Bittrex is one of the largest US cryptocurrency exchanges and was founded in 2014 in Seattle, WA. Bittrex provides one of the largest selection of cryptocurrencies in the US today, along with fast trade execution, dependable digital wallets, and uses industry-leading security.

As of Q4 2021, Bittrex averages around $100M USD in daily trading volume, offering over 450 coins to trade, and serves both US and global customers.

Bittex requires all users to complete KYC (Know Your Customer) identity verification to comply with regulatory laws and is available to use for US investors in 40+ states, excluding New York, Nevada, and a few others.

History of Bittrex

Bittrex was founded in 2014 in Seattle by three cybersecurity engineers from Amazon, Bill Shihhara, co-founder and CEO, Richie Lai, co-founder and CIO, and Rami Kawach, co-founder and CTO. The three executives are also alumni of Microsoft.

The Co-Founder and CEO also served as the Manager of Security Threat Analysis and Security Engineering at Blackberry in the past where he drove anti-malware and security automation strategy. The other co-founders also have extensive experience in threat intelligence, security engineering, and internet crimes, which help them prioritize security in development decisions.

In 2015, Bittrex applied for a New York State Bitlicense, but the application was rejected in 2019 by the New York State Department of Financial Services due to what the NYDFS claims was Bittrex’s deficient customer identification program, which Bittrex management denied. Bittrex uses a self-regulatory model called the Transaction Systems Based on Trustworthy Technologies Act (“The Blockchain Act”) which is still awaiting regulatory approval. Due to this, all customers must undergo strict KYC and AML procedures.

In 2019, Bittrex updated its trading engine to make the platform up to 20x faster, more scalable, and enable support of new features and upgrades like USD and EUR markets. It also launched the international brand of its exchange, Bittrex Global, based in Liechtenstein. Since then, the exchange operates two separate platforms that share liquidity. The core Bittrex exchange focuses on serving US customers, while Bittrex Global focuses on its international user base.

Today, Bittrex’s mission is to help advance the blockchain industry by fostering innovation, incubating new and emerging technology, and driving transformative change.

Bittrex is best for:

- Investors and traders of all skill levels who desire an easy-to-use, highly secure exchange that is compliant with US regulations, offers high volume and liquidity, and a fully functional mobile app as an online platform with advanced charting for only spot investing and trading

- Beginners to cryptocurrency and US investors who do not need advanced margin and futures trading options, but rather prefer a simple buy/sell interface and desire the ability to dollar-cost average into the crypto markets, with one of the wider selection of coins available to US traders

- Crypto-only traders and investors who wish to get access to the entire Bittrex suite of products including the OTC desk, staking services, custom-built highly fast and scalable trading engine, and API services for the use of trading bots

PROS

- Serves US residents

- Large selection of crypto and trading pairs

- Focused on security

- Mobile and browser friendly

- OTC trading portal

- Staking services

CONS

- No margin trading or leveraged futures

- No rebates to makers

- Average fees

- KYC required

Pros & Unique Features

The biggest perks of Bittrex are its service to US investors, large selection of listed cryptocurrencies and trading pairs compared to other US competitor exchanges, and its focus on security and trade execution with a custom-built trading engine that is highly scalable and fast to meet demand.

Bittrex offers over 463 cryptocurrency market offerings and over 1030 pairs, which is a much larger selection as compared to other exchanges that also serve US customers, such as Binance US and FTX US.

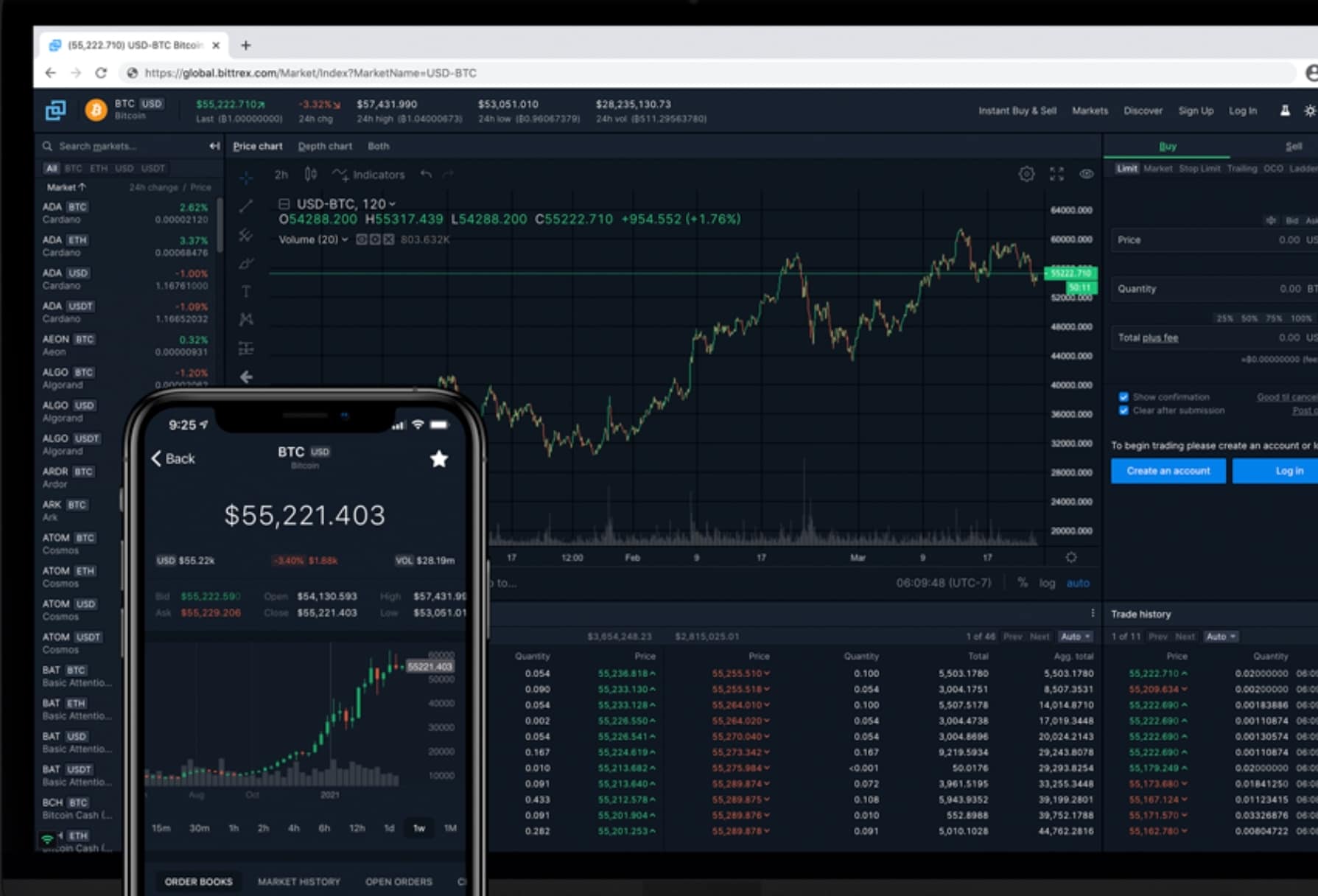

For investing and trading, Bittrex only offers spot trading. There are no margin or leverage trading offerings available. Customers can trade, perform instant buy and sell, participate in automated trading via API services, and offers advanced charting tools for advanced traders.

Bittrex also offers an easy-to-use user online and mobile app interface with full buy and sell functionality suited for all ranges of traders and buy-and-hold investors, without compromising on transaction speeds, security, or uptime. The mobile app also offers the convenience of having a digital wallet on the user’s phone.

Other products offered by Bittrex include an OTC portal for traders wanting to make a large purchase or sale of several cryptocurrency offerings with guaranteed pricing for large trades, reduced customer price risk, and quick trade execution without disrupting the order books.

Bitrrex also offers staking services for select cryptocurrencies including ADA (Cardano) while allowing users to trade while they stake. There are no other extensive ecosystem of products Bittrex offers, instead preferring to focus on these noted product offerings.

As for customer support, Bittrex offers support tickets users can leave or live chat, either online or through the mobile app, or via Slack, Twitter, and Facebook. US users will enjoy using Bittrex due to its compliance with US regulations, high trading volumes, security, user-friendly platform, and competitive trading fees.

Cons & Disadvantages

The main disadvantage of Bittrex is that its ecosystem of products and crypto financial services is nowhere near as extensive as those of Binance, FTX, or Crypto.com. Bittrex does not offer any margin trading or leveraged futures trading products, and only offers spot trading.

Bittrex also offers no fee rebates to makers, but fees are “middle of the road” when compared to other exchanges, but not as low as those of Binance or KuCoin.

Since Bittrex is a US-based exchange, all users are required to complete KYC identity verification, with no exceptions and advanced traders seeking non-KYC trading or leverage and margin will need to trade on other exchanges.

Bittrex users who are not located in approved US states may not deposit USD into their account and trade USD pairs, but they may trade the USDT, BTC, and ETH markets and deposit cryptocurrency into their accounts.

Though some US investors may prefer the peace of mind and reduced regulatory risk that comes with using a compliant US exchange, users who wish to transact without KYC may opt to use competitors like KuCoin or FTX, thereby gaining access to a much wider selection of trading instruments such as margin and futures.

Bittrex Fees

Bittrex uses the common maker-taker model to assign the fee schedule with volume-based incentives based on the user’s trailing 30-day USD trading volume. Trading fees are incurred when an order is filled by the exchange’s matching engine. If an order does not execute, there is no fee charged until it does execute at a later point, or it can be canceled.

Taker fees are charged on market orders that are filled immediately (takers of liquidity from the market), and maker fees are charged on orders that are not filled immediately but rather are placed in the orderbook as limit orders (adding to the market liquidity).

Market orders are always charged taker fees since they take volume from the orderbook, while limit orders are always charged maker fees since they add liquidity and volume to the orderbook.

The table below shows the tiered fee structure for the standard fee schedule and can also be found here.

Bittrex Fee Schedule Based on 30-Day Trading Volume (USD)

| 30-Day Volume (USD) | Maker Fees | Taker Fees |

|---|---|---|

| < $25K | 0.35% | 0.35% |

| $25K-$50K | 0.25% | 0.30% |

| $50K-$100K | 0.15% | 0.25% |

| $100K-$1M | 0.10% | 0.20% |

| $1M-$5M | 0.06% | 0.16% |

| $5M-$10M | 0.05% | 0.15% |

| $10M-$60M | 0.02% | 0.10% |

| $60M-$100M | 0.00% | 0.08% |

| $100M+ | 0.00% | 0.05% |

Note there are no rebates or other fee discounts.

Other Fees

Bittrex charges the following deposit, withdrawal, and other fees:

- No fees are charged for USD deposits and withdrawals, but the user’s bank may charge a fee to send or receive a wire transfer. Other supported fiat include EUR and other transfer methods supported include SEPA

- No fees charged by Bittrex for blockchain deposits, but the blockchain network being transacted on may charge a fee which cannot be avoided

- Each coin or token has a network transfer fee that Bittrex charges a small amount for to cover said fee. The fees are clearly shown upon requesting a withdrawal.

- Bittrex Referral program: the referral percentage given is 10% of all commissions for sharing one’s referral code

- Debit card purchases are supported for approved states in the US via Visa or Mastercard, with a 3% processing fee

There are no fees for signing up or for having an inactive Bittrex account, nor any fees for holding funds in a Bittrex account, and users may hold assets as long as desired.

Account Tiers & Limits

Bittrex requires KYC identity verification for all users to fight financial crimes and remain AML compliant for US customers. The maximum withdrawal value for all accounts is the equivalent of 100 BTC per 24 hour period.

Bittrex implements a 10 calendar day withdrawal holding period for any deposited funds, cryptocurrency or fiat for all newly created accounts for wire transfers and debit card transactions, to protect vulnerable customers from bank and exchange fraud. During those 10 days, deposited, verified funds may be traded on the exchange but not withdrawn.

The minimum trade amount for USD trades is $3. Otherwise, the minimum trade size for cryptocurrency orders is 10,000 Satoshis, with no maximum amount as long as the user has sufficient funds to cover the trade at the time of placement. For using its API, users are restricted to having 1000 open orders and 500K orders per day.

For customers living inside a US state that is not yet approved, they can still participate in Bittrex’s USDT, BTC, and ETH markets, but not USD markets. The list of eligible states can be found here.

Crypto Security

Bittrex leverages an “elastic, multi-stage wallet strategy” to ensure that the majority of funds are kept in cold storage for operational security reasons. Bittrex also enables 2-factor authentication (2FA) for all users by default.

Bittrex also supports whitelisting of IP addresses and whitelisting of wallet and crypto addresses, which enables users to enable withdrawals only to specified wallets. Users can also restrict access to API keys and are encouraged to monitor their account activity.

Bittrex also runs a cross-chain recovery service, meaning for any cryptocurrency deposit worth more than USD $5000 at time of being deposited, the exchange will recover funds if they were accidentally transferred to a wallet of the wrong coin type, for a 0.1 BTC fee. Bittrex has never been the target of any large-scale hacks during its history thus far. Bittrex shares more security precautions users should take here on its blog.

Bittrex Review Conclusion

Bittrex offers an all around solid platform focused specifically on spot trading and investing with a highly scalable and secure trading system and exchange services.

All types of investors, beginner to advanced, will appreciate access to a US- and EU-compliant exchange that offers a large selection of coins and trading pairs for all, along with a simple fee schedule with no other surprise fees.

While it does not have the most competitive fees as compared to Binance or KuCoin, its fees are more competitive than Coinbase and some other exchanges, along with a well-functioning mobile app and online exchange with advanced charting tools.

- With a tiered fee schedule based on 30-day USD trading volume, Bittrex’s trading fees compete favorably with other competitors such as Coinbase and Gemini, while also offering a larger amount of crypto coins and trading pairs, especially as compared to US-specific competitors Binance US and FTX US, however the fees cannot compete with theirs

- Investors and traders of all skill levels who desire the choice between both a simple and high-performance platform for both spot buy-and-hold investing, active spot-only trading, with a great user experience, growing brand presence, and no need for margin or futures products will enjoy the Bittrex experience and security-first approach

- Advanced traders who wish to use 20-100X leverage futures trading with a much larger selection of futures pairs, 5-10X or more leverage margin trading, and in general have access to cryptocurrency futures and leveraged token products, will prefer Binance, KuCoin, or FTX

Other Alternatives

For customers who desire access to a more simple user interface without as many trading options or products, or those who do not desire to participate in cryptocurrency futures trading either similar to Bittrex, Coinbase and Voyager can make great alternatives with a similarly competitive amount of cryptocurrencies offered to trade.

Beginners, buy-and-hold investors, and low volume traders may prefer the easy to use features and functionality of Coinbase with its brand presence, US regulatory approval, and cryptocurrency education that even provides the chance to earn free cryptocurrency for learning, an area where Bittrex lacks.

Coinbase is best designed for buy-and-hold investors or casual to intermediate cryptocurrency users though has a smaller selection of cryptocurrencies offered compared to Bittrex—402 pairs vs. Bittrex’s 1032 pairs—while active traders who need access to order books and advanced charting functionality will prefer using Coinbase Pro, FTX, Binance, or Kraken though their fee structures differ significantly.

For customers who desire to trade and invest in stocks in addition to top cryptocurrencies and do not mind having a smaller selection from which to choose or only desire access to the top 20 cryptos on the market, Webull and Robinhood are brokers that offers US equities and a small selection of cryptocurrencies.

Other competitors to Bittrex include Gemini, Crypto.com, and eToro.

Bittrex vs Coinbase

The main advantage Bittrex offers over Coinbase is its slightly lower fee schedule and much expanded selection of trading pairs and crypto coins. Coinbase’s fees start at 0.5% for both makers and takers for the lowest fee tier, while those of Bittrex start at 0.35% for spot trading for both makers and takers.

Both exchanges offer the option of advanced charting and crypto-to-crypto trading pairs using Coinbase’s Coinbase Pro product and Bittrex’s online exchange or mobile app. Neither Coinbase nor Bittrex offer any margin or leverage futures trading products.

Coinbase is a public US company and offers transparency into its industry-leading security along with its brand reputation, while Bittrex is a top 15 crypto exchange by daily trade volume, and is based in the USA while being US and EU-compliant, serving US customers the same as Coinbase, with slight differences in access for certain US states.

Ultimately, advanced users who desire more competitive fees and a greater selection of trading products than what either Bittrex or Coinbase offer will find the choices below more valuable.

Bittrex vs FTX

Bittrex and FTX are exchanges with fundamentally different product offerings— Bittrex is only focused on spot instruments with a large selection, while FTX is an exchange built for futures traders and prides itself on the most liquid order books and extensive derivatives products on the market, including exotic leveraged tokens.

While FTX offers anywhere from a 3-60% fee reduction with holding varying amounts of FTT, Bittrex offers no fee reductions but its fees are ‘middle of the road.’

FTX cannot be used by US persons, and instead offers a US version of its exchange whose trade offerings are far more limited than its parent global exchange and do not at all compare to Bittrex’s expanded selection, but FTX US fees are much lower than those of Bittrex (0.10% for makers, 0.40% for takers at the lowest tier). Both offer OTC portals for larger traders as well as advanced trading and charting functionality, though active and advanced traders will prefer the product offerings of FTX.

FTX offers 316 coins and 484 trading pairs which is not as broad of a selection as Bittrex which offers 463 coins and 1032 pairs.

FTX is known for its extensive futures pairs and top-class matching and liquidation engine for advanced derivatives traders, while Bittrex is known for its custom-built highly scalable trading engine and security focus.

Bittrex vs Gemini

Bittrex and Gemini are comparable in regards to fees and range of product offerings. The minimum fee tier at Gemini starts at 0.35% for takers and 0.10% for makers, with a flat transaction fee between $0.99-$2.99 and 1.49% transaction fee for trades over $200, so while Gemini’s maker fees are lower for their lowest volume tier, there are extra fees per transaction and extra “auction” fees, which Bittrex does not have due to its more simple fee schedule.

US investors and traders are allowed to use both exchanges with KYC compliance since they are both based in the USA, and neither exchanges offer margin or futures products.

In comparison to Bittrex’s larger selection of coins and trading pairs, Gemini only offers 62 coins and 86 trading pairs which is substantially lower, so traders looking solely for the most trading options, will prefer to use either Bittrex over the two options, or other options such as Binance or KuCoin.

Bittrex vs Kraken

Kraken offers margin trading at up to 5X leverage and several margin offerings, while Bittrex offers none.

Kraken also uses a maker-taker fee schedule, starting at 0.16% maker fees and 0.26% taker fees at the entry level which is more competitive than the fee schedule for Bittrex.

Kraken also offers a large variety of cryptocurrencies and pairs (93 coins, over 400 pairs), so users who value a large selection and advanced traders who seek margin may enjoy using Kraken but sacrifice the larger selection of spot crypto products that Bittrex offers.

Both exchanges pride themselves on compliance and security. Kraken is accessible in 48 US states with KYC and is regulated and licensed by FinCEN in the USA, while Bittrex is US and EU-compliant and allows access for most US states, with KYC.

Bittrex vs Binance

Binance is the leading global crypto established exchange by trading volume, offering a large selection of cryptocurrencies—over 351 coins and over 1300 pairs, which is only beaten by KuCoin when it comes to centralized exchanges.

Traders looking solely for the most advanced trading options such as high leverage margin and futures products will prefer Binance, and Binance’s base maker-taker fee is also much lower than that of Bittrex, starting at 0.1% instead of 0.35% like for Bittrex, and offering further 25% reduction in fees if paid in BNB.

Both the Binance and the Bittrex brands are well-known and respected in the industry, but Binance offers a more extensive web and ecosystem of products, support, and liquidity, especially given its much larger daily volume as compared to Bittrex.

Hence, advanced traders moving large transaction volumes for whom liquidity may be a concern will prefer Binance, but for smaller or intermediate traders, this will not be a concern as Bittrex’s volume and liquidity is enough to support the average person’s activity.

Binance lowered their maximum leverage offering to 20X in 2021 for regulatory reasons, however Binance is the most popular and well-known futures market in the global cryptocurrency industry and well-known for its extensive futures pairs. In contrast, Bittrex offers only spot trading products, so advanced users looking to either hedge their portfolio or speculate with futures will prefer Binance.

The Binance exchange is not at all accessible to US persons and US customers will have to use Binance US which is a much more limited version of its global parent site, with only 64 coins and 130 pairs, making Bitrrex the better choice, unless one prefers the low fee structure of Binance US. Both Binance US and Bittrex allow access for US persons with KYC.

In summary, advanced traders and intermediate users alike who value a large selection of cryptocurrencies, products like staking, lending, and more, competitive fee structures, and futures and margin products will likely prefer Binance, unless they desire to only trade spot cryptocurrency products and don’t need access to the many other services Binance offers.

Bittrex User Reviews

- A few users on social media have complained about Bittrex freezing their accounts due to compliance reasons, and while Bittrex has never been hacked, their support is known for being overzealous in freezing accounts due to compliance reasons. “Bittrex is holding my money hostage,” says u/Sokrats, the OP. “Their support simply ignores me.” u/TheLXK responds: “Unfortunately this is typical AML procedure, they are forbidden by law to tip you off regarding an ongoing investigation and probably forwarded a suspicious activity report to law enforcement – this is why you can’t get any updates from support.”

- A now-deleted user says, “I’m making an account now so I can better trade low market cap coins that aren’t on Coinbase, etc” and wonders if Bittrex is the best for this. A respondent says, “Volume is sometimes slow on some coins but it has the best variety.”

- We sorted all top posts in the unofficial Bittrex subreddit for you.

- u/standingontiptoe says they’d been with Bittrex since 2017 but took a break from trading. When they returned, they had to jump through hoops that hadn’t been resolved in a few weeks. “Can anyone tell me they are still getting good service?” Some reviews mention slow support response times of days to even weeks. Another user responds: “I keep hearing sketchy things about bittrex on this subreddit but I haven’t had much problems myself. Although I’m pushing around small quantities of crypto so maybe that’s why.”