Today we’re going to explain what degen yield farms are and what you can do if you experience one but before we go off into the deep end we need to explain some concepts that’ll help you understand it a little better.

Let’s dig in.

What is a Yield Farm?

First off you need to understand what exactly a yield farm is.

A yield farm is a decentralized application that runs on a blockchain network that allows you to deposit your cryptocurrency coins and tokens in hopes that you earn free coins as interest.

Many people earn a lot of money this way, in fact. We actually have an entire article on what Yield Farming is, you should check it out. In it, we mention 4 other, safer yield farm methods. However, we said at the end there was a 5th version that was essentially gambling… well… this is the 5th method.

In short, there are many ways to earn free crypto, but usually the safer it is, the lower amount you’ll earn. When it comes to these “degen” yield farms, the risk is very high, however so is the reward.

Some farms have paid out 4-5% an hour in the first few hours, and then up to 2% a week for a few weeks. Receiving 50% of our investment in a few weeks is not unheard of. Compared to the stock market, this is easy money.

For reference, “degen” refers to degenerate, which you should keep in mind for the rest of the video.

Farm Token

So now that you know why people would try a degen yield farm, let’s go over how they work.

Almost all degen yield farms create a new token to give out, this is called their farm token. This token has no real value, but the people who start the yield farm will put up an initial deposit of money. This money is added to a liquidity pool so that people can actually buy the token and to set its initial price.

For example, if they wanted to set the initial price to $1, they would simply put in 1 farm token, and $1 and then let people trade using the liquidity pool. However, if they wanted to set the price to $10, they would put in 1 farm token and $10. Even more so, if they wanted the price to be $10, they could also put in 100 tokens and $1000.

You get the idea. Since they can print however many of these tokens they want, they can essentially set the initial price of the token to whatever they want.

To new investors, this can be tricky. This is the first thing to look out for in a yield farm—if the liquidity is very low, it means even the developer doesn’t believe in the project. Also, having low liquidity means that the price is very volatile.

As an example, if a developer put in $1 and 1 token into their liquidity pool, I could double, triple, even 10x the price very simply by spending less than $100.

Tokenomics

Before the degen farm launches, they always have a presale. This is when people can buy their farm tokens and deposit their tokens into the farm so they don’t have to wait for the launch.

The farm always offers the best rewards for those that stake the farm token. Why? This is the only reason to buy the farm token—to put it back into the farm to earn the highest rate.

A safer way to farm is to deposit a token you believe in, for example ETH. The way these farms—which are actually pyramid schemes—work is they pay you in the farm token. Since they essentially can print as many farm tokens as they need, they use the temporary price to set the temporary Annual Percentage Rate (APR).

Now hopefully you get the idea. You deposit ETH, you earn Polywhale (Polywhale is a famous degen yield farm that lots of people have invested in). Nobody really wants to buy polywhale as a long term investment, instead they want ETH or USDT or MATIC—something they truly believe in long term or can cash out easily.

So, many farmers deposit their ETH, and once the farm launches, it starts printing out the farm token and literally giving these newly minted tokens to the people who deposited. The more you deposit, the more farm tokens you receive.

Infinite Printing

You might be wondering, since they are essentially printing a TON of the farm token, doesn’t the price fall? Yes. Always, the price falls.

Since they are always printing more, the price will always fall. Why? Because there will be really smart farmers who understand how it works and will immediately sell their useless farm token for a valuable token like ETH or BNB or MATIC.

In short, smart farmers try to sell their farm token as fast as possible, and these smart farmers can have hundreds of thousands of dollars, which means they can drop the price very quickly.

Speaking of that, I was invested in one to test how they worked and the price rose and fell before I even finished my lunch with Neiko. I was lucky enough to get my funds out before they yanked the liquidity and ran away with a ton of other investor’s money.

4% Fee

Now, you might also be wondering “Why would someone start this farm if they don’t benefit? They are even putting up front money to start the farm.”

This is where the deposit fee comes in. When you deposit any token other than the farm token to stake, almost all farms take a 4% deposit fee. This means if you deposit $100 of ETH to the farm, they’ll immediately take $4.

This doesn’t seem like much, but the most popular degen yield farms have between $100,000 and $4,000,000 worth of tokens staked, which means that 4% quickly becomes profitable. This also means that people have to keep their money in the farm longer just to break even.

A pyramid scheme or ponzi scheme is any business where to grow, they must continue to take money from new members and give it to the people who got in first to give them a false sense of security and success.

Degen yield farms smell very similar. ANY money that you earn from a degen yield farm is probably and definitely the 4% fee that someone else has deposited after you.

The developers claim to use this 4% deposit fee to advertise, to develop, and to add to the liquidity, but in the crypto world, these are just promises. In truth, many people lose money in degen yield farms, and many farms are scams.

In the crypto world, a “rug pull” is when a project is abandoned by it’s developer and the money is stolen, you can check out our article on rug pulls for more information, but rug pulls happen often in these farms.

Now, at WhiteboardCrypto, we take responsibility very seriously. We want our channel to stay 100% educational and not advice or suggestions. So we can’t tell you not to invest in these degen yield farms, morally for the channel, or legally for our wallets.

What we can say though, is that we personally are not going to touch these farms with a 10 foot pole. To us, the evidence is overwhelming that they are essentially high-risk gambling in the crypto world.

Token to 0

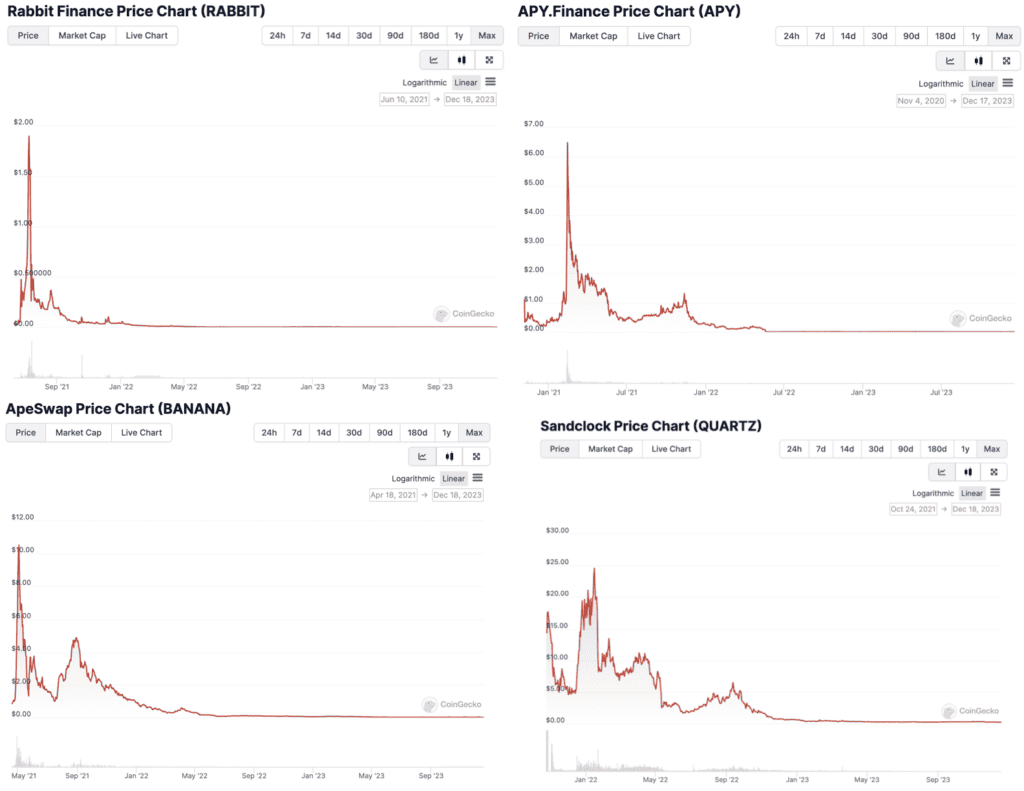

We also want to show you what happens to almost any degen yield farm token. A lot of people go, “Oh look at how much it has risen before launch… I should buy it.”

Or, “this farm has a lot of money locked into it, maybe it’s a good project, I’ll buy the token.” If you want to look at what a bunch of past farm tokens have done historically, check out these images.

They always go to 0. This is because they keep printing more and the people earning them simply want to trade them for a valuable token to get their 4% back.

Just like any good parents who tell their children not to drink, we know you are curious and may want to try it. My dad once told me, “If you ever need a ride, just call—even if it’s 2AM and you think you’ll get in trouble, I’d rather have you home safe than in a ditch.”

We want to offer you the same help. There is a tool out there called the Rug Doctor. It is a compilation and review service of these degen yield farms. The creator actually goes through and reads the smart contracts to attempt to offer help for any humble yield farmers out there.

Another tool out there is called VFat. It allows you to interact with the smart contracts if the website goes down for any reason—their host could have an outage, they could have taken the site offline, or maybe lightning struck a server that didn’t allow you to view the website.

VFat keeps track of the smart contracts so you can actually interact with the blockchain portion of the degen yield farm without needing to access the website.

One of the very first rug pulls was where a developer would launch a farm with a website, and then simply take the website offline and do a few other tricks to steal investor’s money. The VFat website helps you mitigate against this, a very helpful tool.

Conclusion

As we find more and more helpful tools, we’ll continue to share them on this site.

Now that you hopefully know what a degen yield farm is, and how it works, we must come to an end in this article. Leave a comment below if you know any helpful crypto tools that we haven’t mentioned, we’d love to share them here on the site and give you credit for sharing!

Lastly, we hope you enjoyed this article, we hope you learned something, and most importantly, we hope to see you in the next article!