP 0 | <$50K | OR ≥ 0 BNB | 0.10% | 0.10% | 0.075% | 0.075% |

| VIP 1 | ≥ $50K | AND ≥ 50 BNB | 0.09% | 0.09% | 0.0675% | 0.0675% |

| VIP 2 | ≥ $100K | AND ≥ 100 BNB | 0.08% | 0.09% | 0.06% | 0.0675% |

| VIP 3 | ≥ $500K | AND ≥ 200 BNB | 0.07% | 0.08% | 0.0525% | 0.06% |

| VIP 4 | ≥ $1M | AND ≥ 400 BNB | 0.05% | 0.07% | 0.0375% | 0.0525% |

| VIP 5 | ≥ $5M | AND ≥ 800 BNB | 0.04% | 0.06% | 0.03% | 0.045% |

| VIP 6 | ≥ $10M | AND ≥ 1500 BNB | 0.00% | 0.06% | 0.00% | 0.045% |

| VIP 7 | ≥ $25M | AND ≥ 2500 BNB | 0.05% | 0.05% | 0.00% | 0.0375% |

| VIP 8 | ≥ $100M | AND ≥ 4000 BNB | 0.02% | 0.04% | 0.00% | 0.03% |

| VIP 9 | ≥ $250M | AND ≥ 6000 BNB | 0.00% | 0.03% | 0.00% | 0.0225% |

| VIP 10 | ≥$500M | AND ≥ 6000 BNB | 0.00% | 0.02% | 0.00% | 0.015% |

Other Fees

Binance US charges the following deposit and withdrawal fees:

- Direct bank (ACH) deposit and withdrawal are free

- Domestic Wire deposit fee is free. Domestic wire withdrawal fee is $15, or $35 for international wire

- Debit Card fee of 4.5% for deposit

- Credit card purchases are not allowed

- Withdrawal fees for crypto assets differ based on the blockchain network used and the asset in question

- All deposit fees for crypto assets are free

There are no fees for signing up or for having an inactive Binance US account, nor any fees for holding funds in a Binance US account, and users may hold assets as long as desired. There is a $10 trade minimum. Minimum trade amounts and maximum market order amounts are stated here.

Account Tiers & Limits

For new accounts at Binance US, following the completion of USD verification, users can send an initial ACH deposit of up to $5000 which can be traded immediately, but USD deposits are held for a certain number of days before the user can withdraw them.

After a period, based on the user’s deposit activities and history, the ACH deposit limit is increased up to $50,000. Deposit limits for bank wires are $1M with no holds, and withdrawal limits go up to $7.5M via bank wire.

Crypto Custody and Safety

Binance US can improve upon transparency in regards to their security protocols for user accounts and funds. The exchange website claims to use “state-of-the-art storage technology to protect your cryptocurrency and USD assets.” However, there is no publicly available information regarding the percentage of assets held by Binance US in secure & offline cold wallets vs. what percent are kept in online hot wallets.

The exchange offers 2-factor authentication and as of Dec. 2021 Binance US has suffered no major hacks. Binance global has suffered one hack in the amount of $40M in 2019 but reimbursed all investor losses.

All USD cash balances stored in users’ Binance US accounts are held at custodial bank accounts and insured up to $250K for bank failure by the FDIC. Unlike stock brokerages, cryptocurrency exchanges like Binance US are not covered by the SIPC which protects investors for up to $500K in total cash and securities loss in case of brokerage failure, unauthorized trading, or theft.

Binance US Review Conclusion

- Binance US is a good choice of exchange for beginner and intermediate US-based market participants and traders who value low and competitive trading fees with the option to pay in BNB for an additional 25% fee reduction and are not concerned with the exchange’s links to Binance global.

- Binance US offers an acceptable amount of cryptocurrencies, along with giving investors the ability to utilize the power of recurring buys long term to build their crypto portfolio. They use the same high-quality and performance matching engine and wallet technologies used by parent exchange Binance global.

- With a competitive tiered- and reduced-fee structure, Binance US trading fees compete favorably with other US competitors such as Coinbase Pro but cannot compete in the number of cryptocurrencies offered as compared to Coinbase Pro or KuCoin

- Advanced traders who are familiar with the Binance brand and desire a US-regulated option may prefer to use Binance US given it uses the same matching engine, UI, and wallet technology as Binance global for high-performance advanced trading capabilities

- Customers who desire advanced features such as margin trading may prefer to use competitors such as FTX US and Kraken, and clients who are concerned with the regulatory scrutiny of Binance global and the lack of transparency Binance US has in regards to custody of customer assets may prefer to use a much more established US exchange such as Coinbase or Coinbase Pro

Other Alternatives

For customers who value access to a greater range of cryptocurrency selections with the opportunity to use margin trading, Kraken and KuCoin make great alternatives, as well as FTX US if a large selection is not a concern.

Beginner investors and traders may prefer the easy-to-use features and functionality of Coinbase with its brand presence and extensive cryptocurrency education that even provides the chance to earn free cryptocurrency for learning.

Coinbase is best designed for buy-and-hold investors or casual to intermediate cryptocurrency users, while active traders who need access to view depth of market such as order books and charting functionality will prefer using Coinbase Pro, FTX US, KuCoin, or Kraken.

Advanced traders who prefer the most liquid exchange order books with aggressively reduced maker taker fees for larger volume tiers may prefer FTX US.

For customers who are fans of the Binance brand and reduced-fee structure from holding BNB, the international Binance exchange offers arguably the most extensive cryptocurrency spot and futures instruments selections, along with the same high performance matching engine, advanced trading functionality, and wallet technology as Binance US, given Binance is the parent company from whom the technology is licensed. However, users will need to be located outside of the US and as of Q4 2021, perform KYC and prove they are not US persons in order to use Binance internationally.

For customers who desire to trade and invest in stocks in addition to top cryptocurrencies and do not care about having a smaller selection from which to choose or only desire access to the top 20 cryptos on the market, Webull is a broker that offers US equities and cryptos.

Other US competitors to Binance US include Gemini and Crypto.com.

Binance US vs Coinbase

The main advantage Binance US offers over Coinbase is its markedly lower fee schedule along with the option for a further 25% fee reduction which makes it an extremely competitive option in the face of Coinbase’s high fees, whose fees start at 0.5% for both markers and takers for the lowest fee tier, while those of Binance US start at 0.1% for both makers and takers.

Both exchanges offer the option of advanced charting and crypto-to-crypto trading pairs.

Coinbase is a public US company and offers more transparency into its industry-leading security along with its brand reputation, while Binance US is a much newer exchange with ties to Binance global which may concern some conservative investors.

Ultimately, advanced users who desire similar competitive fees to what Binance US offers but less than Coinbase Pro offers will find the choices below more valuable.

Binance US vs FTX US

Binance US and FTX US are the most competitive options for low trading fees for US-regulated exchanges. While both offer similar maker fees without taking into account the 25% fee reduction Binance US offers for paying fees with BNB, Binance US offers much lower taker fees with a more rapid decrease as trading volume increases. When taking the 25% fee reduction into account, Binance US has even lower trading fees overall than FTX US.

Binance US and FTX US both offer OTC portals for larger traders, and both exchanges also offer advanced trading and charting platforms that are comparable for advanced traders.

Binance US offers over 60 coins and 120+ pairs which is a broader selection than that of FTX US which offers 24 coins and 53 pairs.

Binance US vs Gemini

Binance US is a much better choice than Gemini if considering trading fees. The minimum fee tier at Gemini starts at 0.35% for takers and 0.1% for makers, with a flat transaction fee between $0.99-$2.99 and 1.49% transaction fee for trades over $200. Binance US in contrast offers not only fee-reductions for paying fees in BNB, but also offers much lower base fees for both makers and takers with more volume.

Both Binance US and Gemini offer staking services that allow users to earn interest on their holdings.

Binance US vs Kraken

Kraken offers margin trading to high net worth investors at up to 5X leverage in the US which is an additional offering over Binance US which does not offer margin trading.

Kraken also uses a maker-taker fee schedule, starting at 0.16% maker fees and 0.26% taker fees at the entry level which is not as competitive as the fee schedule for Binance US even before taking into account the fee reductions offered by Binance US.

Kraken also offers a large variety of cryptocurrencies and pairs (93 coins, over 400 pairs), so users who value a large selection and advanced traders who seek margin may prefer Kraken but sacrifice the possibility of slightly more competitive fees.

Binance US vs KuCoin

KuCoin is another established exchange available to US persons, offering a large selection of cryptocurrencies— over 550 coins and over 1000 pairs, which is the most extensive selection on this list. The KuCoin brand is well-known in the industry, and many coins offered are coins that are hard to find on many other exchanges. KuCoin is friendly for both beginner users and active, advanced traders alike.

KuCoin also offers margin trading in the USA for qualified individuals while as noted, Binance US does not.

KuCoin even offers rebates to market makers for the highest levels of volume while Binance US does not offer rebates but does offer fee reductions for fees paid in BNB. Fees at Kucoin start at 0.1% for makers and 0.1% for takers at the lowest volume tier, which is equivalent to Binance US’s entry level maker-taker fees, unless fee reductions are used, bringing them slightly lower.

In short, advanced traders and intermediate users alike who value a large selection of cryptocurrencies, an established brand like KuCoin, and the chance to use margin with very competitive fee structures will enjoy using KuCoin exchange.

User Reviews

- A Reddit user, u/SilviusWolf, asks “if anyone could shed some light on why binance.us app has such bad reviews?” They’re especially interested in the supposed delay in getting verified, which returned mixed responses; some people took a month to be verified, others only took a day or two. But, Binance.US isn’t the only CEX to have long wait times for verification.

- Not only do users report a long wait to obtain KYC verification, they also express concern over not being able to withdraw their funds: “…the system comes up with all these glitches why you cant withdraw your money….”

- But, u/isgoodforwhatailsyou claims they’ve had exactly no bad experiences with any of this: “Literally am I the only one who has absolutely 0 issues with binance.us? Literally got verified the same day I applied, I have been able to transfer deposit and receive without any problems at all lmao. Working great here.” They are not. u/loki348 says, “I was able to link a bank account and buy crypto within days. Is it just me or do most of the bad reviews seem to be posted by bots plugging people’s Instagrams?”

- u/DJ_Wristy suggests that using Binance global with a VPN is far superior to switching to Binance.US: “With the ease of accessing Binance.com with a VPN, and the greater features, markets, liquidity etc available there, has anyone else actually bothered to use the US version?” While u/InSearchOfGreyPoupon claims they were “Using it currently. Pretty painless to use. May have to leave Coinbase entirely.”

- u/ssv37 complains of the volume being so low on Binance.US that it isn’t worth using: “binance.us is trash.” A counter to this is provided by u/maxito98: “Yeah i use BinanceUS basically through process of elimination. Kraken doesn’t support ACH, and Coinbase is…well…Coinbase.”